- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

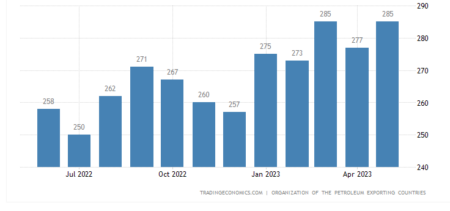

Browsing: OPEC

- Half of OPEC Member Countries are African and this includes the continent’s most populous country, Nigeria, and the largest by area, Algeria.

- OPEC also counts Congo, Equatorial Guinea, Gabon and Libya as Member Countries.

- Additionally, two African countries are part of the historic ‘Declaration of Cooperation,’ between OPEC and non-OPEC producing countries, namely Sudan and South Sudan.

Since assuming the office of OPEC Secretary General almost two years ago, I have had the privilege of visiting every African OPEC Member Country, as well as several other African countries. Every visit has reaffirmed my firm conviction that the future is bright for Africa and that the oil industry can play a constructive role in that future. Our Organization stands ready to offer any support it can to help this great continent realize its awesome potential.

OPEC takes great pride in its strong and enduring African connections, heritage and identity. Half of …

- If oil disappeared tomorrow, thousands of petroleum-based products would vanish with it.

- If oil disappeared tomorrow, it would be catastrophic for health services everywhere.

- If oil disappeared tomorrow, millions of jobs would be lost. Tax revenues would be depleted, and industrial production would crimp.

If oil disappeared tomorrow, there would be no more jet fuel, gasoline, or diesel. Internal combustion engines, automobiles, trucks, lorries, and coaches would be stranded. Airplanes powered by jet fuel would be grounded. Freight and passenger rail powered by diesel would halt. People could not get to work; children could not get to school. The shipping industry, transporting both freight and passengers, would be devastated.

There would be no point in calling emergency services. Most ambulances, fire engines, police cars, rescue helicopters, and other emergency vehicles would be stationary. Most phones and computers would also vanish as their plastic components derive from oil, so it would …

- Congo is working to increase its crude oil and gas production ahead of OPEC negotiations in November.

- Afreximbank is offering $300 million loan to Trident OGX Congo to increase crude oil production by 30%.

- Congo-Brazzaville’s production is expected to rise to 400,000 barrels per day by next year.

Congo is rolling out a plan to increase crude oil and gas production ahead of vital negotiations over OPEC production baselines in November. In the latest move, the African Export-Import Bank (Afreximbank) has entered into an agreement to provide a $300 million loan to Trident OGX Congo aimed at increasing the country’s crude oil production by 30 per cent.

The $300 million loan will enhance Congo’s crude oil output significantly within a year, and double gas production in two to three years, effectively stepping up the country’s 2024 output quota.

Congo-Brazzaville’s production is currently just below 300,000 barrels of oil equivalent per …

Nairobi will continue purchasing fuel on credit from three state-owned Gulf oil marketers until December 2024 in a plan the government is banking on to ease piling pressure on Kenya’s forex reserves.

The move comes in the wake of high expenditure on oil imports even as Kenya remains a net importer grappling with a widening trade deficit that hit $10.8 billion last year. Last year, Kenya’s expenditure on imports rose by 17.5 per cent to $16.9 billion (KSh2.5 trillion), despite growing export volumes.…

Russia’s invasion of Ukraine in February 2022 threw oil and gas markets into disarray. Consequently, the world experienced the first real global energy crisis during the uneven economic recovery from the COVID-19 epidemic. Russia’s inclusion in the OPEC+ group has hampered international attempts to manage the situation. This has made it harder to handle the significant inflationary effects of rising global fuel prices, particularly in developing nations.

Global fuel prices have risen exponentially in the last few months. The rise is hugely significant, as it has seriously aggravated the global cost-of-living crisis. African economies have particularly been on the receiving end. The continent has suffered from disrupted supply chains and a slowdown in the global economic outlook. Thus, rising energy costs complicate matters even further.…

For many Kenyans, life was unbearable during former President Uhuru Kenyatta’s reign. But just one year after President William Ruto came to power, life is getting more onerous. High taxation, the depreciation of the shilling against the dollar, and record-high fuel prices have highlighted the last few months. This has painted a grim picture of Kenya’s future and shattered citizens’ hopes for economic reinvigoration.

On September 14, 2023, the Energy and Petroleum Regulatory Authority (EPRA) announced record-high fuel prices for the September-October regulation cycle. A litre of super will now retail at Kes 211.64, diesel at Kes 200.90, and Kerosene at Kes 202.61. This represents an increase of Kes 16.96, 21.32, and 33.13, respectively, in the new prices announced last midnight.…

- The Republic of Congo Energies forum will be part of this year’s African Energy Week (AEW) expo.

- The conference and exhibition are scheduled for October 16-20, 2023 in Cape Town.

- Forum will facilitate new oil and renewable energy investment deals for the country.

Invest in the Republic of Congo Energies forum will be a part of this year’s African Energy Week (AEW) conference. Recognized as Africa’s foremost energy event, AEW will take place in Cape Town from October 16 to 20, this year.

Under the theme of ‘The African Energy Renaissance: Prioritizing Energy Poverty, People, the Planet, Industrialization, and Free Markets’, the Invest in the Republic of Congo Energies country spotlight will bring together energy policymakers and companies from the central African country with global investors. The forum aims to address pressing industry challenges while showcasing and optimizing energy transition opportunities.

Unlocking the country’s potential

The Republic of Congo is …

African countries will be largely impacted by the decision by the global cartel of oil producing countries to cut oil production given that only 14 out of 54 countries in Sub-Sahara Africa produce oil, which accounts for the lion’s share of their annual export earnings.

Many African countries have to import refined oil and rely on oil products in power generation. A hike in oil prices will boost economies of oil producing countries, by gaining foreign exchange earnings to carry out development projects such as Nigeria, Angola, Gabon, Libya, Cameroon, and Congo among others.

Consequently, this will create more job opportunities and greatly aid in poverty alleviation. In addition, the revenues could be redirected to other sectors that make significant contributions to the respective economies. By example, in countries like Cameroon, Gabon and Congo, internet infrastructure and technology could largely benefit from re-investing.…

African governments must consider strategies to optimise the effective use of imported oil. The optimisation will reduce net oil import proportions to minimise expenses. More generally, African nations must explore these strategies to minimise their reliance on oil as their only energy source.

Reducing oil consumption by shifting to renewable resources represents a long-term or short-term solution. In contrast, if Africa is to benefit or gain from the imminent possibility of an increase in oil prices, these few oil-producing nations must expand their crude oil production and refinery capacity.…

Nigerian presidential contenders must confront persistent insecurity, chronic unemployment, and a deteriorating economic outlook. Bola Tinubu outlined his vision before the Nigeria elections in 2023 in an 80-page paper released by President Muhammadu Buhari at a lavish ceremony on October 21, 2022.…