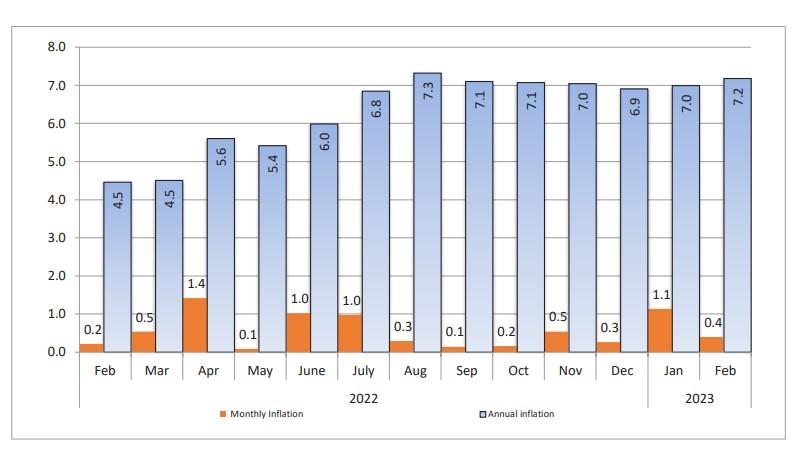

- The annual inflation rate for February 2023 increased by 7.2 per cent compared to 4.5 per cent recorded in February 2022.

- On a monthly basis, inflation rate increased to 0.4 per cent compared to 1.1 per cent registered in the earlier month.

- Load-shedding in South Africa is preventing farmers from buying livestock from Namibia.

In February, the cost of goods and services increased more sharply and the outlook does not appear promising, particularly regarding food, which saw a 14 per cent hike. The Namibian Statistics Agency disclosed inflation figures for February yesterday, with the month displaying a 7.2 per cent rate, one percentage point higher than January’s inflation rate.

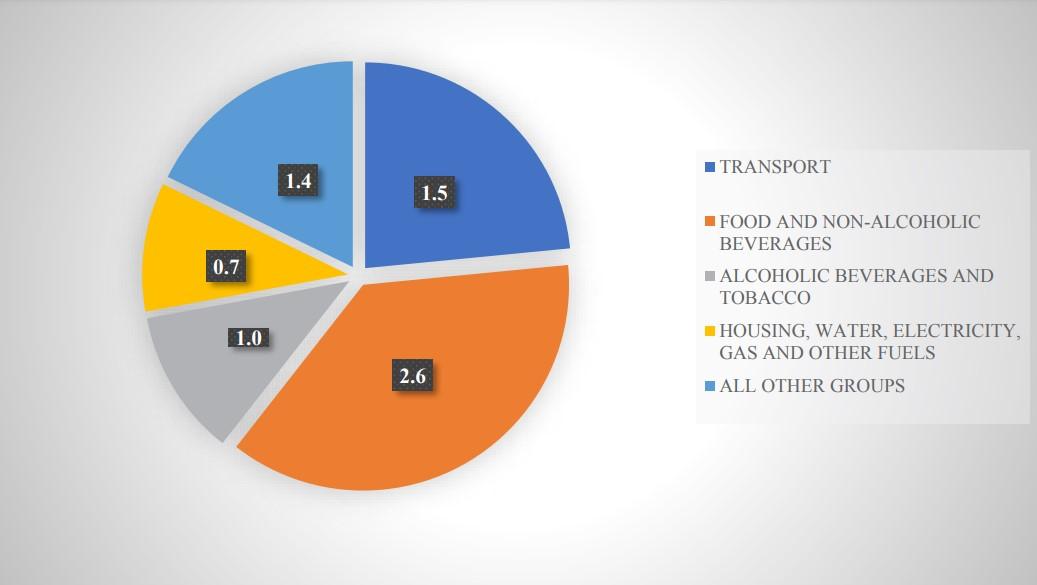

Locally, food prices, which rose by 14 per cent, and transport, which increased by 9.9 per cent, remain the typical drivers of inflation, similar to other countries across the globe in the previous months. These two categories made up 57.1 per cent of the total annual change in inflation last month.

