- Safaricom has requested telco industry watchdog, the Communications Authority (CA) to block satellite internet providers, such as Elon Musk’s Starlink, from operating independently within Kenya.

- Kenya’s largest telco argues that allowing satellite providers to operate independently could lead to challenges in enforcing compliance with local laws.

- Safaricom insists satellite ISPs should only be allowed to operate under the license rights of a local company.

A fierce battle is looming in Kenya’s internet service provider (ISP) industry, with Safaricom PLC, the region’s largest telecommunications operator, requesting the Communications Authority (CA) to block satellite internet providers, such as Elon Musk’s Starlink, from operating independently within the country.

This development sets the stage for what could turn out to be a fierce contest over the control of Kenya’s lucrative internet market, as telco heavyweights Safaricom and Starlink vie for dominance in a rapidly digitizing economy.

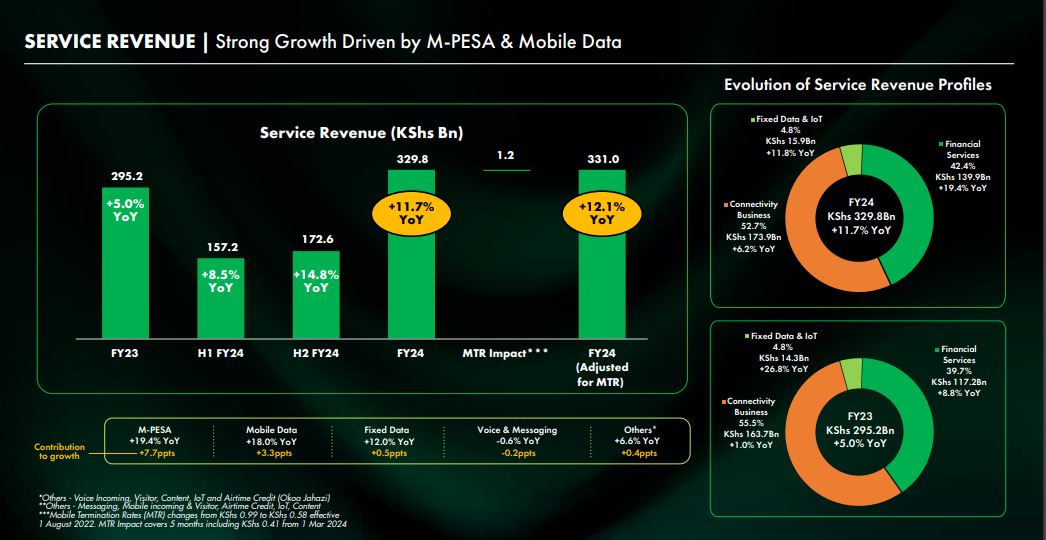

Listed on the Nairobi Securities Exchange and with annual revenues averaging $2.6 billion (KES335.4 billion) as of March 2024, telco giant Safaricom provides connectivity through a wide range of technology, 2G, 3G, 4G and 5G. Since 2007, the firm has been running the world’s pioneer mobile cash transfer and payment platform M-PESA.

Safaricom protecting market share

At the moment, Safaricom’s position as the dominant player in Kenya’s telecom industry is undisputed, boasting a 36.7 percent market share in the data segment alone.

In the fiscal year ended 31 March 2024, Safaricom reported 18 per cent growth in mobile data revenue to $490 million YoY or about KES63.24 billion in the Kenyan market.

“We continue to leverage price transformation, transparency, and personalized offers through CVM initiatives to enhance affordability on our data offerings. Data usage per chargeable subscriber increased by 6.4 per cent YoY to 3.79GB while distinct bundle users grew 13.8 per cent to 19.69 million. Average rate per MB declined further by 4.6 percent YoY to 6.40cents during the period,” the telco reported.

“The number of smartphones on our network grew by 12.9 percent YoY to 22.93 million. 4G devices grew by 27.5 per cent YoY to 16.85 million with 49.7 per cent using more than 1GB while 5G devices rose by 79.3 per cent YoY to 669.71k. Mobile data now accounts for 19.2 percent of service revenue.”

However, the emergence of satellite-based ISPs such as Starlink threatens to disrupt this stronghold. Since its launch in Kenya in 2023, Starlink has seen rapid adoption, driven by aggressive promotions, competitive pricing, and the promise of high-speed internet access in even the most remote areas.

In a July 15 memo addressed to the CA, Safaricom made its concerns clear, urging the regulator to prohibit satellite service providers from operating in Kenya without first establishing agreements with existing local licensees.

“We propose that the CA instead consider mandating that satellite service providers to only operate in Kenya subject to such providers establishing an agreement with an existing local licensee,” the memo read in part.

