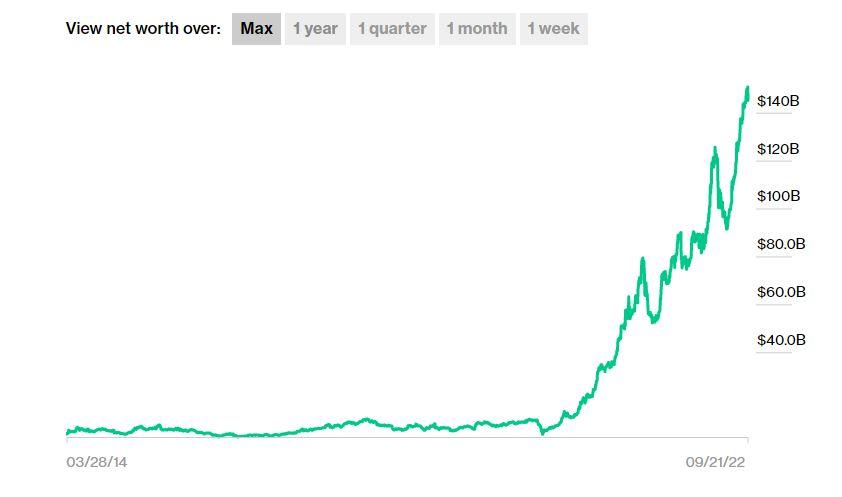

Gautam Adani was relatively unknown 8 years ago.

Back then, he was just another regular billionaire (if that even exists).

Recent times have been good for the Indian-born energy and infrastructure tycoon who, since 2020, has seen his wealth increase twentyfold! News outlets were manic a few days ago when reports emerged that his already substantial fortune surpassed that of Amazon founder Jeff Bezos to become the world’s second wealthiest person.

- Adani, an Indian national, is now the second richest person in the world after Elon Musk, with a fortune estimated to be in the region of US$ 156 billion.

- Through his company, the Adani Group, he has investments in various infrastructure, energy like coal, and port operating companies in India and around the world.

- The Adani Group has an estimated market capitalization of US$ 236 billion.

His fortune is estimated to be worth a staggering US$148 billion. He is second only to Tesla founder and eccentric billionaire Elon Musk. Very interesting to note is the fact that the rise of Adani into the high stakes of global wealth is also the first time that two of the wealthiest individuals in the world are from countries that comprise the BRICS nations.

Though now a US citizen, Elon Musk has South African heritage, and Adani is an Indian national.

That two of the richest men in the world are from BRICS countries is indicative of the emergence of the bloc. Adani is the first person of Indian descent to occupy the position. Adani is the chairman of the Adani Group, which operates a litany of businesses in coal mining, infrastructure, and thermal power generation. His companies also operate private airports and firms. According to media reports, Adani’s wealth began to surge at the beginning of this year when he was ranked 14th on the Bloomberg Billionaires Index.

His company Adani Enterprises Limited which is listed on the Indian stock market, began to surge, which propelled his net worth to the top three. He is still significantly behind Tesla’s chief executive and the wealthiest person on the planet, Elon Musk, who at last count was worth a mind-numbing US$ 277 billion.

- Adani surpassed fellow billionaire Jeff Bezos to become the second wealthiest person in the world.

- Adani began his career in business by importing PVC materials for his brother in Gujarat, India, at age 26.

