In light of the ongoing global fuel crisis due to the Russia-Ukraine war, that has disrupted the global supply chain, it’s inevitable to broach the subject of Kenya’s petroleum industry and oil production on the whole.

At present, oil exploration in Kenya could be the much-needed lifeline, to pull the country out of the daunting fuel crisis, and consequently bring the current high cost of living down a notch.

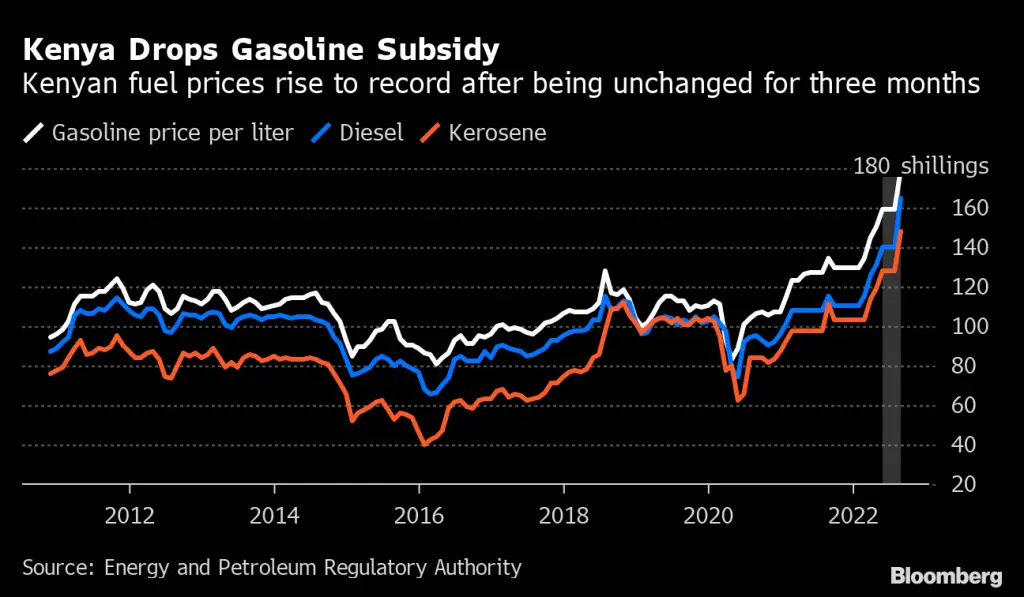

Just what became of Kenya’s petrodollar dream, which sent the country in a frenzy a decade ago, over the myriad economic prospects projected to be harnessed from the golden opportunity? Upon the discovery of oil in Turkana, the country had envisioned minting ‘petrol dollars’ but instead a decade later, Kenya is grappling with fuel prices rising to historic highs, further paling the country’s dream to become a commercial exporter into the shadows.

State of Kenya’s petroleum industry

Kenya’s petroleum industry remains a work in progress but will soon be prominent, given the increased demand and consequent efforts to meet it. The country has four petroleum exploration basins: the Lamu, Anza, Mandera and the Tertiary Rift Basins. Oil and gas exploration in the country began in the 1950s, before the country’s independence. Drills sank between 1960 and 1984 turned out dry with 16 wells drilled mainly in Lamu and Anza basins.

Read: India ditches the dollar, buys Russian oil in rupees

A major breakthrough in March 2012 with the discovery on an oil well, named ‘Ngamia 1 Well’ in Lokichar Basin, Turkana County birthed new hope for numerous economic prospects.

The Petroleum Outlets Association of Kenya (POAK) says that the country is facing fuel supply disruptions and surcharges, as the petroleum industry owes arrears amounting to US$542M, which have been accumulating since June, arising from the subsidy plan which has now become unsustainable.

For the last two months, the Kenyan government has been utilizing the Petroleum Development Levy (PDL) to cushion consumers, because without the subsidy prices could have increased to a historic high. Suppliers have been forced to borrow to sustain operations. Since the introduction of the subsidy plan, the government and fuel suppliers have not been on the same page, due to delays in payments, which led to the notable hike in prices in the wholesale market. Oil majors resold fuel to smaller independent fuel retailers, who control 40 per cent of the market which caused the countrywide shortage in April.

Construction of a new Mombasa-Nairobi line

Plans are underway by KPC to build another petroleum products’ pipeline between Mombasa and Nairobi, which will aid oil exploration in Kenya. This comes scarcely four years after the commissioning of the line that currently transports fuel between the two cities.

Due to the rise in demand for petroleum products in Kenya and the region, there has been significant strain on the pipeline, which started operations in 2018. Deeper investments are needed to increase capacity at its inland depots and the construction of an additional line.

Besides the growing demand, there is also an increase in petroleum product flow rate from ships importing fuel to Kenya, following the commissioning of the second Kipevu Oil Terminal (KOT) in August. As opposed to the old KOT that could only allow one vessel to discharge, the new one allows three ships to discharge simultaneously.

