- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

Author: Martin Mwita

Martin Mwita is a business reporter based in Kenya. He covers equities, capital markets, trade and the East African Cooperation markets.

Kenya’s HF Group Plc has expressed optimism of returning to profitability by the end of this financial year after registering significant performance improvement, cutting its losses by more than half a billion shillings.

The mortgage lender recorded a half-year pre-tax loss of Ksh94.314 million, compared to a loss of Ksh642.74 million for the year ended 31 December 2018.

The Group’s total interest expenses reduced by 9.80 per cent to Ksh1.67 billion from Ksh85 billion during a similar period in 2018, on the back of an aggressive retail banking strategy that has seen the business lower the cost of funding.

During the period, the Group’s property development subsidiary, HFDI, managed to offset outstanding debt worth Kes. 1.5 billion.

Non-funded income grew by 56 per cent to Ksh914 million up from Ksh586 million during a similar period in 2018, on account of gains made on sale of assets.

Managing Non-Performing Loans

…The Nairobi Securities Exchange(NSE) has recorded an 82 per sent drop in half year profit to June 30, the self listed firm has reported.

The group’s profit during the period Ksh24 million as compared to Ksh134 million recorded over the same period in 2018.

This was occasioned by an 18 per cent decrease in revenues mainly driven by a 28 per cent drop in equity turnover which declined from Ksh108.5 billion for the six months ended 30 June 2018 to Ksh78.1 billion for the six months ended 30 June 2019.

READ:Bear run continues at NSE with drop in key index

This in turn led to a reduction in equity trading levies by 28 per cent from Ksh259.9 million for the six months ended 30 June 2018 to Ksh187.5 million for the six months ended 30 June 2019.

“The decline in the equity turnover was as a result of low …

Regional financial services group—I&M Holdings (plc) has announced a 17 per cent after tax profit growth for its 2019 half year financial results bouyed by a strong non-interest income.

The lender’s net profit for the year to June 30 closed at Ksh4.5 billion compared to Ksh3.9 billion recorded in a corresponding period last year.

READ ALSO:I&M quarter three profit jumps 20.4% on higher income

Durng the period, the Group’s loan book expanded six per cent to close at Ksh172.1 billion up from Ksh162.8 billion for the similar period last year.

On the other hand, customer deposits recorded a 12 per cent growth from Ksh210.9 billion in June 2018 to close at Ksh237.2 billion as at June 2019.

On account of increased allowances for loan losses, the net Non-Performing Assets (NPAs) recorded a decline of 28 per cent to Kshs 9.2billion.

Total assets recorded an impressive growth to …

Kenya Airways has reported its half-year performance for the half-year to June 30 amid losses at the national carrier.

KQ, as it is known by its international code, posted a Ksh8.563 billion loss for the period, a slip from Ksh4.035 billion in a similar period.

READ:Kenya airways in trouble as loss deepen to US$74 million

This came as total operating costs jumped 15.5 per cent to Ksh61.5 billion from Ksh53.2 billion, a move that eroded gains made in total income which increased to Ksh58.6 billion during the period.

This was up from Ksh52.2 billion income realised in a corresponding period last year.

“Some of these losses can be attributed to the return in to KQ service of two Boeing 787’s that were on sub-lease to Oman Air, investment in new routes and adoption of the new International Financial Reporting Standard (IFRS 16),” KQ chairman Michael Joseph told investors …

The Kenya National Chambers of Commerce and Industries(KNCCI) has raised concerns over mishandling of investors in the ongoing crackdown on tax evaders.

KNCCI President Richard Ngatia on Monday criticized the manner in which the operation is being conducted.

He has called on the government and the Kenya Revenue Authority(KRA)to look for compassionate ways of engaging the business persons suspected of evading taxes payment, rather than treating them in a way that will cause their businesses to shut down.

Ngatia who was accompanied by KNCCI Embu chairman John Mugo among others said if business persons suspected to have defaulted in revenue payment are treated harshly, they will close down.

This, he said, will have several implications including job and revenue losses by the government.

“There are ways that you can negotiate with them, there are ways that you can have payment plans with them, and there are ways you can …

Kenya has finally sent its first crude oil into the global market marking a major milestone in the country’s quest to become a net oil exporter.

President Uhuru Kenyatta flagged off the country’s maiden crude oil at the Kipevu Oil Terminal in Mombasa.

The oil tanker-Mv Celsius Riga will deliver the consignment of 200,000 barrels in Malaysia.

Kenyatta has since called for peace, warned against corruption and urged for prudent use of resources for the benefit of all Kenyans and the country.

