- Aggressive marketing campaigns targeting the younger demographic are significantly driving the choice of drinks.

- Health consciousness is not just a buzzword; it’s a lifestyle shift that’s influencing the beverage market.

- The influence of social media and global trends have heightened consumer awareness of new products and flavours.

Innovation and cultural heritage intersect as Africa’s beverage market evolves in response to shifting consumer tastes and socio-economic currents.

From the cherished rituals of traditional tea and coffee to the burgeoning popularity of carbonated soft drinks and fruit juices, Africa’s beverage market is evolving, reflecting its diverse society and changing preferences.

The Middle East and Africa Functional Beverage Market Size & Share Analysis – Growth Trends & Forecasts (2023 – 2028) report captures this dynamic evolution. It underlines key trends that are reshaping the way Africans quench their thirst.

Health benefits influencing Africa’s beverage market

One significant trend driving the beverage scene is the surging popularity of functional beverages, particularly among millennials. These drinks are capturing attention due to their purported health benefits and the aggressive marketing campaigns targeted at the younger demographic.

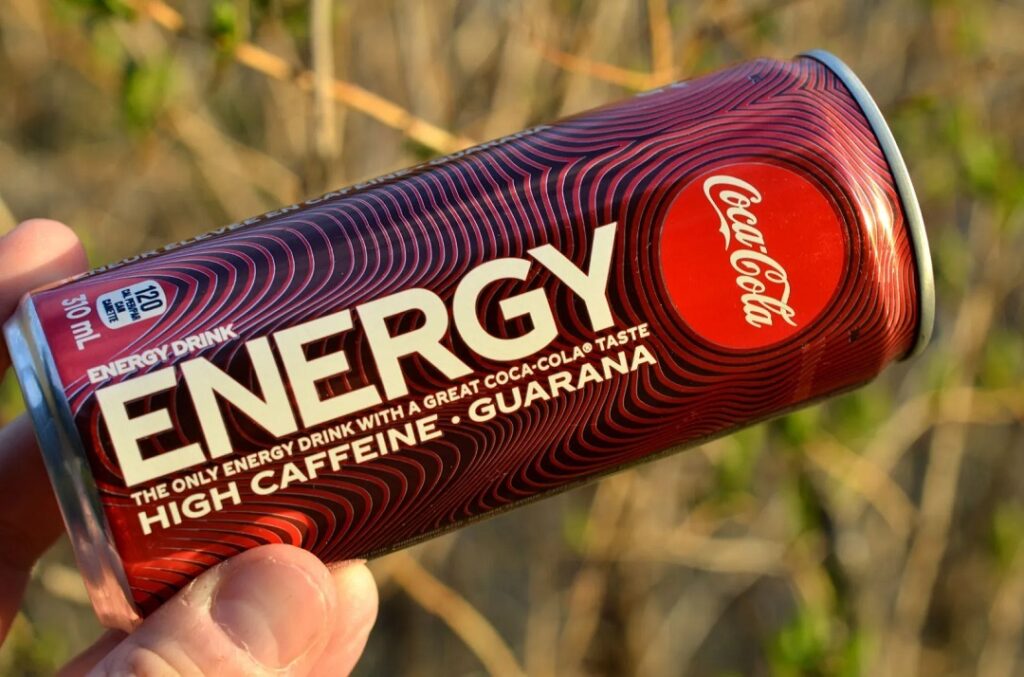

Energy drinks, in particular, are portrayed as elixirs that invigorate the mind, revive the body, and enhance performance. This resonates very well with the vitality-driven spirit of the youth.

As we navigate the intricate web of beverage trends, it’s worth noting that Africa and the Middle East collectively consumed nearly 118 billion liters of packaged beverages in 2021, according to Krones. This staggering consumption underscores the central role beverages play in the daily lives of Africans.

The functional beverage market in the Middle East and Africa is undergoing a revitalization, marked by novel flavor formulations, a focus on reduced sugar and calories, and the infusion of innovative ingredients such as botanicals and herbs.

A case in point is Coca-Cola Energy, a product tailored to the South African market. This energy drink boasts a blend of caffeine, guarana extracts, B vitamins, and the notable absence of taurine, catering to the growing interest in more health-conscious choices.

Health-consciousness is not just a buzzword; it’s a lifestyle shift that’s influencing Africa’s beverage market. The concerns around obesity, chronic illnesses, and overall well-being are leading consumers to seek beverages that offer both refreshment and nourishment.

