HOW DONORS CAN DRIVE ECONOMIC GROWTH AND DEVELOPMENT IN AFRICA THROUGH A NEW MODEL OF PHILANTHROPY

Foreign aid has been a key driver for social and economic growth, as well as bridging the domestic development financing gap in Africa. Unfortunately, the continent has not utilized the tremendous value of philanthropy to unlock market shaping and economic growth opportunities as it should. Countries in Africa therefore need to rethink how they approach development financing by exploring philanthropy as a tool for the scale-up of impactful solutions driven by market-based, self-sustaining approaches.

One of the ways economies in the global south progressively leap out of poverty is by opening up spaces for more innovative use of philanthropic capital to spark up the ecosystem for innovation that delivers sustainable economic and social value.

Patient capital is an interesting new trend in development that is changing the way the world looks at philanthropy. Its emergence is gaining popularity because development, in the past has seen many failures due to issues of funding sustainability. In addition, the over-reliance on aid seems to take the primary agency roles from communities thus stifling the growth of homegrown innovation beyond project pilots.

Global Philanthropy Trends

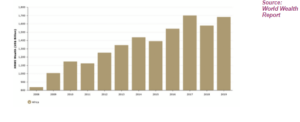

In the last 10 years, there has been a surge in private wealth with about 65% increase in the population of high-net-worth individuals (HNWIs) and wealth has increased almost fourfold in the last 20 years. The 2020 world wealth report estimates that the size of the HNWIs population increased by 6.1% in 2019, while wealth increased by 6.5% to US$1.7 trillion in 2019. This has been hugely as a result of global economic growth which has been fueled by global economic integration, the emergence of new industries, privatization, and the generational wealth transfer.

According to the global philanthropy report, while many countries in Europe and North America have long traditions of philanthropic giving, the current global philanthropy sector is growing with about 72% foundations established in the last 25 years.

Many philanthropic institutions explore a number of operational approaches to pursue their philanthropic missions; the mechanism for deploying capital has remained the same until recently that a variety of non-traditional social investment strategies are emerging in order to respond to the rapidly evolving social complexities and maximize their impact. Many new non-traditional social investment mechanisms are evolving but still limited.

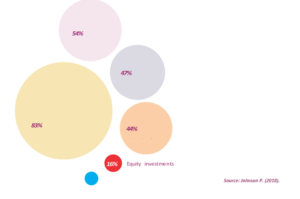

The global philanthropy report also suggests growing interest in alternative investment strategies with less than 4% of foundations indicating that they employ loans, equity investments, or impact investments in pursuit of philanthropic goals. Among the 4% cluster, 16% made equity investments, 11% provided loans; and 8% engaged in impact investments.

While the overall expectation is that increasing capital leads to increased impact, this may not be a simple linear relationship. There have been arguments against conventional philanthropy that drives the trend toward social entrepreneurship and impact investing as alternatives. From a governance perspective, the absence of discrete national policy frameworks to allow philanthropist and social investors embrace a variety of shared value and outcome-based models tend to discourage less siloed approaches to social investment.

Some of these criticisms also include that the conventional philanthropy model is flawed as they do not empower those in need but push them further away into a conundrum of continuous reliance on development aid hence continuing the poverty cycle. In addition, there are sustainability and scale concerns as many projects’ theory of change are forced to align with predefined philanthropy goals locked into a 3-5year framework. In addition, philanthropic capital is often used to operate in-house programs rather that explore market-creating innovations.

Regardless, philanthropy holds great potential in Africa as it can help innovate solutions to social problems by providing risk capital. But the conventional model will require reengineering in terms of its intentions, focus, organizational model and decision-making processes.

Philanthropy in Africa

African philanthropy is moving into a defining time. Across the continent, African philanthropy is starting to play a strategic role in driving advancement and sustainability and is increasingly transforming strategy measures at a national level. The interest in and momentum of African philanthropy is growing faster than ever before. In the past philanthropy was accorded no part in formal and inter- governmental processes. Currently, philanthropists play a crucial role in bridging gaps and connecting actors to help drive outcomes.

Based on the 2018 Charities Aid Foundation (CAF) World Giving Index, more people and organizations are giving than ever before, and the gap between Africa and the regions that give the most has closed significantly in the last five years. While majority of donor financing in Africa has been from the United States, Europe and (recently) Asia, there is a growing community of high net worth individuals and institutional philanthropists who are taking a more center stage in supporting and funding programs and projects in their local countries of origin.

The African Philanthropy Network estimates the potential giving pool of wealthy individuals at $2.8 billion per year, with the potential to be as high as $7 billion. With Africa’s household spending progressively growing at an average of 3.5% per year since 2015 (when Africa’s consumers and businesses already total $4 trillion),by 2025, private spending could reach $5.6 trillion – $2.1 trillion by households and $3.5 trillion by businesses according to a Mckinsey’s research. Given this progress, it is estimated that half a billion Africans will have disposable income by 2030.

Unfortunately, the COVID-19 pandemic in 2020 has disrupted this growth trend thus resulting in a significant decline in key global economic parameters. The World Bank’s June 2020 issue of the Global Economic Prospects which describes both the immediate and near-term outlook for the impact of the pandemic and the long-term damage it has dealt to prospects for growth suggests a baseline forecast of a 5.2% contraction in global GDP in 2020. Despite the fiscal and monetary policies, stimulus packages and contingency measures implemented by governments may manage the shock but leave a huge gap in terms of human capital potentials, capital inflow and social determinants of systems change.

As Africa moves toward the Fourth Industrial Revolution, two significant trends are clear:

- Development aid still presents one of the greatest opportunities to stimulate action needed to alleviate the economic damage from COVID- 19, as well as drive economic growth and recovery.

- There is a massive growth and expansion of Africa’s philanthropic capacity; and

- Countries must be innovative to tap into the hidden opportunities for growth that global philanthropy brings to the region.

Some forward-thinking African countries are already positioning philanthropy within its broad development financing integration agenda. For example, in 2009, the Liberian government established the Liberia Philanthropy Secretariat, a forum for linking national priorities with philanthropic resources. In 2015, the African Union launched the African Union Foundation to mobilize voluntary contributions in support of Agenda 2063. Meanwhile, the Southern African Development Community is developing a framework for the inclusion of philanthropic activities in supporting its regional integration agenda.

Amongst this emerging category of investors, are those who offer a type of social investing in the form of patient capital.

Building on the accomplishment of microfinance in demonstrating the commercial viability of a neglected asset class, patient capitalists believe that it is possible to achieve a commercial or quasi-commercial return and outsized social impact by betting on innovative entrepreneurs addressing underserved markets. Patient capitalists share a desire to do more with their capital rather than simply maximize financial return; they look forward to solving a problem with their capital; providing solutions that can bring about social and environmental benefit to a community or country.

Ikechukwu Ibeawuchi is Head, Strategy and Growth at Sociocapital Impact Group

Sociocapital is a social impact organization partnering with philanthropies, public, private and social sector organizations to improve lives, empower communities and transform systems through market-based solutions delivered at scale.