- History beckons as push for Kenya’s Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

- Empowering the Future: Humanity Protocol’s Dream Play Initiative

- TikTok Community Guidelines update aims to curb hate speech and misinformation

- Rwanda sees 39% surge in bank borrowers as Sacco and MFI loan uptake declines

- Kenya Ports Authority wins dispute case over cargo release

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

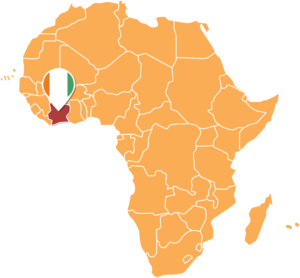

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- Standard Chartered Kenya has partnered with business accelerator Somo to launch a program that would allow women to access loans ranging between KSh250,000 and KSh2 million at an interest rate of 5%

- Disadvantaged women in Kenya have a chance of accessing small-ticket loans to support their businesses

- The loans, which are designed to help the women restore and revitalise their businesses, will be payable over a period of up to 3 years

Disadvantaged women in Kenya have a chance of accessing small-ticket loans to support their businesses under a plan by Standard Chartered Kenya in partnership with business accelerator Somo.

Women in business will be able to access loans ranging from KSh250,000 to KSh2 million, at an interest rate of 5 percent. The loans, which are designed to help the women restore and revitalise their businesses, will be payable over a period of up to three years.

StanChart said the …

- Mastercard said plans are in motion to remove PVC plastics from payment cards on its network by 2028

- The global payment solutions company said the move would further reinforce their sustainability commitments

- All newly–produced plastic payment cards will be required to be made from more sustainable materials – including recycled or bio-sourced plastics such as rPVC, rPET, or PLA

Mastercard said it is planning to remove PVC plastics from payment cards on its network by 2028.

In a statement, the global payment solutions company said the move would further reinforce their sustainability commitments and scale the accessibility of more sustainable card offerings for consumers seeking a way to reduce the environmental impact of their wallet.

Mastercard turns to recycled, bio-sourced plastics

From January 1, 2028, all newly–produced plastic payment cards will be required to be made from more sustainable materials – including recycled or bio-sourced plastics such as rPVC, rPET, …

- Tanzania garnered $1.2 billion (approximately Sh2.8 trillion) in investment through projects filed with the Tanzania Investment Centre (TIC) from January to March, compared to $787.4 million (Sh1.8 trillion) in 2022

- According to the most recent TIC report, the investment will be invested in 93 projects that would create more than 16,400 job possibilities

- Domestic sources made significant contributions, contributing US$887 million, or 76 per cent, of the total permitted investments ,US$276 million, or 24%, came from overseas sources.

Due to an improvement in the economic climate, Tanzania had a 52.4 per cent rise in investment over the first quarter of this year compared to the same period last year.

Tanzania garnered US$1.2 billion (approximately Sh2.8 trillion) in investment through projects filed with the Tanzania Investment Centre (TIC) from January to March, compared to US$787.4 million (Sh1.8 trillion) in 2022.

According to the most recent TIC report, the investment will be …

The Arab Bank for Economic Development in Africa (BADEA) has been a key player in Senegal’s economic landscape since 1975, working diligently to promote economic and social development in the country. Dr. Sidi Ould Tah, the Director General of BADEA, sheds light on the bank’s mission, projects, and strategic partnership with Senegal in his conversation with African Business portal.

BADEA’s Mission and Operations in Senegal

As a multilateral development bank owned by 18 Arab States, BADEA’s mission is to foster cooperation between Arab countries and Africa through investments and trade. The bank operates in four main areas: infrastructure, private sector development, agricultural value chains, and support for SMEs, with a focus on women and youth entrepreneurship. However, such a business niche for investment as online gambling still remains untapped, so there is ample opportunity for new cooperation in this area. For example, the 7alalcasino website dedicates its various services to …

- CIC Insurance Group has reported a 64% rise in its net profit to hit KSh 1.1 billion in the year ended December 2022

- The regional insurer said the performance was driven by the continued execution of their transformational initiatives focusing on customer experience and performance management

- CIC Group’s gross written premium grew by 20% from KSh 19.7 Billion reported in 2021 to KSh 23.7 Billion in 2022. The net earned premiums grew from KSh 14.7 Billion to KSh 17.5 Billion

CIC Insurance Group has reported a net profit of KSh 1.1 billion in the year ended December 2022, marking a growth of 64% from the KSh 668 million reported in 2021.

On Wednesday, March 22, the regional insurer said the performance was driven by the continued execution of their transformational initiatives focusing on customer experience and performance management.

The company also pegged its improved performance to operational efficiency, digital transformation, …

Regionalising the power balance between central and commercial banks can address the risks associated with the adoption of CBDCs in Africa. Commercial bank digital wallets can thus reduce the costs underlying the correspondent banking channels. These wallets can also promote cross-border trade in Africa by restricting the focus of central banks to the B2B and interbank payment ecosystems. Central banks have traditionally managed this well while incorporating these systems across borders. In such a scenario, each actor—public and private—does what it does best.…