- History beckons as push for Kenya’s Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

- Empowering the Future: Humanity Protocol’s Dream Play Initiative

- TikTok Community Guidelines update aims to curb hate speech and misinformation

- Rwanda sees 39% surge in bank borrowers as Sacco and MFI loan uptake declines

- Kenya Ports Authority wins dispute case over cargo release

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

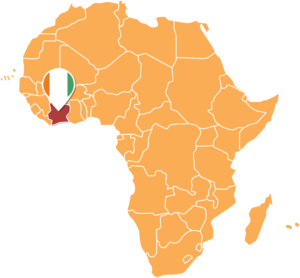

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- The project is billed to help African countries play catchup as the continent is still relatively behind when it comes to global consumer banking habits.

- The African Development Fund in partnership with Smart Africa Alliance will evaluate policy gaps in the digital trade and e-commerce ecosystems in selected countries that are lagging behind their counterparts in terms of digital trade and e-commerce adaptation.

- Data by the International Trade Administration (ITA) indicates that the continent is forecast to surpass half a billion e-commerce users by 2025.

The African Development Fund has partnered with Smart Africa Alliance to launch a $1.5 million project aimed at streamlining digital trade and e-commerce policies across 10 African countries.

In a project dubbed Institutional Support for Digital Payments and e-Commerce Policies for Cross-Border Trade (IDECT), the two institutions will evaluate policy gaps in the digital trade and e-commerce ecosystems in the selected countries that are lagging …

- A number of the proposals in the Bills are aimed at broadening the tax base by bringing income that was previously untaxed or exempt into the scope.

- The Uganda Revenue Authority (URA) before Parliament’s Committee on Finance, the government expects to collect US$7.72 billion (UGX29 trillion) from domestic tax revenue in the next financial year 2023/2024 (FY20233/24) from both existing and new tax policy measures.

- The Income Tax (Amendment) Bill 2023 is now proposing to introduce a separate direct tax in the form of a digital services tax (DST) on Facebook, Netflix, Zoom and other digital platform.

Uganda has released the Tax (Amendment) Bill for the financial year 2023/2024. These proposals have been tabled before Parliament, and if passed into law, they will take effect on July 1. As a business owner or investor in Uganda, it’s essential to understand what these tax proposals mean for your business.

A

- In 2018, fintech Flutterwave received a series A funding of $20 million, setting its pace ahead of most of its competition.

- In 2022, Kenya’s tech Industry accumulated $574.8 million in funding, showcasing its tech startups’ potential.

- Mr Oluwabankole Falade claimed that Fluttwerwave recognizes Kenya’s invaluable role in East Africa.

Nigerian fintech company Flutterwave has picked Kenya as its hub as the firm seeks to grow its presence across East Africa. This announcement signal’s Kenya’s growing significance in Africa’s digital transformation and competitiveness in business.

Olubenga Agboola, CEO of Flutterwave, said the organization is propelling financial inclusion in the country. Started in 2010, Flutterwave facilitates cross-border payment transactions of both small and large African businesses.

Flutterwave is among the few organizations to tap into Africa’s rising virtual economic community; the Web3 Community. One of its main selling points is its ability to integrate blockchain technology and use it to drive financial …

In the past decade, nations around the world have sought to transition to an investment-focused strategy in Africa, recognizing the continent’s substantial $100 billion annual infrastructure financing gap. In this era of a global transition towards investment-focused strategies in Africa, Japan emerges as a proactive player, steering the trajectory toward sustainable growth with its substantial financial commitments and innovative initiatives.

Japan’s Active Position for Investing in Africa

While China’s Belt and Road Initiative dominated the global scene, Chinese lending to Africa has been on the decline since 2016. This has prompted a series of “Africa+1” summits in 2022, with countries like the United States, the United Kingdom, India, and Russia placing significant emphasis on investment and trade deals.

Among these nations, Japan has taken a proactive stance, particularly highlighted at the Eighth Tokyo International Conference on African Development (TICAD) summit held in Tunisia last summer. Japan pledged an impressive $30 …

- The meeting will share lessons and experiences on strategies deployed to catalyse the development of insurance sectors for inclusivity and innovation..

- Delegates will also explore client value and viability dimensions of national health insurance schemes in Africa.

- Insights and lessons from trends and business models on inclusive digital insurance solutions; taking stock of what has worked and what has not worked will be shared.

Kenya is preparing to host the Eastern and Southern Africa regional conference on inclusive insurance, which is part of a series of regional learning sessions aimed at contributing to the development of inclusive insurance markets in Africa.

Across the continent, insurance penetration remains low and different players including governments have been deploying various strategies to scale up uptake of various cover products.

The eighth regional conference is modeled as a combination of high-quality training and plenary forums that are aimed at sharing insights on inclusive insurance …

- Growth in sub-Saharan Africa is expected to slow to 3.6 percent in 2023, as a “big funding squeeze” tied to the drying up of aid and access to private finance hits the region.

- If no measures are taken, the funding shortage may force countries to reduce fiscal resources for critical development areas of health, education, and infrastructure, the IMF warned.

- Persistent global inflation and tighter monetary policies have led to higher borrowing costs for sub-Saharan African countries, placing huge pressure on exchange rates.

Economic growth in sub-Saharan Africa is projected to slow to 3.6 percent in 2023, as a “big funding squeeze”, tied to the drying up of aid and access to private capital sweeps across the region, the International Monetary Fund (IMF) has said.

The Regional Economic Outlook for Sub Saharan Africa April 2023 report indicates that if no measures are taken, to tackle this shortage of funding, a …