- Zimbabwe’s Central Bank said the increase in its policy rate to 200 per cent from 80 per cent will take effect from July 1

- Zimbabwe already suffers from sanctions that have exacerbated the pre-existing economic crisis

- The benchmark interest rate was last raised to 80 per cent in April from a previous 60 per cent.

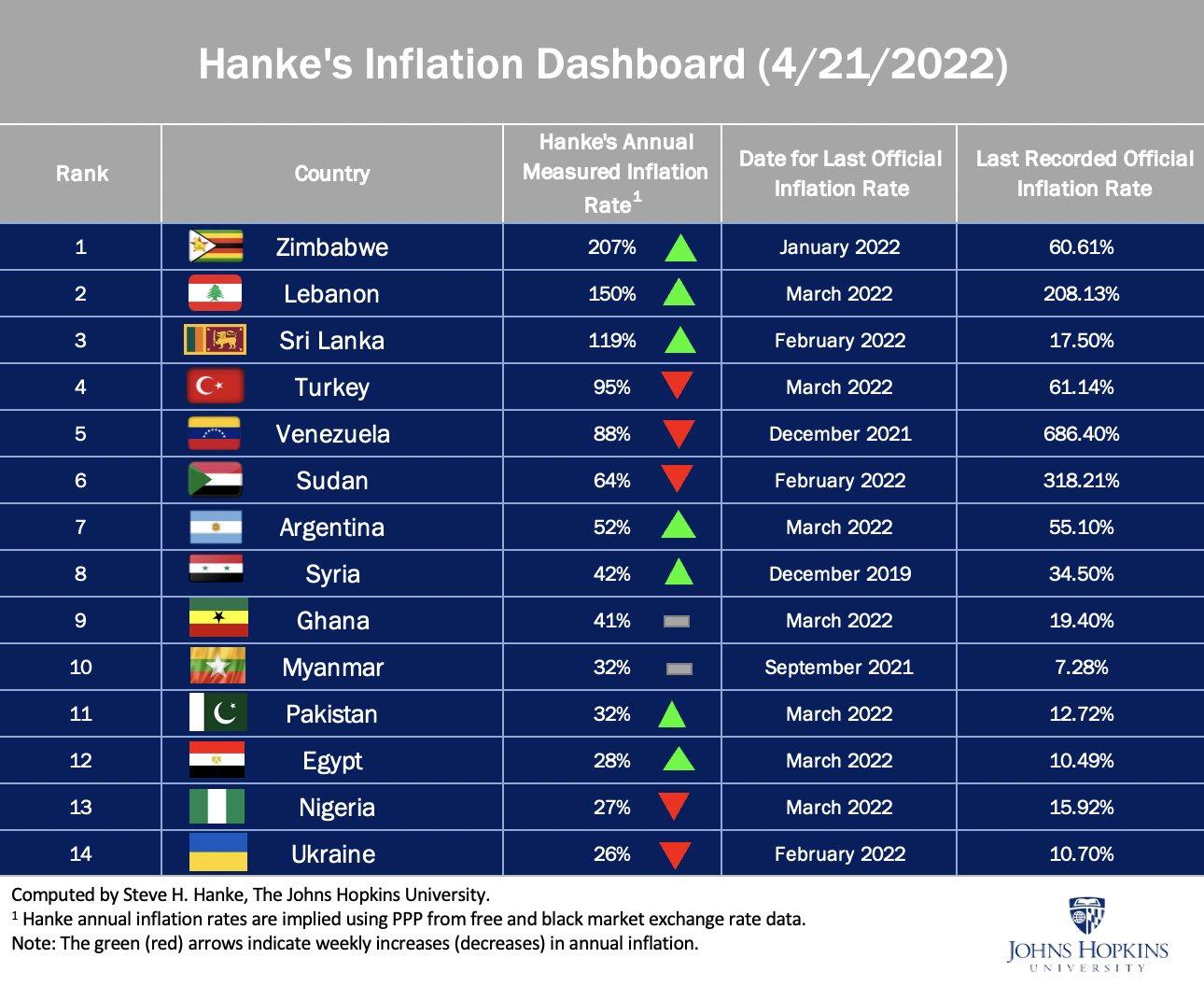

The Reserve bank of Zimbabwe more than doubled its key interest rate to 200 per cent on Monday, the highest in the world as the southern African country battles hyperinflation.

Zimbabwe’s Central Bank said the increase in its policy rate to 200 per cent from 80 per cent will take effect from July 1 after annual inflation hit almost 192 per cent this month.

The benchmark interest rate was last raised to 80 per cent in April from a previous 60 per cent.

“The committee noted that the increase in inflation was undermining consumer demand and confidence and that, if not controlled, it would reverse the significant economic gains achieved over the past two years,” central bank governor Dr. John Mangudya said.

The latest figures from the Zimbabwe National Statistics Agency (ZIMSTATS) showed Saturday that the country’s annual inflation rate reached 191 per cent in June. A new blow to the purchasing power of Zimbabweans, stoking fears of a return to the 2008 hyperinflation period where savings were wiped out.