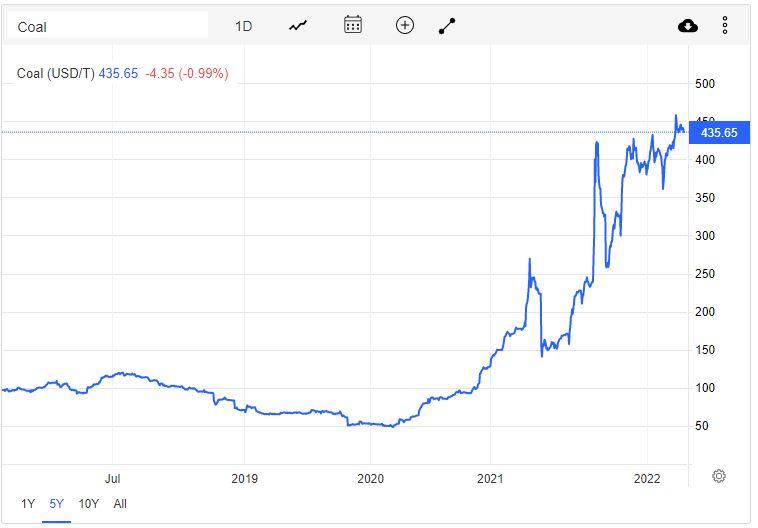

- Investments in the production and trading of coal are responsible for the increase in Adani Group’s value and, subsequently, Adani’s surge in wealth.

According to Bloomberg, Adani owns 75% stakes in Adani Enterprises, Adani Power and Adani Transmissions, according to March 2022 stock exchange filings. He also owns about 37% of Adani Total Gas, 65% of Adani Ports & Special Economic Zone and 61% of Adani Green Energy. The shares are held by promoter groups, which include family members and holding companies that are credited to Adani to reflect his status as founder.

Adani is nothing if not ambitious. Everything about this man and his business interests is described in superlatives. Adani Enterprises’ corporate website describes the company as “India’s fastest growing corporate catering to a billion aspirations”.

The vision of the company is to be a world-class leader in businesses that enrich lives and contribute to nations by building infrastructure through sustainable value creation. The website lists very impressive credentials, including a staff complement of 23,000 strong, over 3,000 mangroves afforested, 4 million trees planted, and no less than 3.4 million beneficiaries of the company’s corporate social responsibility initiatives.

- The price of coal has increased by more than fivefold over the last two years. Adani’s company is primed to supply the fuel to Europe in the wake of sanctions against Russia, which has withdrawn gas and coal supplies to the European continent.

- The Adani Group consists of 7 companies that are publicly traded.

- Adani once negotiated with no less than 500 landowners to purchase land he needed to build roads to his commercial port in India.

- Europe’s impending winter has stoked the Adani family fortune through its potential further to increase the value of the Indian domiciled Adani Group.

The Adani Group is diverse and consists of 7 publicly traded entities. Its headquarters are in Ahmedabad, Gujarat in, India. The website described the man as “a first-generation entrepreneur who is driven by the core philosophy of infusing “Growth with Goodness” through his nation-building vision. Each of the Group’s businesses focuses on helping build world-class infrastructure capabilities to help accelerate the growth of India.”

Adani is married to his wife, Priti, a dentist who runs the company’s foundation, and they have 2 adult children. He was born in 1962 in Gujarat, India. From his birth, Adani’s life seems to follow the typical rags to riches, starting from scratch to billionaire. According to Bloomberg, Adani dropped out of college as a teenager, moved to Mumbai, and worked in the diamond trade before returning to his home state. He began his business by importing polyvinyl chloride, or PVC, for his brother’s plastic business. In 1988, he set up Adani Enterprises, the group’s flagship company, to import and export commodities.

Adani Enterprises got the nod from the Gujarat government in 1994 to build a harbour facility to handle its own cargo at Mundra Port. Adani soon transformed this into a commercial port after seeing the potential for future profit the project had. Adani is energetic. Which is another hallmark of the few entrepreneurs that make it into the high-stakes billionaire league that he has graced.

Businesspeople of Adani’s ilk and those aspiring to become like Adani need to have high octane and high voltage energy levels. Adani noticed with his port project that to realize its potential, he had to build rail and road links to it. He achieved this gargantuan feat by individually negotiating with more than 500 landowners across India to create the largest port in India. Adani got into power generation in 2009.

Adani Group’s interests comprise infrastructure and energy. His company is the largest, closely held producer of thermal coal in India. It is also the largest coal trader in India. Most likely, his coal interests are responsible for the exponential rise of his wealth over the last two years. The coal price is not slowing down. It is projected to continue climbing and fuel Adani’s wealth even further.

The price of coal has increased more than fivefold from its US$ 73 level in 2020 to around US$ 435, the level the commodity is trading at. If the price of coal continues to rally, it is not inconceivable to imagine that Adani could become the richest man in the world. Not bad for a boy from Gujarat.