- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Trade

A recent report has revealed that the ban on second-hand clothing, also known as mitumba, might not enhance Kenya’s textile industry as previously anticipated. The report commissioned by the Mitumba Consortium Association of Kenya (MCAS) on the Second-Hand Clothing Industry in the East Africa Community has cautioned against protectionism towards importing second-hand clothing.…

- Kenya’s President William Ruto is urging Africa to shift from exports of raw materials to industrial processing of goods. He says African economies must change tact to revamp import/export trade.

- Comesa bloc has a combined GDP of $805 billion and a global export/import trade in goods worth $324 billion.

- In a radical move, Dr Ruto calls for merging of Comesa, the East African Community, and the Southern African Development Community.

Kenya’s President William Ruto is calling on the Common Market for Eastern and Southern Africa (COMESA) member-state to embrace industrial processing of to boost the value of exports and in turn enhance Africa’s share of global trade.

In a radical shift that is also seeking to boost trade across Africa, Dr Ruto is also calling for the consolidation of trading blocs Comesa, the East African Community, and the Southern African Development Community.

Industrial processing to boost Africa trade

By joining …

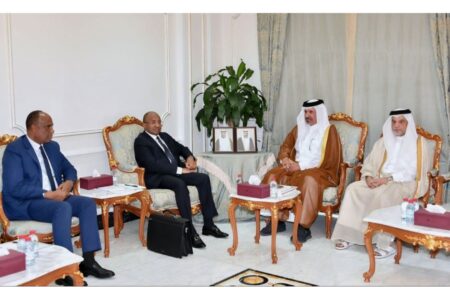

A recent meeting between the President of Zanzibar, Dr Hussein Ali Mwinyi and Qatar’s First Vice-Chairman, Mohamed bin Twar Al Kuwari highlighted these figures. The two high-ranking officials met in Qatar. The Zanzibar president called on investors from the rich United Arab Emirates to invest in the island.…

–

Uganda border of Malaba. It is one of the businesses in the East Africa

region

- Indian buyers are progressively making room for thermal coal coming from Mozambique, a non-traditional destination.

- Close to 600,000 MT thermal coal was traded from Mozambique to India in November and 3.7 million MT have been traded to India so far in the year.

- The Mozambique coal, typically loaded from the Maputo port, has high sulfur content and comes in a near-powder form, making it unacceptable for sponge iron and metal industries.

The International Energy Agency (IEA) has found coal burning for electricity generation will reach record levels this year.

According to a report released last week by the International Energy Agency (IEA), 2022’s global coal use will surpass the 2013 record. The IEA expects coal use to peak either this year or in 2023, then plateau until 2025, before declining again.

Rising natural gas prices and sanctions on Russia are largely driving demand for less expensive coal to …

- The agreement reaffirms the US commitment to elevating a strong private sector voice in AfCFTA implementation.

- Through exploring these challenges and opportunities in-depth, the U.S.-Africa Leaders Summit seeks to chart new avenues for improved U.S.-Africa cooperation.

- The business forum focuses on growing the commercial partnership between the U.S. and Africa, with priority discussion topics including the U.S.-Africa commitment to trade and investment.

The United States Chamber of Commerce’s U.S.-Africa Business Center (USAfBC) and the African Continental Free Trade Area Secretariat (AfCFTA) on Wednesday signed a Memorandum of Understanding (MoU) to launch a working group to help advance trade and investment between the U.S. and Africa.

The agreement reaffirms the US commitment to elevating a strong private sector voice in AfCFTA implementation.

Scott Eisner, President of the U.S.-Africa Business Center, said coordination between the private sector and the AfCFTA is key to unlocking Africa’s full economic potential.

“As the world’s leading …

When buying any product what do you really look at on the labels? How often do you check where the products were made? Who knows, maybe some of the products are made on Mars.

One thing for sure is you will come across a tag which reads: ‘Made in Zimbabwe,’ ‘Proudly manufactured in Zimbabwe’ or simply ‘Grown in Zimbabwe.’

Exports continue to grow this year thanks to the increasing popularity of Zimbabwean products in regional markets.

According to statistics recently released by ZIMSTAT, Zimbabwe’s exports grew by 12.8 per cent, from US$3.75 billion to US$4.22 billion, between January and August this year.

This growth has been anchored by export growth in emerging and non-traditional markets in countries such as United Arab Emirates (UAE), China, Belgium, and Italy.

The figures show that Zimbabwe’s products to United Arab have grown to US$1.38 billion in 2022. Exports to China also grew to around …

- Last year, trade between Angola and Italy was valued at US$400 million.

- Vice-president of the Angola-Italy Chamber of Commerce and Industry (CCIAI), Hélder Cardoso, said strengthening of financial collaboration between Angola and Italy is with a view to diversifying Angola’s exports.

- In the first quarter of 2022, the USA, France, Italy, China and the United Kingdom were the countries that stood out in terms of the origin of foreign direct investment in the oil sector.

In 2021, trade between Angola and Italy was valued at US$400 million, thus corresponding to an increase of more than US$100 million dollars compared to the same period last year.

From the total, US$280 million derived from the country’s oil exports to Italian soil, while US$180 million represents imports of agricultural equipment and the country’s manufacturing industry in this European country.

This information was revealed by Hélder Cardoso, vice-president of the Angola-Italy Chamber of Commerce …

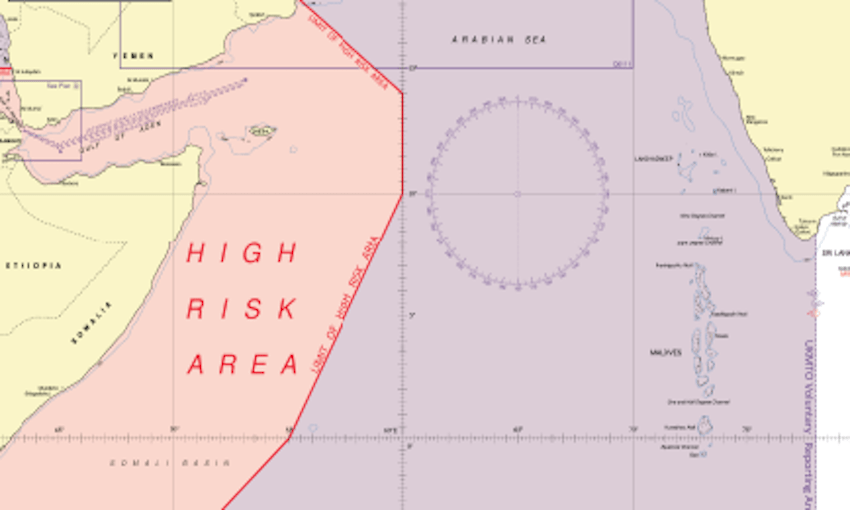

As a high-risk area, Kenya was paying billions to shipping lines for insurance of their goods.

But there is a break. The International Maritime Organisation (IMO) has removed the Indian Ocean from the list of High-Risk Areas (HRA) giving a major boost to trade for Kenya and the wider Eastern African region.

The decision was communicated during the 106th session of the Maritime Safety Committee at the International Maritime Organization in London. This is the UN agency responsible for the safety and security of shipping, by the Best Management Practice (BMP-5). It consists of the five largest global shipping industry associations.

BMP-5 looks to deter piracy and enhance maritime security in the Red Sea, Gulf of Aden, Indian Ocean and Arabian Sea.…