- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Author: Martin Mwita

Martin Mwita is a business reporter based in Kenya. He covers equities, capital markets, trade and the East African Cooperation markets.

Tullow Oil PLC (TLW.LN) recorded a strong performance in the first half of 2019 reporting a 91.5 per cent jump in profit, as it continued with its investments in Africa’s oil space.

Profit after tax for the period ended June 30, closed at US$103.2 million up from US$53.9 million in a corresponding period last year.

This is despite a drop in sales revenue which closed the period under review at US$872.3 million; compared with US$905.1 million it recorded a year-earlier.

Operating profit however went up to US$388 million compared to US$300 million in H1 of 2018 with the British oil firm reducing its net debt to US$2.9 billion from US$3.1 billion in June last year.

“Tullow has delivered a good set of financial results in the first half of 2019, with further reductions in net debt and gearing underpinned by strong cash flow generation from our assets despite the lower …

Kenya’s capital markets performed dismally in the second quarter of the year, latest data shows, despite political stability and growing interest from foreign-based investors.

The Capital Markets Authority (CMA) report for the quarter ended June 2019 shows secondary equities market registered slow activity during the review period.

Equity turnover for Q2.2019 stood at Ksh32.89 billion (US$316.3million), compared to Ksh45.25 billion(US$435.1million ) registered in the previous quarter; a 27.31 per cent decrease.

Similarly, market capitalization recorded a 3.46 per cent decrease to Ksh2.278 trillion (US$21.9billion) from Ksh2.360 trillion(US$22.7billion)in Q1. 2019.

READ ALSO:NSE dips as 2018 ends on a bear market territory

Traded volumes followed the same trend, falling by 3.46 per cent to 1.39 billion during the period under review.

Other composite indicators such as the NSE All Share and NSE 20 Shares indices likewise recorded decreases of 5.11 per cent and 7.51 per cent closing the quarter at 149.61 …

The Central Bank of Kenya (CBK) has retained its benchmark lending rate at 9.0 per cent for the sixth straight time since bringing it down in July 30 2018, sparing borrowers higher cost of loans.

The Monetary Policy Committee (MPC) which is CBK’s top decision making organ met on Wednesday to review the country’s macroeconomics.

Chaired by CBK governor Patrick Njoroge, the committee held retained the rates where there have been for almost a year, even as the capping of interest rates continues to affect lending trends by banks.

President Uhuru Kenyatta signed into law a Bill capping bank interest rates at 4 per cent above the Central Bank Benchmark Rate, in August 2016.

With the bench mark rate at 9.0 per cent, banks can only charge interest of up to 13 per cent.

READ ALSO:Why banks in Kenya will lend at a maximum 13%

Why retain

Among the …

Kenya’s Pharmacy and Poisons Board (PPB) has approved the use of a prescription drug manufactured by Janssen, one of the pharmaceutical companies of Johnson & Johnson, for the treatment of prostate cancer.

The local pharmaceuticals regulator has approved the use of Janssen’s once-daily medication ZYTIGA® (abiraterone acetate) for the treatment of metastatic castration-resistant prostate cancer ahead of a chemotherapy regime.

The approval is expected to help boost ongoing efforts to minimise existing barriers to cancer care access in Kenya.

READ ALSO:Kenya: Prostate cancer patients to get cheaper drugs

The prescription only innovator (non generic) oncological management drug is distributed locally by Janssen Kenya as part of the global pharmaceutical firm’s commitment to enhance access of essential drugs.

Speaking, when he confirmed the recent approval, Janssen Kenya Country Manager Marseille Onyango said prior to the approval, ZYTIGA had only been licensed for treatment of advanced prostate cancer cases post chemotherapy.…

Kenya’s Insurance sector is set to face disruption following the launch of a new InsurTech ecosystem seeking to create new solutions to the ailing insurance sector.

READ:Why Kenya’s insurance sector is “rotten”

Over 60 InsurTech start-ups pitched to investors at the inaugural two day Africa 3.0 conference held in Nairobi, as they seek to partner in increasing insurance penetration in the region.

The Conference which was organised Market Minds in partnership with Evolution East Africa and the UK Department for International Trade also saw over 150 start-ups from Africa participate.

Market Minds Founder, Sebastian De Zulueta, says a number of deals are expected to be signed with over 30 venture capitalists keen to tap into the opportunities in the insurance market in Kenya and Africa at large.

READ ALSO:Sanlam Kenya reveals secret weapon for 2019

“East Africa’s mobile penetration gives great opportunities for disruptions in the insurance sector. …

Mining experts will be converging in Rwanda later this year to deliberate investment and growth opportunities in the continent’s mining sector, in the wake of increased focus on Africa by multinationals.

The Rwanda Mines, Petroleum and Gas Board (RMB) will be hosting the new East and Central Africa Mining Forum conference and exhibition that will be held in Kigali from October 28-29, an event the country intends to also use to open the country for investment.

“We are opening up our mining sector in a way that has not been done in the past” says Francis Gatare, CEO of the RMB, “providing as much geological information as possible and we have recently revised our regulatory framework from policy to mining code and regulation – to not only make it competitive for companies to operate in but to also provide a platform that will make it easy for companies to comply …

Pan-African financier that exclusively supports the development of the housing and real estate sector in Africa, Shelter Afrique, has urge governments to establish a housing microfinance fund to improve access to housing finance by those in the lower end of the market.

