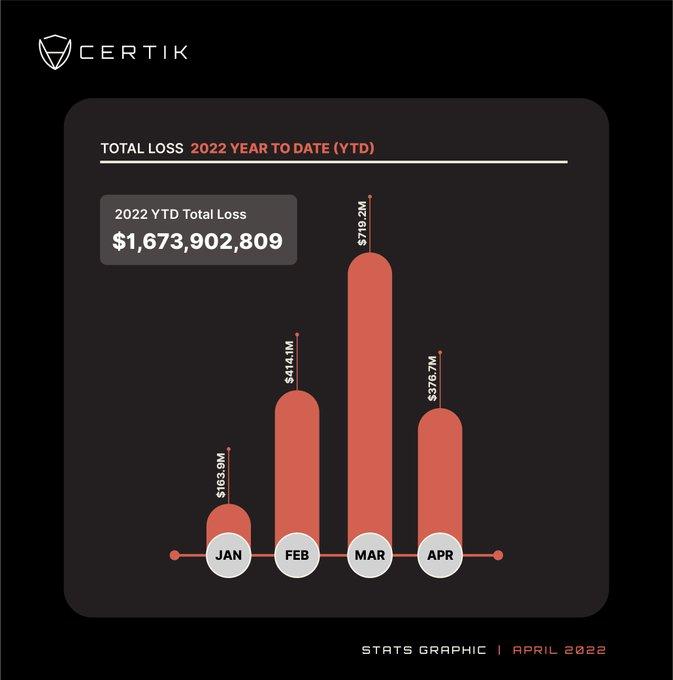

- Over US$1.6 billion worth of crypto has been stolen from users in the first quarter of 2022, the highest ever recorded

- CertiK recorded 31 significant crypto scamming incidents in April

- In 2021, hackers wiped out nearly US$3.38 billion from Africrypt, a cryptocurrency investment platform based in South Africa

The increased adoption of crypto trading is attracting massive fraudulence.

Fraudsters are finding it easy to steal cryptos from the many users who are ignorant about the market they are getting into and who are anxious to make a fortune quicker. The scammers are also capitalizing on the fact that there are few regulations governing the cryptocurrency market for investors.

2022 records the highest cryptocurrency theft in history

CertiK, a blockchain security firm, reports that the amount exploited in the first four months of 2022 surpasses the total amount stolen in 2021 (US$1.3 billion) and 2020 (US$516 million) combined. The month of March alone beats 2020 by US$203.2 million.

The decentralized finance (DeFi) space has been stained with hackers, exploiters and scammers. Over US$1.6 billion worth of crypto has been stolen from users in the first quarter of 2022, the highest ever recorded.

CertiK revealed the statistics on May 2; the month of March recorded the highest stolen value of US$719.2 million.

Cryptocurrency flash loans attacks

CertiK revealed that April 2022 holds the record for the highest losses in flash loan attacks ever recorded by the company, with losses reaching US$301.4 million. In contrast, flash loan attack losses in January, February, and March 2022 combined amounted to US$6.7 million.

Flash loans do not require a loan borrower to provide typical proof of income, reserves, or collateral requirements.

Among the critical exploits in March was the Ronin Bridge exploit, where attackers made off with over US$600 million worth of crypto.

The Ronin Bridge operations halted after the 173,600 Ethereum (ETH) and 25.5 million USD Coin (USDC) heist on March 23, 2022.

CertiK recorded 31 significant crypto scamming incidents in April. The most valuable hacks included:

- The US$182 million is milked from Beanstalk farms. Beanstalk Farms lost all of its US$182 million collateral from a security breach caused by two sinister governance proposals and a flash loan attack.

- The US$80 million was siphoned from Fei Protocol.

- US$10 million lost from automated market maker protocol Saddle Finance.

Most of the funds lost are never retrieved because of the high anonymity of the hackers. An isolated case is the Poly Network hack in 2021, where the hacker returned all the US$610 million stolen from the network.

Cryptocurrency theft in Africa

The wave of cryptocurrency theft in Africa is also on the rise. The continent must stand prepared for the threats of digital currencies, including crypto scams and financial and organized crimes.

In 2021, hackers wiped out nearly US$3.38 billion from Africrypt, a cryptocurrency investment platform based in South Africa.

The founders of Africrypt vanished with the money as international investigators struggled to establish what and how it happened. Two brothers founded the platform. The elder brother, Ameer Cajee, informed Africrypt clients that the company was the victim of a hack. He further asked them not to report the occurrence to authorities as it would slow down the recovery process of the “stolen” funds.

The incident establishes that Africrypt was a fraudulent crypto investment platform where the two founders vanished with about 69,000 coins.

South African Mirror Trading International (MTI) also pulled the biggest crypto scam in 2020, where the platform walked away with US$588 million worth of bitcoin from customers.

Read: The crypto uncertainty: Ethereum to surpass bitcoin in market capitalization

Mirror Trading International presented itself as a crypto investment platform, asking its new users for at least US$100 in funds in the form of bitcoin. MTI claimed to pool those funds into a trading account on a forex derivative trading platform and then conduct high-frequency trading using artificial intelligence that could allegedly produce average daily returns of 0.5 percent.

In 2020, the platform claimed to have 260,000 members globally. As cryptocurrency theft in Africa increases, here are a few ways crypto theft happens.

Examples of cryptocurrency scams

- Pump and dump. Scammers lure investors into buying shares in toddler cryptocurrency platforms. This makes the share price subsequently rise. The scammers then sell their shares, making the share price speedily dump, leaving investors crawling into losses.

- Fake celebrity endorsements. Hackers either hijack celebrity social media accounts or create fake ones. The scammers then encourage followers to invest in fake crypto schemes.

- Ponzi schemes. Investors are tricked into buying shares in a non-existent company.

- Fake and copycat exchanges. Scammers create a copycat site that nearly looks precisely like a legit crypto investment platform.

- Phishing. Emails, social media messages, and texts are spoofed to appear sent from legitimate and trusted sources.

Read: Cryptocurrency mining stagnating the Africa COP27 agenda