Safaricom’s argument centers around the difficulty of regulating foreign-based satellite ISPs that lack a physical presence in Kenya. The company noted that allowing these providers to operate independently could lead to challenges in enforcing compliance with local laws and regulations, ultimately undermining the government’s ability to oversee the industry.

Starlink challenging Kenya’s Internet market status quo

Elon Musk’s Starlink, a satellite internet constellation project developed by SpaceX with a presence in over 102 countries globally, has been rapidly expanding its footprint internationally. In Kenya, Starlink’s growing appeal lies in its ability to deliver fast, reliable internet to underserved areas, a scenario that is resonating well with many users frustrated by the limitations of the systems of traditional ISPs.

Since its launch in Kenya, Starlink has employed various tactics to grow its user base, including offering discounts on hardware and introducing a low-cost monthly plan at just $10.

This aggressive pricing strategy has paid off, with data from the CA showing that Starlink users grew tenfold in the three months to March 2024. In August this year, Starlink further disrupted the market by introducing a $15 monthly kit rental plan, catering to users who cannot afford the $350 hardware purchase cost.

The rapid growth of Starlink’s customer base has not gone unnoticed by local ISPs. Safaricom, in particular, has ramped up its marketing efforts in a bid to retain customers and stave off the threat posed by the new entrant.

Safaricom’s concerns are further compounded by Starlink’s reliance on third-party distributors and resellers to connect users, which Safaricom argues could lead to regulatory challenges and accountability issues.

At the heart of Safaricom’s opposition to Starlink’s independent operation in Kenya is the issue of regulatory oversight. Safaricom contends that allowing satellite ISPs to operate without a physical presence in the country would severely limit the government’s ability to regulate their activities.

“Granting a license to an entity that will typically operate in Kenya without having a physical presence in the country (via third-party partners/resellers only). This would mean negligible control for the government to ensure accountability for non-compliance issues,” Safaricom stated in its memo.

According to Safaricom, satellite ISPs should only be allowed to operate under the license rights of a local company, ensuring that they are subject to the same regulatory framework as other ISPs operating within Kenya.

This approach, Safaricom argues, would not only protect local businesses, but also ensure that the government retains control over the rapidly evolving internet market.

Read also: SpaceX offers Starlink kit at half price for first-time Kenyan customers

Safaricom’s 5G expansion: A countermeasure to Starlink?

While Safaricom battles to block Starlink’s independent entry into the market, it is also making strides in expanding its own network infrastructure. On August 12, Safaricom announced that it had crossed the 1,000 sites mark in its 5G network coverage, noting that its high-speed internet services are now available in all 47 counties across Kenya.

This achievement marks a significant milestone in Safaricom’s efforts to solidify its position as the leader in Kenya’s digital transformation.

With a total of 1,114 5G sites covering 102 towns across the country, Safaricom said its 5G network now reaches 14 percent of Kenya’s population of over 50 million. Additionally, the telco reported a growing number of enterprise customers on its 5G network, with over 11,000 businesses and 780,000 active 5G smartphones now connected.

These developments underscore Safaricom’s commitment to providing a “worry-free, always-on ubiquitous network” that bridges the digital divide and drives Kenya’s digital economy.

In the update, Peter Ndegwa, CEO of Safaricom PLC, highlighted the potential of 5G to catalyze innovation and economic growth, stating, “We believe that the benefits of 5G will be a key catalyst in leapfrogging other innovations, industries as well as Kenya’s digital economy.”

The road ahead: Safaricom-Starlink on collision course?

As Safaricom continues to expand its 5G network and push for regulatory measures that would limit Starlink’s operations, the battle for control of Kenya’s internet market is far from over. Starlink’s ability to deliver high-speed internet to remote areas presents a unique challenge to Safaricom’s dominance, particularly in regions where traditional infrastructure is lacking.

However, Safaricom’s entrenched position in the market, coupled with its expansive 5G network, gives it a formidable advantage. The telco’s push for regulatory intervention suggests that it is keenly aware of the threat posed by Starlink and is willing to leverage its influence to protect its market share.

In the coming months, the Communications Authority’s response to Safaricom’s proposals will be closely watched by industry stakeholders. Whether the regulator will side with Safaricom or allow Starlink to operate independently could have far-reaching implications for the future of Kenya’s internet business.

Overall, the simmering rivalry between Safaricom and Starlink is emblematic of the broader challenges facing traditional telecom operators as they contend with disruptive new technologies. As Kenya continues its journey toward digital transformation, the outcome of this battle will play a crucial role in shaping the country’s internet market for years to come. Whether through regulatory intervention or market competition, one thing is clear: the fight for Kenya’s internet market has only just begun.