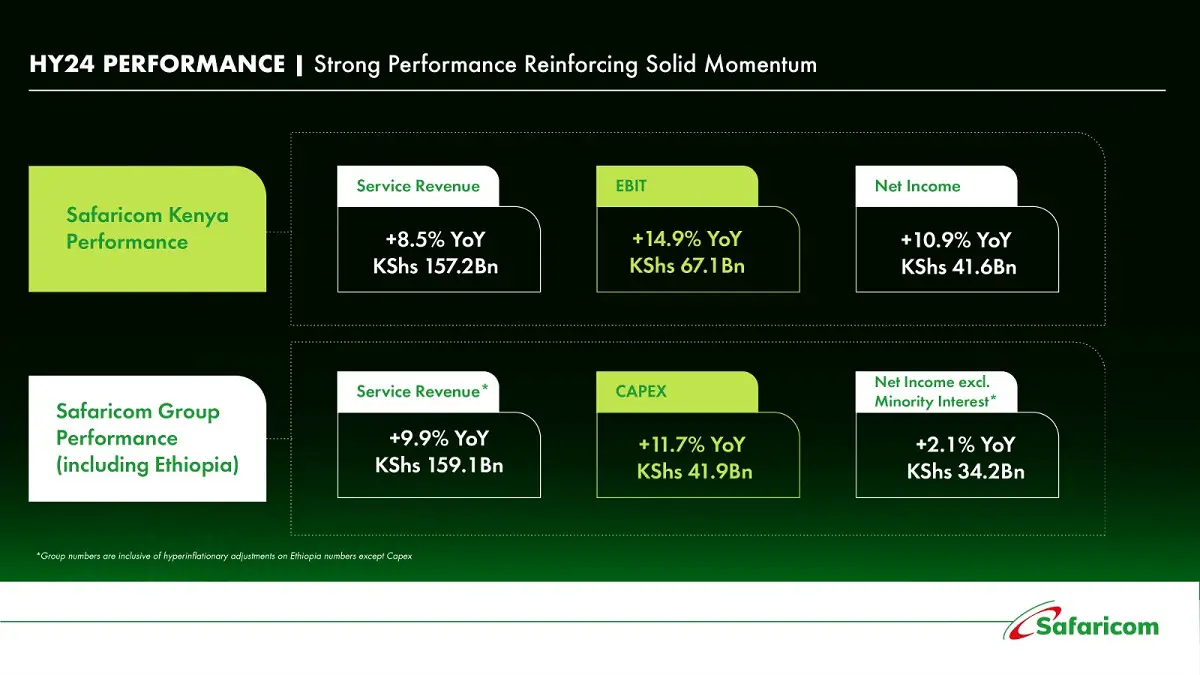

- Telco giant Safaricom has reported a 2.1% increase in net profit, reaching $225 million (KES34.2 billion) for the six months ending on September 30.

- Company CEO says there was heightened pressure on consumers’ finances due to both global influences and domestic inflation.

- Money transfer service M-PESA was the firm’s biggest source of revenue at 42% in the period.

Kenya’s telecommunications giant, Safaricom, has reported a 2.1 percent increase in net profit, reaching $225 million (KES34.2 billion) for the six months ending on September 30. During this period, earnings from the cash transfer service, M-PESA, which constitutes approximately 42 per cent of the total service revenue, saw a 16 per cent surge compared to the same period in the previous year.

Safaricom CEO, Peter Ndegwa, pointed out that during the six months, there was heightened pressure on consumers’ finances due to both international influences and domestic factors such as inflation. Furthermore, Kenyan consumers are facing challenges in a higher tax environment, which is limiting their spending in an overall weaker economy.

“We significantly reduced prices on the M-PESA side once again, taking a more long-term perspective,” he told investors.

Service revenue growth

Service revenue grew 9.9 per cent Year on Year (YoY) to $1 billion, mainly supported by M-PESA and mobile data revenues. Money transfer service M-PESA was Safaricom’s biggest source of revenue at 42 per cent. The second biggest source of revenue was voice at 24.6 per cent followed by mobile data at 18.8 per cent..

“Of the $120 billion in transactions through M-PESA during this period, $65.7 billion or 55.4 per cent were chargeable, reflecting a 64.3 per cent YoY increase. It’s important to note that as expected, we registered a drop in the transaction value of the bank to and from M-PESA post return to charging by $7.23 billion or 29 per cent YoY. This drop is not significant given that this ecosystem has grown 140 per cent over the last three years,” said Dilip Pal, Safaricom’s Chief Finance Officer.

Mobile data was also a key growth driver, making up nearly 19 per cent of the firm’s service revenue. Mobile data grew by 12.5 per cent, fueled by increased usage.

“The widespread adoption of smartphones is a cornerstone in propelling this growth by providing an enhanced customer experience and driving usage. We’re pleased to report that the number of smartphone users has grown by 11.4 per cent year-on-year, reaching 21.4 million. Of these users, 67 per cent (about 14.4 million) utilize 4G devices which has recorded a growth of 19 per cent YoY. We also have 510,000 users with 5G devices,” said Peter Ndegwa, Safaricom, CEO.

Data business

The average usage per chargeable data subscriber grew by 11.7 per cent YoY, reaching 3.8 gigabytes. About 9.2 million customers now use more than 1 gigabyte monthly, marking an 8.7 per cent YoY growth.

Overall, the Group’s customers grew 11.3 per cent YoY to 48.24 million, while one month of active customers increased by 9.9 per cent YoY to 35.86 million.

Kenya’s overall market share stood at 66.1 per cent as of June 2023. Group capital expenditure for the six months to 30 September 2023 stood at $290 million, with $17.45 billion invested in rolling out operations in Ethiopia.

Read also: Safaricom to expand investment in early-stage startups across East Africa

Safaricom Ethiopia business

Safaricom Ethiopia venture has doubled its active voice customers to 4.1 million, with 63 per cent being 30-day active customers. The 90-day active data customers closed the period at 2.3 million, a 62 per cent penetration of the active voice customers. However, voice usage remains low, at an average of 63.8 minutes per customer per month, an improvement from 55.4 minutes recorded at year-end.

“We also launched M-PESA in August, which had recorded 1.2 million registered customers as of September 2023. We shall give a firmer update during the Q3 update in January 2024 on how this is fairing since it’s still early days,” Ndegwa added.

Overall, the Group’s customers grew 11.3 per cent YoY to 48.24 million, while one month of active customers grew by 9.9 per cent YoY to 35.86 million.

The Group capital expenditure for the six months to September stood at $275 million, with $114.8 million invested in rolling out operations in Ethiopia.

Voice revenue decline

In the half, voice revenue declined by 3 percent YoY to $254 million. During the period, the rate per minute declined 14.6 per cent YoY to $0.008, while minutes of use per subscriber rose 21.6 per cent YoY to 184.31.

Messaging grew six per cent YoY to $37 million, supported by 10.7 per cent YoY growth in Average Revenue Per User (ARPU) to $0.29. Voice and messaging revenue are now 28.3 percent of service revenue.

Fixed service and wholesale transit revenue rose by 9.1 percent YoY to $48 million, supported by growth in consumer revenue, which rose 28.8 percent YoY to $23 million, which offset the 1.4 percent YoY decline in Enterprise revenue to $28 million.