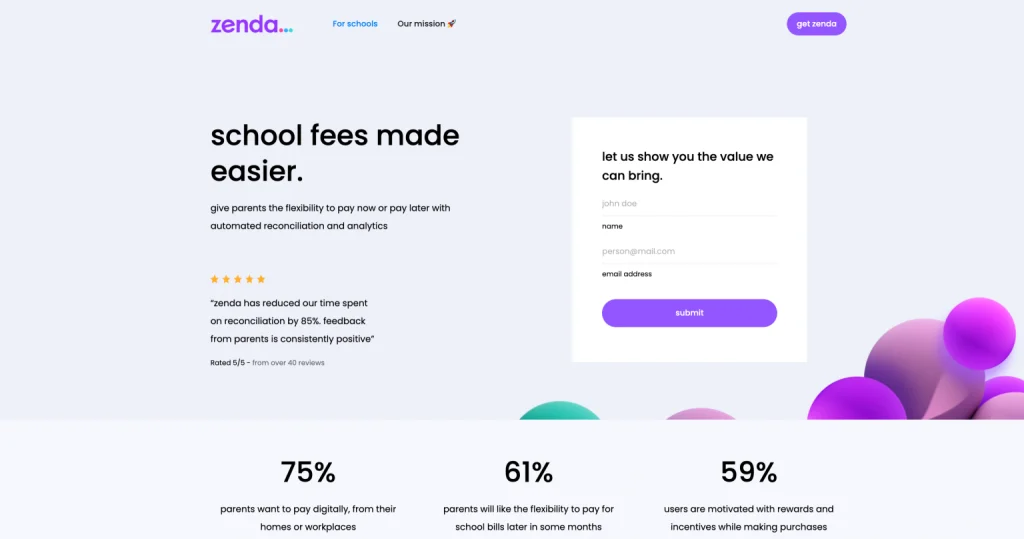

- Through its app, Zenda allows parents to pay fees directly to schools, all while streamlining collections by enabling schools to accept and manage online payments

- Parents do not necessarily need to provide bank deposit slips as proof of payment because all transactions on Zenda happen in real-time

- Zenda’s users have increased 20 fold, with the app reaching over US$100 million in annual contracted payment volumes by the close of last year

UAE- based startup Zenda is now eyeing Africa as its next frontier market for growth.

The company which is looking to change how parents pay school fees and the way in which educational institutions manage the collection of fees is looking to expand its reach to Africa.

Formerly known as nexopay, the firm plans to penetrate the African market through Egypt in the coming months as the firm embarks on a growth drive accelerated by a US$9.4 million seed funding it has raised.

Through its app, Zenda allows parents to pay fees directly to schools, all while streamlining collections by enabling schools to accept and manage online payments.

Through the app, parents do not necessarily need to provide bank deposit slips as proof of payment because all transactions on Zenda happen in real-time.

The startup also has an embedded financing option that extends tuition fee credit to parents on a flexible repayment structure.

Founded in June last year by Raman Thiagarajan and Haseeb Ahmed, both ex-McKinsey & Company staff, the company is the duo’s second venture.

Thiagarajan said that the Zenda borrows from their first social edtech startup dubbed nexquare, a management and data analytics system for schools, educators and regulators.

Thiagarajan, who previously led McKinsey’s financial services practice in the Middle East and North Africa (MENA) region, said that their first startup helped them understand the education market at a granular level, enabling them to build a fintech solution that solves the challenges encountered by parents and the schools around fee payment and management.

“Fee payments in schools are mostly manual, and where it is digital, it is cumbersome, expensive and has a manual aspect to it,” said Thiagarajan.

“With all the knowledge we have from our previous venture, we understand the education sector. And so, we have a parent-facing app… we also deeply integrate into educational institutions to remove the friction for both the parents and the schools,” he added.

Among the investors that took part in the seed round were STV, COTU Ventures, Global Founders Capital, and VentureSouq.

The STV general partner Ihsan Jawad said, “Raman, Haseeb and the team have identified a compelling gap in the market and in supporting families on a topic that is very important to them. Seeing their strong traction over the past several months, we couldn’t be more excited about Zenda. The UAE itself is a $8+ billion market for private education fees and they are already well poised to capture leadership.”

Since launch, Thiagarajan says, Zenda’s users have increased 20 fold, with the app reaching over US$100 million in annual contracted payment volumes by the close of last year.

The startup is also eyeing greater growth this year as it accelerates its expansion beyond the U.A.E using the new funding, which will also support the refinement of its product.

“Most of the funding is going to be used in the area of market development and customer experience,” Thiagarajan said.

In the long-term, Zenda is envisioned to go beyond school fee payment by encompassing other personal financial management aspects.

“Our mission is to help families thrive. We aim to make it easier for families to manage their money, and to enable their financial wellness … We see a need for family-centric products that are simple and collaborative,” Thiagarajan said.

READ: NSSF partners with M-Pesa in cashless drive