Progress of Kenya’s petrodollar dream: Quest for a strategic partner on course

Kenya first announced the discovery of oil in Block 10BB and 13T in Turkana in March 2012.

This became a beacon of hope for the nation, to massively spur economic growth through the so-called ‘petro-dollars’. Currently, Tullow is the project operator and has a 50 per cent stake, while Africa Oil Corp and Total Energies hold 25 per cent each. However, the country is yet to fully commercialize crude oil production. Hitherto, Kenya’s petrodollar dream has only experienced delays and missed deadlines. The project stalled as the companies’ focus was on mitigating debt and finalizing its development programme.

The major road block has been a lack of sufficient working capital, which has led to a scale back in activities to minimize capital investment, until both a strategic partner and the Final Development Plan (FDP) are approved. Since the start of the year, the firm has been engaged in discussions with the government, on the approval of its FDP and securing their deliverables thereof. Currently, the government has extended the review period of the FDP to the November 6, 2022.

“These items require satisfactory resolution before the Group can take a final investment decision. Due to the binary nature of these uncertainties, the Group was unable to adjust the cash flows or discount rates appropriately,” Tullow explained.

Tullow has been under pressure from Kenya to develop the Turkana oil wells that are expected to yield up to 120,000 barrels per day once production kicks off. The three partners’ final investment decision was to be made in 2019, with a projection to commence oil production between 2022 and 2023.

A deadline had been set by Kenya for December 2021, for Tullow to present a comprehensive investment plan for oil production in Turkana, or risk losing concession on two exploration fields in the area.

Read: Kenya exports first crude oil

In light of the financial meltdown suffered, Tullow made public its plans to sell notable share of its 50 per cent stake in the blocks. In the first quarter of 2022, Tullow announced that its assets in Kenya risked depreciating by nearly Kshs 30B, dependent on the government’s timing to hand over its production license. Amid a wave of uncertainties, Tullow’s stand on the viability of the project has not wavered. The Irish explorer Tullow based in London, is yet to onboard a strategic investor.

Since the project is costly, given that it includes setting up a crude pipeline and processing facilities for the oilfields; the ideal strategic partner would have to possess deep-pockets to adequately cushion risks undertaken by the joint partners for the project. Following the announcement of a merger with Capricorn Energy towards the creation of a leading African energy company, the firm is still working towards the goal in its fiscal note for the first half of the year.

Despite expressing sheer optimism about making progressive strides by the end of the year, the firm highlighted uncertainties towards the realization of the Project’s Value in Use (VIU). This refers to future cash flows expected to be derived from an asset in its present state, or cash generating unit. However, Tullow remains positive on oil exploration in Kenya under the new government, making a vow to work with the new administration to progress the project; which wields the potential to make a plethora of significant gains to the Kenyan economy, through revenue sharing, taxation, employment and local content.

According to an audit by British Petroleum Consulting Firm Gaffney Cline Associates (GCA); the commercially extractable volume climbed to 585 million barrels from the previous estimate of 433 million barrels. Currently, the crude price of US$100 a barrel and the potential crude in the reservoir is valued at US$284B, equivalent to nearly three times Kenya’s GDP; whilst the proven commercially viable reserves are valued at US$58.4B. Oil exploration in Kenya could help bridge this gap.

Given the big chunk going to production and shipping costs, Kenya would not earn the entire amount when production kicks off.

The Ministry of Petroleum and Mines hosted a meeting in August, as part of Tullow’s ongoing process to secure a strategic investor for ‘Project Oil Kenya’. In August, Tullow was in talks with two Indian state-backed companies to acquire the firm’s stake in the Turkana oil projects, in a deal estimated to amount to US$3B.

The two, ONGC Videsh, the country’s second-largest oil and gas firm, and Indian Oil Corp, a top refiner, may acquire the stake for between US$2B and US$3B respectively. The two will be joint operators if the deal is closed.

The Asian country is the world’s fourth-biggest oil consumer and has charged state oil firms with acquiring assets overseas to bolster security of its energy supplies, given that it imports 80 per cent of its crude needs. The deal spells a revival of Kenya’s Petrodollar dream of exporting oil on a commercial scale after the successful oil exploration in Kenya.

Kenya’s contract with Tullow for concession of the two blocks in the Lokichar Basin, the 4,719sq km 13T and 6,172 sq km 10BB; contained a clause which allows the government to exercise a back-in right; which essentially means buying back a percentage of the ownership, before production commences. The rights mean Kenyans can own part of the oil-producing blocks upon certification hold reserves, further cushioning taxpayers from the risky initial exploration stage. If the JV Partners in the project manage to get a strategic investor and the government grants approval of the FDP in November; the fruition of Kenya’s oil-producing dream will undoubtedly edge closer.

Read: Despite the Turkana fiasco, Kenya’s mines continue to dazzle China, West