- Partners back AIM Congress 2024 vision for global economic stewardship

- AIM Congress 2024: pre-event forums set the stage for strategic insights on global showcase

- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

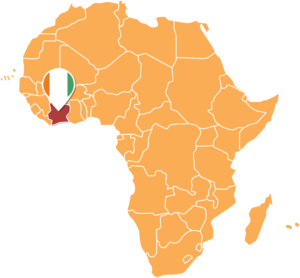

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- Africa is home to 65 percent of the world’s uncultivated fertile land, but millions sleep hungry daily.

- Amini Corp seeks to address the scarcity of data in Africa as well as facilitate capital investment.

- The scarcity of high-quality environmental data prevents others from building climate solutions such as farmer insurance schemes.

Amini Corp, a Kenyan-based climate tech startup, has raised $2 million in pre-seed funding which it plans to channel into developing an environmental data platform for Africa. The funding was secured through an oversubscribed round led by top European Climate Tech Fund, Pale Blue Dot.

Other investors in the venture are Superorganism, RaliCap, W3i, Emurgo Kepple Ventures and angel investors from the global tech community.

Amini Corp seeks to address the scarcity of data in Africa as well as facilitate capital investment. The company also promotes climate resilience, and helps accelerate economic development opportunities in the region.…

- Utility Kenya Power has started implementing the fourth phase of the Last Mile Connectivity Programme (LMCP) which will benefit an additional 280,473 Kenyan households.

- The company has invited bids for turnkey contractors, who will undertake the electrification

project in 32 counties in Kenya at a total cost of $193 million. - This phase will see deployment of 940 new transformers, maximisation of 3,735 existing transformers, and set up of associated power lines target counties.

Kenya Power has started preparations to implement the fourth phase of the Last Mile Connectivity Programme (LMCP), which will benefit an additional 280,473 Kenyan households.

The utility has invited bids for turnkey contractors who will undertake the electrification project in 32 counties at a total cost of $193 million. This phase of the LMCP project will entail the installation of 940 new transformers, and maximisation of 3,735 existing transformers. Further, target zones will benefit from the set …

- In Kenya, fuel is set to cost more once the taxman effects 16 percent VAT from the current 8 percent, which will make already high pump prices simply prohibitive.

- Starting January 2024, Finance Bill also seeks to increase the advance tax payable on passenger and commercial trucks to $36.52 from $21.91 per year.

- The new tax will simply increase the cost of transportation in Kenya, piling pressure on consumers already overburdened by high food prices amid sluggish economy.

Kenya’s transportation sector is at risk as the government considers fresh fuel VAT increase, which threatens to cripple businesses. Through the Finance Bill, the government is also proposing to increase the advance tax payable on passenger and commercial trucks to $36.52 from $21.91 per year. As a result, investors in the industry might be forced to scale down their operations even as others heap the costs on consumers.

The looming hit by …

- ChatGPT has a premium version – ChatGPT Plus – that is only accessible for a monthly fee of $20.

- Open AI termed the release of these new features as a move from an alpha phase to a beta phase, allowing access to over 70 third-party plugins.

- The power of the latest AI application has led to the development of AI-created SEO articles.

Open AI’s revolutionary product, ChatGPT, is readying additional features this week which allows more accurate internet search results. This move could power a new wave of subscribers for the AI platform that already has over 100 million users.

The updates comes even as the firm faces mounting concerns that AI applications could render various jobs obsolete. To counter this, Open AI has set in motion a new approach to technology targeting various industries relying on the power of Artificial Intelligence.

New web browsing and plugins

Open AI …

- Global NPL and distressed assets present a promising opportunity for investors looking to diversify their portfolios.

- A forum at the Annual Investment Meeting explored how rising interest rates are creating opportunities for distressed debt investors.

- Key speakers discussed the different asset classes, including real estate, corporate, and consumer debt.

Investors have been urged to capitalise on investing in distressed assets and non-performing loans to grow their portfolios. According to experts at the Annual Investment Meeting (AIM), non-performing loan (NPL) investing is becoming a popular strategy for investors seeking high returns.

The conference, which was held in two panels examined the current global economic environment and how rising interest rates are creating opportunities for distressed debt investors.

According to Harvard Business School, distressed debt investing is the process of investing capital in the existing debt of a financially distressed company, government, or public entity.

Why having partners is a must

The …

- The forum offers a unique chance to shape global investment policies by tackling the challenges to international investment.

- The forum will offer policymakers and other stakeholders an opportunity to identify solutions and reach a consensus on climate finance and investment priorities.

UNCTAD World Investment Forum Executive Director James Zhan has announced the launch of ‘UNCTAD World Investment Forum 2023’. Taking place under the theme ‘Investing in sustainable development’, the forum, which will be held in October will bring together government leaders, global CEOs and other investment stakeholders.

Zhan stated that the UNCTAD World Investment Forum is the foremost global platform dedicated to investment and development. The forum is aimed at coming up with strategies and solutions for the challenges faced by global investment and development.

Climate finance and investment priorities

It also offers a unique chance to shape global investment policies by tackling the challenges to international investment resulting from …