There is no disputing how much electronic payments have made our lives easier.

Online payment systems have significantly improved financial transactions, from bill payments to online purchasing. Online payment solutions that make use of Payment Gateways and Payment Processors are used to handle this money.

E-payments in Africa have been gaining momentum since 2000 and have taken a leap forward during the COVID-19 pandemic. Many African countries have seen record growth in e-payments over the past two years: mobile-money transaction volumes in Nigeria doubled to around 800 million in 2020, according to the Central Bank of Nigeria, while data from South Africa show that online commerce grew by around 40 per cent during lockdowns in 2020 and 2021.

- Flutterwave has continued to integrate other payment services through a partnership, enabling multi-payment options to make its platform useful across the globe.

- The fintech company announced that it had onboarded Google Pay, a mobile payment service developed by Google, as a payment method.

- With these moves, it is clear that Flutterwave is on a mission to enable swift and variegated payment solutions for its users.

Online payment solutions are immensely beneficial for their users, both customers and merchants alike. Online payments help reach global customers, reduce the cost of transactions and provide payment security (compared to cash payments). They create a more pleasant experience for the users who need not rush to banks and malls to buy or pay for their needs.

Pan-African fintech giant Flutterwave has kept its promise about Google Pay, as users of the global payment service can now use it for transactions with merchants on Flutterwave’s stores.

Google Pay was designed to enable users’ safe, seamless, contactless payments. It uses near-field communication (NFC) technology to facilitate fund transfers for retailers in physical stores. Users can also save their card details into the Google Wallet service and make online or in-app payments.

Read: Amazon Web Services and Google to extend their footprint in South Africa

Google Pay is a popular payment method in Africa and is currently accessible to users with Android phones, tablets, or wearables in 42 countries; Flutterwave’s decision to make this service accessible to Africans is noteworthy. With this integration, Google Pay users from all over the world may pay companies on Flutterwave in an average of three minutes.

Flutterwave claims that this action will lower the rate of online stores’ customers abandoning their shopping carts.

“With this collaboration, Google Pay users in supported countries across the world can pay businesses on Flutterwave across Africa. With an average transaction completion time of three minutes, this integration is slated to reduce the cart abandonment rate for businesses on Flutterwave,” the company said.

In a statement Olugbenga Agboola, Flutterwave’s founder and CEO, expressed convictions that the Google Pay integration will connect global customers to businesses on Flutterwave.

“The continued and rapid growth of Flutterwave is due to our commitment to building a platform with simplified payments for everyone. The GooglePay payment option will attract more international customers and increase the current success rates for businesses on Flutterwave. Integrating with Google pay will allow users across the globe to participate in the booming e-commerce ecosystem in Africa. It will enable us to fulfil further our promise of creating endless possibilities for all,” he said

Meanwhile, Flutterwave is not making this integration automatic for the 30,000 merchants on its platform. Interested merchants would have to opt-in manually from their dashboards.

This follows the company’s recent integration of Nigeria’s digital currency, the e-Naira, into its platform, enabling buyers and sellers to transact directly with the cryptocurrency.

Clickatell is a global player in the communication platform-as-a-service (CPaaS) and chat commerce sector. It provides a suite of products, including integrated SMS messaging, USSD services, and enterprise chat desk solutions. In this case, it is helping the Central Bank of Nigeria (CBN) to enable USSD services for its e-naira—something the apex bank promised as an imminent upgrade four months ago.

Flutterwave is helping to scale the e-naira adoption across its platforms by enabling buyers and sellers to link the e-naira to their platforms and transact with the e-currency directly.

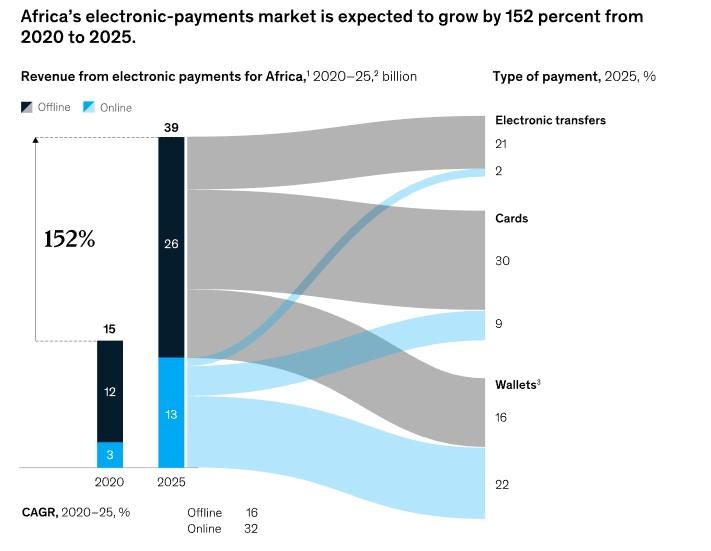

Electronic payments are a booming industry globally, having attracted more investment than any other financial-services sector and delivered the highest returns and growth in the sector over the past decade. Africa has been no exception.

According to an article by McKinsey published on September 7, 2022, in 2020, Africa’s e-payments industry, across domestic and cross-border payments, generated approximately US$24 billion in revenues, of which about US$15 billion was domestic electronic payments.

The domestic electronic payments revenue of US$15 billion was generated from 47 billion individual transactions totalling just over US$800 billion of transaction values. This means e-payments are a major growth opportunity on the continent, especially as the convenience and scalability of payment methods and supporting infrastructure development.

By bridging the gap in cross-border payments, Flutterwave, an Africa-focused payment company, is bringing companies from around the world closer to Africa. In that case, it has served over 900,000 businesses and handled over 200 million transactions totalling over US$16 billion, including clients like Uber, Flywire, Booking.com, and others.

The ability to handle worldwide payments in 150 different currencies and accept a variety of payment methods, such as local and foreign cards, mobile wallets, bank transfers, Barter by Flutterwave is a fundamental benefit. As a result, the business now has a sizable customer base in over 34 African nations, including Nigeria, Uganda, Kenya, and South Africa.

Flutterwave has made the decision to list on the Nasdaq Stock Exchange, driven by this innovative growth that has increased its value to US$3 billion.

The company’s chief financial officer, Oneal Bhambani, disclosed that the company has attractive market potential.

“We have attractive market potential and opportunity to do so now. We are a growth company, and we have a tremendous opportunity to invest and really develop solutions for the largest enterprises in the world that transact in Africa.

“The listing is an initiative of the payment company that is reaching the scale and trajectory comparable to what other investors seem to invest in the public markets,” he said.