China Development Bank

The Zambian government announced an agreement with the China Development Bank (CDB) to defer a loan repayment that fell due in October 2020. The terms of the deal include a halt on interest payment for six months, with payment of interest expected to resume in April 2021. The principal due was also postponed and will be rescheduled over the entire loan period. Chinese lenders are not known for their flexibility which is why the deal comes as a welcome shock.

I’m glad to learn that China Development Bank has reached a debt deferral agreement with Zambia. This fully shows that in addition to official creditors, other Chinese financial institutions are also actively resolving the debt issue of Zambia and other African countries.

Wu Peng, Director-General, Department of African Affairs, MFA, China on Twitter

The government did not, however, disclose the size of the debt or the amount involved. There is still uncertainty as to whether this deal covers the entire loan to the CBD or a percentage of it.

China is one of Zambia’s biggest creditors with 25% of Zambia’s debt owed to China.

This year was particularly stressful for Zambia as it also missed a deadline for a Eurobond debt repayment of $42.5million. The country is currently within a 30 day grace period. The countries government is appealing to Eurobond holders for a similar deferment deal but there are yet to find joy in that regard.

The meeting in which Eurobond holders are expected to vote on the deferment of Zambia debt is expected to take place on November 13 following the last month’s postponement. In the last meeting, 40% of Zambia’s creditors opted to abstain from voting. Some analysts are of the view that the secrecy surrounding the Chinese debt is a major contributing factor to the failure of Zambia to get a reprieve on Eurobond holders. More clarity on the amount and interest of Zambia’s debt to china so as to have a clear picture of the risks involved. Bondholders are wary of a suspension only to find themselves funding Zambia’s repayments to China.

Compounding the countries woes, last month Zambia’s foreign currency rating was downgraded by S&P to “selective default”.

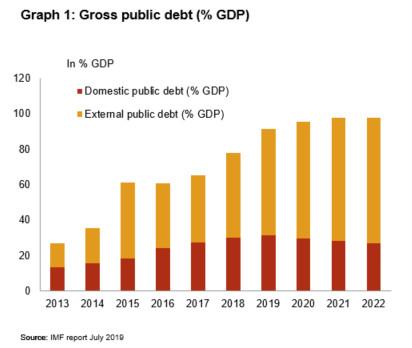

The country, teetering on the edge of crises, owes close to US$12B. Of this figure, US$3B comprises Eurobonds while US$3.5B is owed to bilateral lenders. In addition, there is US$2.9B in commercial debt and multilateral lenders are owed US$2.1B.

The country’s president Edgar Lungu is reported to have told the media that he was having sleepless nights over the debt situation.

Zambia’s debt crisis further highlights the problem associated with the high cost of borrowing that comes attached to an African tag. Also, the Chinese loans, which in some quarters have been described as a debt trap, create a further problem in the debt market as they have not been fully disclosed. The COVID pandemic accelerated Zambia’s debt quandary as it put unexpected pressure on government expenditure.

Zambia’s aggressive debt-financed drive to improve infrastructure may have backfired. As the country continues to find solutions to its debt crises, it remains to be seen whether the debt relief of this nature can prove to be a solution to the countries debt crisis.

Read also: Zambia plans to pay external debts