Rural businesses in Africa will benefit from an ambitious new financing programme launched by the UN’s International Fund for Agricultural Development (IFAD), as part of its broader efforts to address rising hunger and poverty levels in the world’s poorest countries.

In a statement, IFAD says the programme, dubbed ‘The Private Sector Financing Programme (PSFP)’, aims to spearhead an increase in private investment in small and medium-sized enterprises (SMEs), farmers’ organizations and financial intermediaries servicing small-scale farmers, which are too often neglected by investors.

It will provide loans, risk management instruments (such as guarantees), and equity investments.

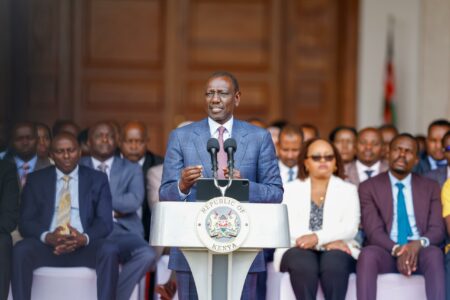

Commenting on the development, Gilbert F. Houngbo, President of IFAD said there is need to urgently stimulate more private sector investments to rural areas and unlock the immense entrepreneurial potential of millions of rural SMEs and small producers.

“With access to capital, they can attract more investors and partners, grow their businesses and create employment opportunities – especially for young people and women,” he said.

As part of its launch, the PFSP announced its first loan of US$5 million to a Nigerian social impact enterprise, Babban Gona, which has a strong background in successfully moving small-scale farmers from subsistence to a more market-orientated model.

The loan will help Babban Gona support 377,000 small-scale rice and maize producers in Nigeria with a comprehensive package of training, quality inputs, and marketing services.

Babban Gona will also store and sell the harvest on behalf of its farmers when prices are higher. They aim to create up to 65,000 jobs for women and 66,500 jobs for youth by 2025. (https://www.apolloclinic.com/) By committing these funds, the PSFP aims to stimulate larger contributions from other investors and help Babban Gona meet its target to raise $150 million to reach millions of small producers.

Data by the organization indicate that lack of financing and access to financial services prevents rural SMEs and small-scale farmers from harnessing opportunities offered by a growing demand for more diverse and nutritious food globally.

SMEs involved in food processing, packaging, transport and marketing are essential to small-scale farmers, providing them with services, inputs, and market opportunities, which contribute to increasing their income and employment.

IFAD adds that even before the COVID-19 pandemic, financial service providers only met about 30 percent of the $240 billion that rural households required in their demands for finance.

In addition, the lending gap to agricultural SMEs was around $100 billion annually in Sub-Saharan Africa alone.

The organization says it is aiming to mobilise $200 million for the PSFP from public, private and philanthropic sources to leverage a total of $1 billion in private investments.

This will improve the lives of up to 5 million small-scale farmers. The PSFP will focus its investments on job creation, women’s empowerment, building farmers’ resilience and accelerating climate change mitigation.

“With growing hunger and poverty and the urgent need to make our food systems more sustainable and equitable, business as usual is not an option. We need to innovate now,” said Houngbo.

COVID-19 response must target African agriculture and the rural poor

“This is why IFAD is creating new instruments to catalyse increased private sector investments to rural areas where they are needed most.”

IFAD’s investments, combined with its 40 years of experience working with rural communities, global field presence and large portfolio in agriculture, give it an advantage in attracting private investors who may be cautious about investing in agriculture and rural economies.

The funding comes at a time when rural businesses, especially farmers, are trying to recover from the impact of the pandemic.

In July last year, the Food and Agriculture Organization (FAO) in a report said at the farm level, human movement restrictions due to COVID-19 resulted in farm-labour shortages, hence affecting their business.

FAO indicates that reliance on agriculture and casual daily wages for survival is very high, with livestock being the backbone of the economies of Ethiopia, Somalia and South Sudan.

It adds that the livestock sector supports livelihoods of over 40 million people and comprises almost half of the livestock population in sub-Saharan Africa.