“The government will ensure that the local communities benefit from the oil,” the Presdeint said, “I urge all those in charge to avoid any misuse of the resource that would deny others Its benefit.”

Petroleum Cabinet Secretary John Munyes said plans are underway to construct a pipeline between Turkana and Lamu Port to ease transportation of the commodity.

READ ALSO:Pipeline deal inked as first Kenyan

…Africa needs more than US$1.4 trillion in funding to be able to effectively address the growing housing crisis, Pan African housing development financier, Shelter Afrique has said.

Shelter Afrique Chief Executive Officer Andrew Chimphondah was speaking in Nairobi after the Company signed a Memorandum of Understanding (MOU) with Habitat for Humanity International (HFHI), which will see HFHI assist Shelter Afrique in mobilizing capital for affordable housing.

“Research from our Centre of Excellence (CoE) shows that the overall shortage of housing in Africa is estimated now to be 56 million housing units. Out of this, more than 90 per cent or 45 million units are in the affordable housing bracket. This means that for Africa to fully address the issue of affordable housing shortage, at an average construction cost of 25,000 dollars per unit, the continent requires at least 1.4 trillion US dollars excluding the cost of the …

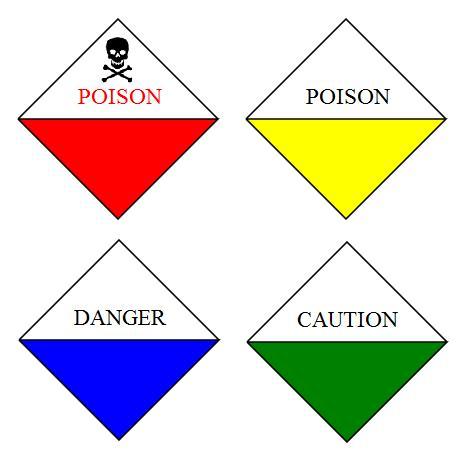

A lobby group consisting of organizations that advocate for sustainable agriculture is pushing for the immediate withdrawal of harmful pesticides in Kenya.

These are pesticides containing active ingredients that are toxic to human health and the environment, and that threaten food security and affect food safety in the country.

According to the group, at east 32 per cent of pesticide active ingredients that are currently registered and being sold in products in Kenya, have been withdrawn from the European market, due to their serious potential impact on human and environmental health.

The group comprises the Route to Food Initiative (RTFI), Biodiversity and Biosafety Association of Kenya (BIBA-K), Kenya Organic Agriculture Network (KOAN) and Resources Oriented Development Initiatives (RODI).

READ ALSO:Obstacles to food tourism development in Tanzania

Informed by a White Paper on pesticide use in Kenya that was commissioned by the RTFI, the organizations are calling for the withdrawal …

The East African Business Council (EABC) has secured US$ 3.2 million financing from TradeMark East Africa Africa (TMEA) to support trade initiatives mainly addressing barriers in the region.

This will support implementation of a three year programme,“Integrating Public-Private Sector Dialogue (PPD) for Trade and Investment in East Africa Community (EAC) Programme”.

The partnership will support EABC’s advocacy efforts of improving coordination, reporting and resolution of Non- Tariff Barriers along the corridors; harmonization and adoption of East African Standards, Sanitary and phytosanitary (SPS) measures, improve adoption and harmonization of customs and domestic tax-related policies and trade facilitation in the EAC.

To strengthen and sustain EAC’s trade and investment, it is critical that an enabling environment is in place to guarantee growth and predictability.

Public‐Private Dialogue plays a crucial role in addressing constraints, providing short‐term stimulus with long‐term impact and contribute to economic growth and poverty reduction.

The project will enhance advocacy …

Hong Kong is targeting investment and trade deals in Kenya in renewed effort to deepen its relations with the East Africa’s economic power house.

The Hong Kong Trade Development Council (HKTDC) this week led a delegation to Nairobi and Mombasa, eying investments in the Kenyan market.

It is keen to tap on investments under the government Public Private Partnership (PPP) initiatives, in a close collaboration with the Kenya National Chamber of Commerce and Industry (KNCCI).

The delegation which included ten leading companies held talks with the Kenyan business community and government in Nairobi and Mombasa, with KNCCI playing host during the six days visit that commenced on Monday.

Hong Kong companies are eying investments in Export Processing Zones (EPZ), export market, Special Economic Zones, logistics, real estate and trade.

READ ALSO:What Kenyatta secured at China Belt and Road Summit

Speaking during a Nairobi forum, KNCCI President Richard Ngatia encouraged …