Zimbabwe already suffers from sanctions that have exacerbated the pre-existing economic crisis. A context that makes it increasingly difficult for the population to afford a living.

According to an article by New Zimbabwe published on June 25, 2022, the tide of surging inflation is however currently not synonymous with Zimbabwe alone as it comes on the back of rising global inflation triggered by the impact of the Russia-Ukraine war on supply chain disruptions.

According to an article by Baptist News dated June 21, 2022, the challenge on the African continent is not just about the rising cost of living but of food scarcity linked to adverse climate conditions such as drought and desertification. That’s compounded by insecurity caused by religious extremism and banditry that have killed or driven farmers from their lands, leading to low agricultural productivity.

The situation is further worsened by the combined effects of the COVID pandemic and the ongoing war in Ukraine that have increased the price of staples such as wheat, bread, and gasoline. For these and other essentials, some African countries are import-dependent, meaning there are no reliable supplies of certain goods apart from exports

Separately, finance minister Prof Mthuli Ncube said that Zimbabwe will maintain the multi-currency system for the next five years, including the U.S. dollar. The greenback is already used in Zimbabwe, but it will become legal tender to boost market confidence, Prof Ncube told a news conference.

“We are entrenching the multi-currency system that is already in place. We want to advise the public that the use of the U.S. dollar will continue for the duration of the NDS 1 period. We want to assure that there is no reversal of policy around this measure that we have adopted. It will continue and we want to buttress it,” he said.

“The market’s lack of confidence in multi-currency is causing us problems, but I’m here to assure you it will remain in place for the next five years,” he added.

On May 7, 2022, President Emmerson Mnangagwa introduced a raft of measures meant to stabilize Zimbabwe’s economic crisis. Among the measures included was a suspension – with immediate effect – of lending by banks to both the government and private sector.

President Mnangagwa accused ‘economic saboteurs’, who include corporates and individuals, of sabotaging his efforts to stop the spiralling inflation. Just over a week later, the Reserve Bank of Zimbabwe lifted the ban on bank lending.

Read: Zimbabwe: President Mnangagwa’s measures to restore investor confidence

Zimbabwe will slightly lower its economic growth forecast for 2022 following economic challenges that have been spawned in part by the Russia-Ukraine conflict, Prof Ncube said. The minister had initially forecasted the economy to grow by 5.5 per cent this year but he said this will now be lowered when he presents the mid-term fiscal policy statement in July.

“As is the tradition, we are going to announce the revision during our mid-term budget review statement in July, suffice to say that we will announce a slightly lower growth rate than the 5.5 per cent,” Prof Ncube said during a press briefing to announce economic measures to stabilize prices.

He said the revision has been necessitated by the disruptions that are happening in the economy seen in rising inflation, and food and fuel prices.

In a related article, the permanent secretary of the Ministry of Finance, George Guvamatanga said the current legislative framework does not fully entrench the use of the U.S. dollar, hence the need for the new Statutory Instrument. He said the Zimbabwean government does not have sufficient U.S. dollars to sustain dollarization, hence the use of both the Zimbabwean dollar and U.S. dollar will continue for the next foreseeable future.

Zimbabwean dollar transactions constitute 70 per cent of the national payment system, and 30 per cent are in U.S. dollars, while government revenue also follows the same ratio of 70 per cent in Zimbabwean dollars and 30 per cent in U.S. dollars.

“The figures are showing us that the majority of Zimbabweans prefer transacting in the Zimbabwean dollar. So it is clear that we do not have enough U.S. dollars to cause us to want to dollarize,” Guvamatanga said.

According to an article by Zimbabwe Mail published on June 25, 2022, In May, the country’s annual inflation stood at 131.7 per cent. Month-on-month inflation was 30.7 per cent gaining 9.7 percentage points on the May 2022 rate of 21.0 per cent.

ZIMSTAT said the Consumer Price Index (CPI) for the month ending June 2022 stood at 8,707.35 compared to 6,662.17 in May 2022 and 2,986.44 in June 2021.

On the Blended Consumer Price Index, ZIMSTAT said the month-on-month inflation rate in June 2022 was 18.0 per cent gaining 9.3 percentage points on the May 2022 rate of 8. (Diazepam) 7 per cent.

The year-on-year inflation rate (annual percentage change) for June 2022 as measured by all items blended Consumer Price Index (CPI) stood at 70.0 per cent.

The blended CPI for the month ending June 2022 stood at 205.39 compared to 174.03 in May 2022 and 120.80 in June 2021.

On the Blended Consumer Price Index, ZIMSTAT said the month-on-month inflation rate in June 2022 was 18.0 per cent gaining 9.3 percentage points on the May 2022 rate of 8.7 per cent.

The year-on-year inflation rate (annual percentage change) for June 2022 as measured by all items blended Consumer Price Index (CPI) stood at 70.0 per cent.

The blended CPI for the month ending June 2022 stood at 205.39 compared to 174.03 in May 2022 and 120.80 in June 2021.

Read: Government and business hostilities undermine Zimbabwe’s economy