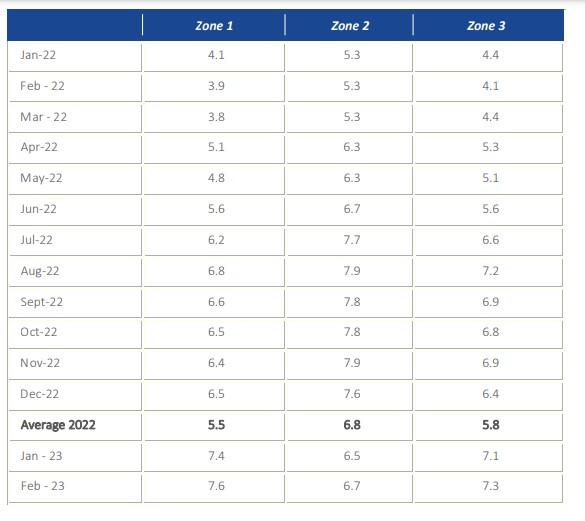

Namibia’s Inflation rates by Zones

While housing carries the most significant weight in the consumer price basket, it accounts for only 10.4 per cent of the annual change in inflation. The zonal inflation rates for last month indicated that Zone 1 recorded the highest annual inflation rate of 7.6 per cent, followed by Zone 3, which recorded an annual inflation rate of 7.3 per cent. Zone 2 recorded the lowest annual inflation rate of 6.7 per cent.

Namibia’s Goods and Services inflation rates

During the month of February 2023, the annual inflation rate for Goods increased by 10.1 per cent compared to 5.5 per cent registered during the same period last year. The annual inflation rate for Services rose by 3.1 per cent in February 2023 compared to 3.0 per cent recorded in February 2022. The monthly inflation rate for Goods and Services rose by 0.7 per cent and 0.0 per cent in February 2023 compared to 0.6 per cent and 1.9 per cent registered during the previous month, respectively.

The annual inflation rate for Housing, water, electricity, gas and other fuels component which accounts for 28.4 percent of the consumer basket, increased by 2.9 percent during February 2023 compared to 1.3 percent registered in February 2022, according to the Statistical Agency.

The increase in the price levels of this category was reflected in the subgroups of electricity, gas and other fuels (from -0.1 per cent to 7.0 per cent) and Rental payment for dwelling (from 1.4 per cent to 2.1 per cent). The monthly inflation for this component stood at 0.2 percent compared to 1.7 percent recorded a month earlier.

Food and non-alcoholic beverages which accounts for 16.5 percent of the NCPI basket, registered an annual inflation rate of 14.0 percent during the period under review, compared to 5.4 percent during corresponding period of 2022. On a monthly basis, price levels for this category increased by 1.0 percent during February 2023 compared to 2.4 percent recorded during the preceding month.

The annual inflation rate for the Transport category which accounts for 14.3 percent of the consumer basket increased by 9.9 percent in February 2023 compared to 13.2 percent recorded in February 2022. The increases in the Transport component were reflected in the price levels of Purchase of vehicles which rose by 5.3 percent compared to 3.7 percent registered in February 2022. Transport monthly inflation rate was stagnant in February 2023 compared to a deflation of 3.2 percent noted in January 2023.

According to an article published by The Namibian, Simonis Storm Securities analysts stated that although the year started with high rates, they expect a slowdown in the later months, and estimate that average inflation will settle at 5.3 per cent. However, the risks of high inflation rates remain elevated.

For example, NamPower is expected to raise its tariffs later this year by between 20 per cent and 25 per cent, which will lead to increased prices. Additionally, due to the poor rainfall and load-shedding in South Africa, food prices are under supply pressure, as observed last year.

The state of electricity in South Africa has been a cause for concern in recent years. The country has been experiencing frequent power outages and load shedding due to various factors such as inadequate maintenance of power plants, breakdowns, and a lack of investment in new infrastructure.

These power cuts have had a significant impact on businesses and households, leading to disruptions in daily activities and economic losses. The government and power utility company, Eskom, have been working to address these issues through various measures, including the introduction of renewable energy sources and plans to improve the reliability of the power grid. However, the situation remains a challenge, and South Africans continue to face uncertainty regarding their access to electricity.

Simonis analysts noted that load-shedding in South Africa is preventing farmers from buying livestock from Namibia, as slaughtering activity is limited due to insufficient electricity supply. Also, once slaughtered, meat products cannot be correctly stored in freezers or fridges due to electricity supply disruptions. This decrease in demand has resulted in lower livestock prices, and local farmers are not willing to sell at current prices, limiting supply artificially.

Furthermore, farmers cannot use irrigation systems at full capacity, so shortages in various horticultural products are expected. This will likely add inflationary pressure to Namibian food prices in the coming months, as long as electricity disruptions remain a problem in South Africa.

Even if farmers use diesel generators to run irrigation systems, this will increase their costs and thus food prices for consumers.