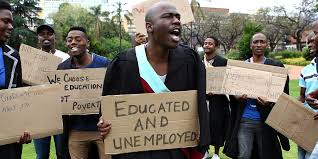

- Youth Unemployment in Kenya: The Role of Vocational Training

- New $900,000 initiative aims to boost sustainable trade in Tanzania

- Organization of the Petroleum Exporting Countries’ (OPEC) pride in its African roots

- AIM Global Foundation pushes for stronger Gulf-Africa trade partnerships

- Investment opportunities in South Sudan’s emerging gold industry

- Family planning drive in Kenya gets 450,000 self-injectable contraceptive doses from UK

- AfDB commits $2 billion to revolutionise clean cooking in Africa, save forests

- The harsh realities of family laws for African women revealed

Premium

- Kenya’s forex reserves dipped to $6.2 billion on May 19, an eight-year low, before a slight improvement to $6.4 billion on May 26.

- At $6.4 billion, Kenya’s reserves are just 3.60 months of import cover, which is below the Central Bank of Kenya’s desired target.

- What’s more, the reserves are below the East Africa Community preferred threshold of 4.5 months of import cover, hence exposing the country to high volatilities in the global market.

A dip in export earnings, coupled with reducing diaspora inflows at a time of huge debt repayments have left Kenya grappling with low forex reserves, raising concerns on the health of East Africa’s economic powerhouse.

The low forex reserves are further compounding the dollar shortage problem that has been gripping importers for months. Importers, mainly in the manufacturing and the energy sectors, have been struggling to secure the greenback to replenish their suppliers.

Kenya’s forex reserves

…According to SWIFT, African regions with strong integration saw increased use of local currencies and decreased use of hard currencies such as the US dollar. For instance, the use of the West African franc by the eight countries in the West African Economic and Monetary Union has overtaken the South African rand and the British West African pound.

This implies that boosting the use of regional currencies will shield the African trade market from adverse global conditions associated with the performance of US dollars. However, further regional coordination remains necessary to build a continental payment system that encourages the use of local correspondent banks and local currencies. These moves can help in managing currency depreciation to boost African trade finance. …

Into a menacing economic quick sand African economies have been sinking, taking hefty blows from numerous unprecedented challenges birthed by the overarching global crisis. The status quo has instigated a clarion call to cushion them from dipping further beneath the horizon, by casting different viable iron rods, as the ‘one shoe fits all’ approach is not feasible due the dynamic nature of African economies. Inarguably, Africa has not been left unscathed amid the ongoing global ‘polycrisis’, as described in the 2023 World Economic Forum’s (WEF) Global Risks Report, to mean a cluster of related global risks with compounding effects, such that the overall impact exceeds the sum of each part.

In light of this, on day three of the WEF in Davos, Switzerland, UN Secretary General António Guterres in his speech, stated that at present the world faces “a category five” storm of challenges that need urgent action. These include …

It is unfair to mention African development pillars without mentioning the agriculture sector which employs nearly half of the population of sub-Saharan Africa (SSA).

The sector has enormous benefits to the continent, where farmer-centred organizations such as AGRA (Alliance for a Green Revolution in Africa) argue that nearly one-half of the young population is involved in the continent’s 60 million farms.

It is with no doubt that African farms stand to be the next profitable food market suppliers of the world.

“Out of total urban food sales of roughly US$200 to US$250 billion per year, over 80 per centcomes from domestic African suppliers,” according to AGRA.

Nearly 23 per cent of SSA’s GDP comes from agriculture (McKinsey, 2019); the sector is responsible for providing decent income, growth and poverty reduction for SSA.

The region’s food market was valued at $300 billion in 2017 and it could be …

Digital ID Africa Financial Inclusion

We can all agree that there is a possibility in the future, for anyone who can’t be digitally identified, the opportunity to access services are slim to none, especially financial services.

A digital ID is a form of identification where an individual can be known via remote means over digital channels. This features a high degree of verification and authentication, uniquely formed with individual consent and also observes user’s privacy and control over personal data. The latter, user privacy is a matter of a different discussion, but for now, the digital inclusion of an individual is paramount to create an electronic footprint in today’s globally connected world.

At present, there are more than 1 billion people who are not legally recognized as they bear no form of any identity (ID). According to World Bank 2018 estimates, almost 48 per cent of these “unknown” individuals exist …

Africa Entertainment Industry

Nothing soothes the African plains like heart-pumping beats and the melodious ethos of African instruments playing to cultural tunes intertwined with western influences of hip hop and RnB (Rhythm and Blues).

As Africa poses the world’s youngest population, the continent is not short of excitement. The region has plenty of singers, dancers, musicians and beatmakers, all hungry to produce the continent’s next hit. But it’s not just music that’s driving the continent’s entertainment industry.

The billion-dollar business of entertainment spans across, television, cinema, radio, video games, e-sports, print and online publishing, book publishing, business-to-business, music, out-of-home, and virtual reality.

Currently, only five countries are taking the lead in churning more revenue and putting talents out for the world to see as opposed to its other neighbours in Africa. Nigeria, South Africa, Ghana, Kenya and Tanzania have taken a lead in Africa, leaving much of …

Africa is big! Africa is growing and is projected to be more populous than it is now. Estimates indicate that nearly 2.8 billion people will inhabit Africa by 2060, according to the World Bank.

The high population could impact African countries depending on each respective country‘s reaction toward overpopulation and urbanization.

A crucial factor in this is land. To be more specific, urbanization of African economic hotspots ought to be analyzed effectively, because Africa is not open to the world as it supposed to be.

Not only that, but African cities are changing fast, and Africa requires a robust approach which is close to fool-proof to push the region towards sustainable development.

In this case, the Organization for Economic Co-operation and Development (OECD) report on Africa’s Urbanisation Dynamics 2020 enlightens the perspective quite vividly.

Kenya had more urban dwellers than the entire …

Africa is rising and gradually taking over the helm of economic power. This growth is now evenly spread, as other parts of the continent experience a slower growth pace compared to the rest, albeit recent years point to evidence of uneven growth across the continent’s sub-regions.

The African Development Bank’s (AfDB) economic outlook observed that only a third of Africa’s nations met the inclusive mark—downplaying inequality and poverty across the continent. Inequality and poverty have not been combatted efficiently as that would require deep structural reforms, build resilience for farmers against harsh-weather conditions by providing for smart agricultural schemes and providing fiscal space for expansion of safety nets.

In the same context, the continent’s growth has been forecasted on different levels. The outlook released on January 30, pointed out that Africa’s economic growth had stabilized at 3.4 per cent in 2019 and …

The insurance industry in Tanzania is poised for growth and has the potential to pocket more markets over time.

The industry has gained vital milestones as the Tanzanian Insurance Regulatory Authority (TIRA) argues that the country has continued to play its strategic role in the national economy by providing underwriting capacity, making appropriate compensation against risks and contributing towards mobilization of financial resources for Tanzania’s sustainable economic development.

In 2019 former insurance regulator Dr. Baghayo Saqware noted that essential reforms were underway to increase coverage and stimulate economic growth by ensuring implementation of policy and non-policy reforms intended to boost the image of the insurance industry and increase public confidence, according to a report by The Citizen.

Across East Africa, Tanzania has been cited to record a promising mark over the past eight years on life insurance category, according to a report by Deloitte East Africa Insurance Outlook 2019/2020…