Functional beverages provide a seamless avenue to enhance one’s intake of essential nutrients, vitamins, and minerals. The added appeal lies in the incorporation of natural, plant-based ingredients, aligning with the global trend toward cleaner, more sustainable consumption.

Preference for reduced sugar alternatives

The pendulum is swinging towards reduced-sugar alternatives. This is because an increasing number of consumers are adopting consumption patterns that safeguard against diabetic symptoms. Gut-friendly probiotic drinks are poised for a surge in demand, riding on the wave of heightened immunity awareness.

In a digital age, the distribution landscape is shifting, with manufacturers recognizing the need to embrace online channels to reach an ever-growing base of tech-savvy consumers.

Moreover, the replacement of coffee with energy drinks among students and office employees is changing the way we perceive and use beverages. What’s more, energy drinks are finding a new role as mixers in alcoholic cocktails.

Also offering an inside view into this dynamic sector is Smollan, the herald of renowned FMCG and commerce brands. According to Smollan the momentum behind Africa’s evolving beverage consumption patterns is driven by a set of factors. Surging economic growth has given rise to a burgeoning middle class with increased purchasing power, offering consumers the liberty to explore an array of choices.

Influence of social media and global trends

At the same time, the influence of social media and exposure to global trends have heightened consumer awareness of novel products and flavours. Further, Africa’s rich cultural diversity has sown a tapestry of preferences, spinning regional variations that define beverage consumption trends.

Aromatic teas, from the robust Kenyan purple to the refreshing North African mint and the soothing Red Rooibos from the south, capture a market imbued with ancient traditions and rituals.

This market is set to achieve an annual growth of 5.5 percent between 2022 and 2027 according to a Mordor Intelligence report. Coffee, too, enjoys a firm cultural foothold, from the Ethiopian coffee ceremony’s significance to Kenya’s role as a prolific coffee producer and Morocco’s embrace of Arabic coffee as its national drink.

These beverages transcend mere flavours, acting as cultural conduits, binding communities, and embodying hospitality’s essence.

In parallel, the global fruit juice market’s value, estimated at $147.5 billion in 2022 by IMARC Group, benefits significantly from Africa’s contribution.

Brands such as Nigeria’s Chivita 100 per cent, celebrated for its “no added sugar, no preservatives, and no artificial colours or flavours” philosophy, have secured their place. Meanwhile, Ceres Fruit Juices, a southern African gem, not only captivates local palates but also finds its way to over 80 countries, including the US.

Global beverage giants have set their sights on Africa’s vast potential and invested in expanding their foothold, informed by the growing consumption of carbonated soft drinks.

This influx has led to the establishment of local bottling plants and efficient distribution networks, bringing these beverages within easy reach of a broader populace.

Read also: East Africa’s macro-economic slowdown hurts EABL earnings

Rising incomes powering Africa’s drinks market

Urbanization, improved living standards, and rising disposable incomes synergistically propel African consumers’ mounting appetite for such drinks. Additionally, the surge of locally-produced brands, offering quality and affordability, has spurred healthy competition for global counterparts.

Warren Brett, Cluster Executive for the SEA Region at Smollan Tanzania, notes, “The fusion of tradition and innovation paints a dynamic picture of African consumption. We’re witnessing robust growth across various markets, with industry titans like Coca-Cola and Pepsi reigning in the carbonated sector, while Diageo, Heineken, and ABInbev propel the alcoholic beverage realm.”

Alcoholic beverages, deeply embedded in African culture, continue to be a centerpiece of social gatherings and festivities. Traditional drinks like Nigerian palm wine, Zambia’s sorghum beer, and Côte d’Ivoire’s tchapalo millet beer evoke nostalgia across the continent.

As globalization and urbanization expand, Western alcoholic beverages have staked their claim, introducing beer and spirits to local shores.

“Manufacturing primarily takes place locally, capitalizing on brand building and local strength, while we lend our expertise in technology-driven execution,” stated Brett. This evolving, intricate landscape forecasts a journey of ongoing adaptation, with a long-term vision at its core, compelling us to remain ever-alert and innovative.”

Africa’s beverage trends reflect a confluence of health consciousness, innovation, and changing consumption patterns. The allure of functional beverages, the emphasis on reduced sugar, and the infusion of natural ingredients are driving the shift towards healthier, more holistic choices. As the continent’s diverse and dynamic market continues to evolve, these trends are carving a path toward a refreshingly healthier future.