- President Uhuru Kenyatta has urged the International Finance Corporation (IFC) and other World Bank constituent financial institutions to give more support to the country’s private sector

- Kenyatta said IFC has the potential to help make Kenya a lucrative investment hub by supporting the private sector in implementing the Government’s Big 4 Agenda

- IFC recently gave Equity Group a US$165 million (KSh 18.6 billion) loan to help it increase working capital and trade-related lending to its small and medium-sized enterprise (SME) clients in Kenya

- It is also set to become Equity’s second-largest shareholder after signing an agreement to purchase insurance firm Britam’s stake in the lender

IFC supports Kenya private sector big 4

The International Finance Corporation (IFC) has committed to working with Kenya private sector big 4, following calls by President Uhuru Kenyatta. On Tuesday, February 1, 2022, Kenyatta urged IFC and other World Bank constituent financial institutions to give more support to the country’s private sector to spur the country’s economic growth.

Read: Africans breaking new ground in international organizations

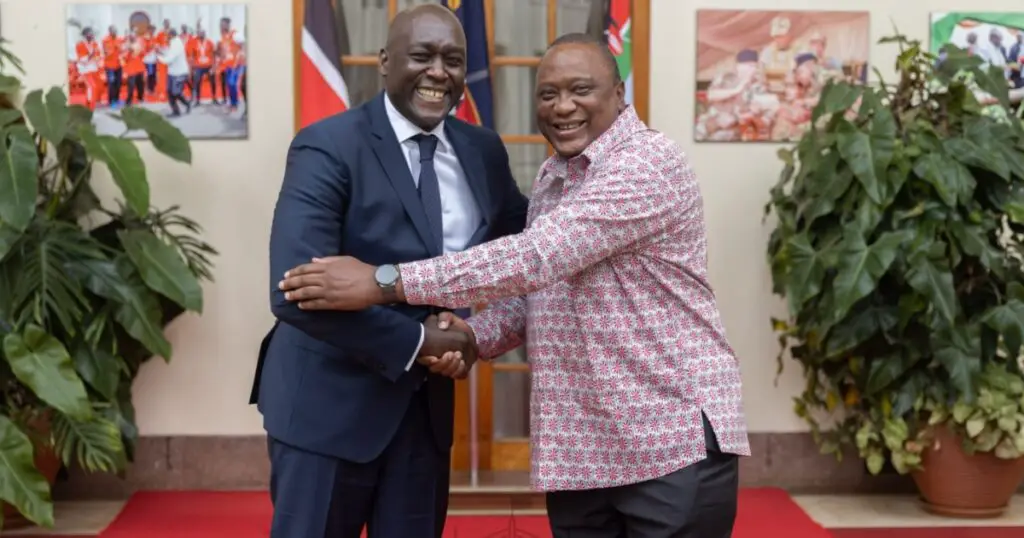

Speaking in State House Nairobi during a meeting with IFC Managing Director Makhtar Diop at State House, Nairobi, Kenyatta said IFC has the potential to help in making Kenya a lucrative investment hub through supporting the private sector in implementing the Government’s Big 4 Agenda.

The Big 4 Agenda is Kenyatta’s ambitious plan of development blueprint. It comprises offering Kenyans affordable houses, ensuring Kenya has food security, providing affordable healthcare, and spurring the country’s manufacturing sector.

Kenyatta launched the agenda at the start of his second term at the presidency. The term, which is his final, lapses this coming August.

Working together

Kenyatta said the country had the potential to speed up its economic growth with the group’s help.

“I am confident that with your partnership we can achieve that goal,” he said.

The IFC MD, who led a high-level delegation, briefed the President on the involvement of IFC in different economic sectors under the Big 4 Agenda.

Diop said he was holding roundtable discussions with stakeholders in the pharmaceuticals and housing sectors to deliberate on how to collaborate in the areas of affordable healthcare and housing for the Kenyan people.

President Kenyatta and Diop also discussed a plan that Kenya is keen on implementing to manufacture vaccines.

Kenyatta noted that the Big 4 Agenda had opened opportunities for increased collaboration through the country’s Public-Private Partnership program.

“We believe there is still a role that you can play in enabling the private sector to participate more to support our provision of affordable housing, universal healthcare, food security, and manufacturing through Public-Private Partnerships,” the President said.

Financing to Kenya

During the discussions, Diop assured the President of his institution’s commitment to continue supporting Kenya’s development agenda through private sector financing.

He said IFC intends to achieve its goals by providing inclusive financing and boosting recovery by developing the capital markets.

“We look forward to working more closely with the private sector in Kenya, which is already vibrant and enable it to contribute more significantly in the country’s achievement’s development goals as well as promote intra-Africa trade. It is time for Africa, as a continent, to trade within itself,” Diop said.

On climate change, Mr Diop said his institution is keen on providing financial support to the private sector in implementing environmental adaptation and mitigation projects.

The President said his administration was working to enhance the supply of electricity at an affordable cost to boost economic growth across the country.

Read: Training for Ugandan financial institutions and SMEs

IFC supports Equity

The visit by Diop comes weeks after IFC gave Equity Group a US$165 million (KSh 18.6 billion) loan to help it increase working capital and trade-related lending to its small and medium-sized enterprise (SME) clients in Kenya, especially those facing COVID-19 related challenges.

The loan from IFC is one of the single-largest credit facilities ever given to a Kenyan lender.

Equity said that besides shoring up the bank’s capital base, the facility would also be lent to customers fitting IFC’s impact investing criteria.

The corporation encourages the financial institutions it funds to lend to women-owned enterprises and climate-related ventures such as renewable energy projects.

The facility will partly support Equity’s lending towards Climate Smart Projects and the local SME sector, which was hard hit by the Covid-19 containment measures.

The loan, which will ultimately support hundreds of Kenyan businesses in the manufacturing, health, trade, transport, and consumer goods sectors, is part of IFC’s global $8 billion fast-track COVID-19 facility, announced in March and designed to help businesses maintain operations and jobs during—and after—the COVID-19 crisis.

Dr. James Mwangi, Equity Group Managing Director, and CEO said the loan was part of its business continuity management plan and would help the bank extend support to its clients.

“We are particularly targeting SMEs in sectors hit hard by COVID-19. We have purposed to support and walk with them so that they can survive during this crisis, recover, and thrive after it,” he said.

Acquiring Britam

Manuel Moses, IFC Country Manager for Kenya, said IFC would directly provide US$50 million (KSh 5.6 billion), with the remaining US$115 million (KSh 13 billion) coming from partners.

IFC is also set to become the bank’s second-largest shareholder after signing an agreement to purchase insurance firm Britam’s stake in the lender.

The institutional investor will buy 253.1 million shares of the bank from Britam at KSh55 each based on negotiations with the insurer.

IFC will acquire 164.5 million shares of the lender directly and another 88.5 million shares through its IFC Financial Institutions Growth Fund LP.

Read: Kenya, Rwanda to benefit from IFC housing project