Speaking at the Affordable Housing Investment Summit in Nairobi recently, Shelter Afrique’s Chief Executive Officer Andrew Chimphondah said most policies had an exclusive urban focus, and non-consideration of the low-income groups and the rural areas.

According to Shelter Afrique, establishment of such a fund would make it easier to facilitate efficient and inclusive housing market systems and make affordable housing a reality across Africa.

Currently, 90 per cent of Africans cannot afford to buy a house or qualify for a mortgage.

READ ALSO:AfDB to inject more millions to support affordable housing in Africa

“Access to adequate housing for low-income earners is a critical development issue globally and …

Cellulant’s Agrikore platform – an online marketplace for smallholder farmers, agricultural input and produce traders is tapping into Africa’s emerging Agritech market valued at €5.3 billion (US$5.9 billion) according to a new report by the Technical Centre for Agricultural and Rural Cooperation (CTA) and Dalberg Advisors.

This comes as 94 per cent of the continent’s emerging Agritech market remains untapped, according to the survey.

The State of Digitalisation of Agriculture in Africa 2019 report identifies online marketplace solutions such as Agrikore as significant use cases of how digital tools are being built to tackle major challenges of attracting and retaining a significant number of buyers and sellers, and in thus doing, help to solve the problem of inefficient and fragmented agricultural markets.

READ ALSO:Kenyan fintech Cellulant sells $47.5M stake to American investors

The Agriculture market in Africa is projected to grow to US$1trillion by 2030. It continues to be …

Kenya’s Equity Bank has been named as the most ‘Socially Responsible Bank in Africa’ at the most prestigious Africa’s banking and financial sector event – The African Banker Awards 2019.

This affirms Equity’s social and environmental leadership on the continent.

The award recognises Equity’s initiatives steered through the Equity Group Foundation (EGF) programmes that are positively impacting communities.

READ ALSO:Renewable energy attracts IFC loan for Equity Bank

The programmes are across five thematic areas that include education and leadership development, entrepreneurship and financial education, health, agriculture and agribusiness, and energy and environment.

The efforts they are geared towards, go beyond the philanthropic use of funds to use of overall knowledge, resources and reputation to improve livelihoods.

Through EGF, the bank has had successful initiatives, key among them being the improvement of secondary school education access for 16,168 students under the Wings to Fly program; Financial Literacy training that …

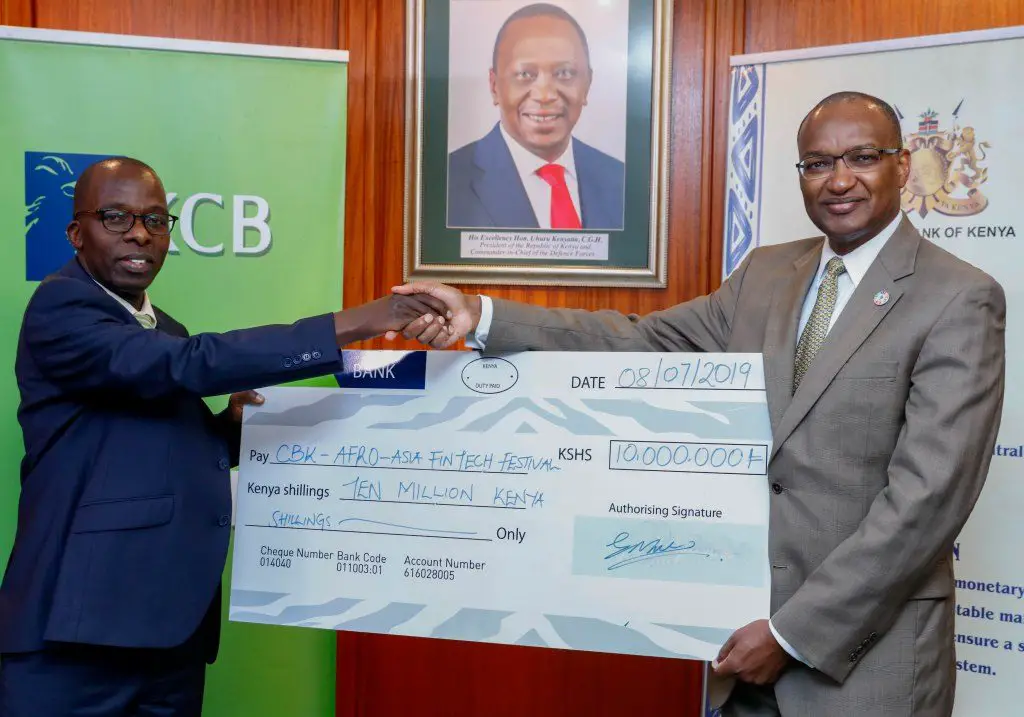

KCB Bank Kenya has committed Ksh10 million (US$97,448) to the Afro-Asia Fintech Festival 2019, a first of its kind in the region which will be held next week.

The funds will go into supporting the mega financial technology (Fintech) summit being hosted by the Central Bank of Kenya (CBK) and the Monetary Authority of Singapore.

The forum will take place between July 15–16 and is themed, ‘Fintech in Savannah’, modeled along the Singapore Fintech Festival.

KCB backing is informed by the need for Kenya to continue driving innovations in the banking sector to boost financial inclusion, the Nairobi Securities Exchange (NSE) listed lender has noted.

Speaking during the cheque handover to the CBK, KCB Group Chief Operating Officer Samuel Makome said: “For the past five years, we have made significant investments in financial technology in the realization that the future of banking is in digital finance. We will therefore remain …