Equity Group Holdings Plc has completed the acquisition of a majority stake in the Congolese lender Banque Commerciale Du Congo (BCDC) at a discounted price of $95 million after getting a 10 per cent discount.

Last year September, Equity bank announced it had agreed with the George Arthur Forrest and family a major shareholder to acquire all its 625,354 shares which is 66.53 per cent owned by the Belgian entrepreneur at a cost of $105 million with the dividend price per share of $167.9.

In a bank’s statement, it said the takeover is now complete making it the second-largest commercial bank in the Democratic Republic of Congo (DRC).

George Arthur Forrest and family was the majority shareholder owning 66.53 per cent, the government of the Democratic Republic of Congo (25.53 per cent), while the remaining 7.94 per cent shares are owned by other minority shareholders.

Equity Bank has more than 14 million customers with operations across the region in Kenya, Uganda, Rwanda, Tanzania, South Sudan, and the DRC.

In 2019, the bank announced plans to strengthen its subsidiary in DRC by acquiring BCDC and merging its business with the Equity Bank Congo S.A (EBC).

After the lender bought an additional 7.6 per cent stake held by the German state-owned development bank KfW, the Nairobi Securities Exchange (NSE) listed that it had increased its shareholding in EBC to 94 per cent from 86 per cent.

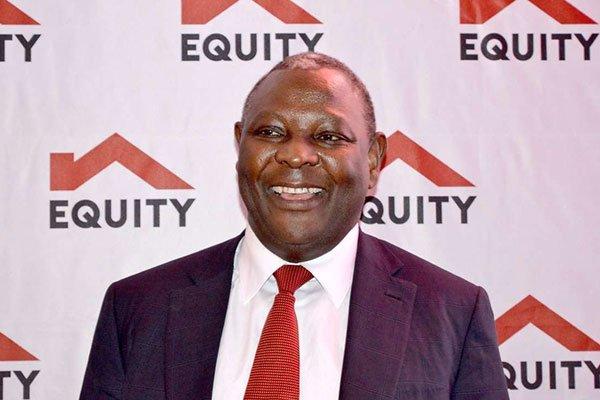

“We have been fortunate to have had the opportunity to acquire two of the most solid banks in the market,” Equity Group’s Chief Executive James Mwangi said.

“With the second and fourth-largest banks in the country being our subsidiaries, we are confident that amalgamation and merger of the two subsidiaries will produce a combined bank with a balance sheet in excess of $2 billion with the capacity and capability to contribute significantly to the development and transformation of the DRC,” he said.

In May, Equity Group Holdings Plc has posted a 14 per cent decline in net profit in the first three months of the year to hit ksh5.3 billion, attributable to increasing its loan loss provision by tenfold to Sh3 billion from Sh300 million in 2019.