- Indian buyers are progressively making room for thermal coal coming from Mozambique, a non-traditional destination.

- Close to 600,000 MT thermal coal was traded from Mozambique to India in November and 3.7 million MT have been traded to India so far in the year.

- The Mozambique coal, typically loaded from the Maputo port, has high sulfur content and comes in a near-powder form, making it unacceptable for sponge iron and metal industries.

The International Energy Agency (IEA) has found coal burning for electricity generation will reach record levels this year.

According to a report released last week by the International Energy Agency (IEA), 2022’s global coal use will surpass the 2013 record. The IEA expects coal use to peak either this year or in 2023, then plateau until 2025, before declining again.

Rising natural gas prices and sanctions on Russia are largely driving demand for less expensive coal to fill the gap in energy supply, according to the Conversation.

Coal is a black or brownish-black sedimentary rock that can be burned for fuel and used for electricity generation. It is composed mostly of carbon and hydrocarbons, which contain energy that can be released through combustion (burning).

Coal sits in the centre of climate and energy discussions because it is the largest energy source for electricity generation and for the production of iron, steel and cement but it also remains the largest single source of carbon dioxide emissions. The current energy crisis has forced some countries, including India, to increase their reliance on coal slowing down climate and energy targets.

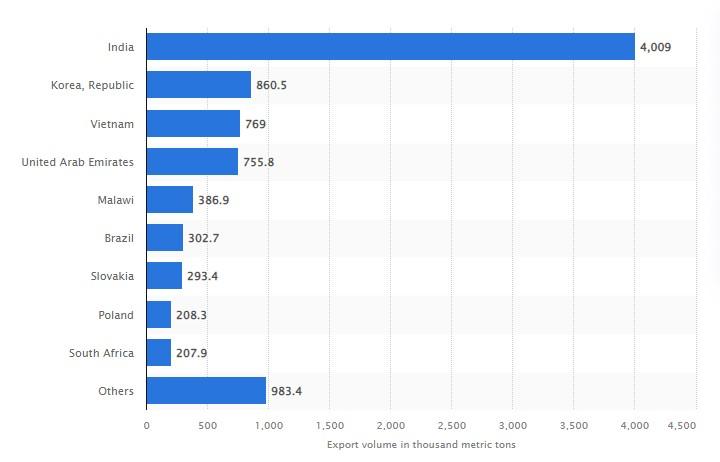

Indonesia, Australia, and South Africa account for over 80 per cent of India’s coal imports. According to Observer Research Foundation, in 2020 and 2021, Indonesia accounted for 42.98 per cent of India’s coal imports followed by Australia 25.53 per cent, and South Africa with 14.45 percent. Indonesia was the largest source of thermal coal imports accounting for 55.56 per cent, followed by South Africa and Australia. Australia alone accounted for 70.21 per cent or 35.945 MT of India’s coking coal imports in 2020-21.

However, due to prices that have been fairly competitive compared to South African or Australian coal, Indian buyers are progressively making room for thermal coal coming from Mozambique, a non-traditional destination, market sources told S&P Global Commodity Insights.

This is also exhibited by the volumes of coal traded between Mozambique and India. The thermal coal volume traded between Mozambique and India for November and December has been comparable with volumes sourced from South Africa.

Close to 600,000 MT thermal coal was traded from Mozambique to India in November and 3.7 million MT have been traded to India so far in the year. In comparison, 1.3 million MT thermal coal came from South Africa to India in November, according to S&P Global data and similar indications from market participants.

Read: Coal is still king in Southern Africa

Mozambique coal specifications

Major steel and cement companies are the biggest buyers of coal from Mozambique, with the share of thermal coal standing at around two per cent and that of coking coal at one per cent of India’s total imports in June.

As per data maintained with CoalMint, the country’s total thermal coal imports from Mozambique was two mnt during the first six months of the year, up 109 per cent year-on-year, while coking coal imports stood at 1.3 mnt, up 40 per cent year-on-year.

The Mozambique coal, typically loaded from the Maputo port, has high sulfur content and comes in a near-powder form, making it unacceptable for sponge iron and metal industries, according to S&P Global Commodity Insights.

“Cement companies can use the coal from Mozambique because of the higher sulfur content and it is a good alternative to petcoke,” an India-based trader said.

Mozambique’s coal price competitiveness

According to S&P Global Commodity Insights, Mozambique-origin 6,000 kcal/kg NAR coal was priced around US$167-$175/mt CFR West India. In comparison, the 6,000 kcal/kg NAR Richards Bay coal was at US$205/mt and the 5,500 kcal/kg NAR Newcastle coal was at US$140-$150/mt.

Further, compared with the 5,500 kcal/kg NAR coal from South Africa loaded from Richards Bay, or the high-ash coal loaded from Newcastle, Australia, the coal from Mozambique has a grade range of 5,800 kcal/kg to 6,000 kcal/kg NAR.

“The buyers in India can switch grade and origin of the fuel quickly if it can be used in their industry and if the price is competitive. Many users blend their fuel and use it because in India, price competitiveness is the number one factor,” another India-based trader said.

Using the coal directly may be difficult due to its low volatile matter but large companies in India are using the fuel in power plants, according to an article by S&P global.

Read: How Tanzania’s coal found its way to European markets

India’s coal import behaviour

India typically imports 150 million-180 million mt of thermal coal in a year, apart from the 750 million-800 million MT it produces.

Coal minister Pralhad Joshi said in July that production was likely to surpass 920 million MT in fiscal year 2022-23 (April-March), which would record an annual growth of 18 per cent. India aims to increase domestic production to 1.2 billion MT by FY 2023-24.

Historically, as demand for power accelerated, coal was put under open general licence (OGL) in 1993 that initiated thermal coal imports. Until the mid-2000s, volume of coking coal imports exceeded volume of thermal coal imports. This changed in 2005-06 when India imported 21.695 MT of thermal coal compared to 16.891 MT of coking coal. It was attributed to consumer (thermal power generators) preference for coal quality.

India’s coal imports in October, 2022, fell 20 per cent year-on-year to 17.32 million MT, while imports over April-October were 14 per cent higher at 149.23 million MT. Meanwhile, November output rose 12 per cent year-on-year to 76 million MT.