- The government of Tanzania is looking to make the country cooking oil self-sufficient by 2025, that is in just two years.

- ASA reports that it has 13 farms covering a total area of 16,588 hectares, but unfortunately, of these, only 12,731 hectares are suitable for farming.

- The deficit costs the country US$ 250 million every year in palm and other edible oil imports.

Tanzania is short of 650,000 metric tons which is over 60 percent of its requirements plugged by imports. Now the country wants investors to close this gap.

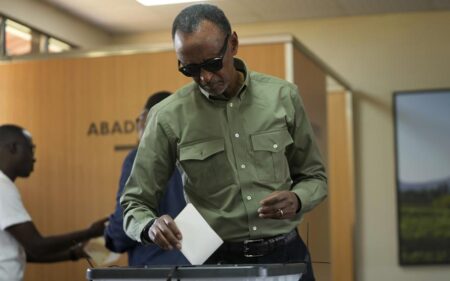

Speaking recently to farmers in South Tanzania, Prime Minister Kassim Majaliwa challenged local and foreign investors to see this demand gap as an investment opportunity.

The deficit costs the country US$ 250 million every year in palm and other edible oil imports, making the edible oil sector, the second-highest foreign exchange earner by the value of transactions.

“However, the government has been strategizing with the view to increasing local production of sunflower and palm oil seeds so as to reduce dependence on importation and end price fluctuations,” reports the USAID in a recent report titled “Driving New Investments into Agriculture in Tanzania’s Edible Oils Sector.”

According to data from the Tanzania Sunflower Processors Association (Tasupa), Tanzania is a net importer of 395,000 tonnes of palm oil from Malaysia. But the price of edible oil imports has skyrocketed because the world’s two largest producers Russia and Ukraine are at war.

Russia and Ukraine own 25 and 22 percent of the global edible oil markets respectively, “however, the ongoing Russia-Ukraine war has adversely affected the supply of cooking oil from the two nations to most countries causing the hiking of prices,” notes the USAID report.

Also Read: Tanzania sunflower farming inching for regional supremacy

Tanzania edible oil investment opportunities

The government of Tanzania is looking to make the country cooking oil self-sufficient by 2025, that is in just two years.

Tanzania has set its sights on increasing annual production from the current 250k metric tonnes per year to a whopping one million tonnes, surpassing its domestic demand by about 400k metric tonnes.

“The Tanzania Agriculture Seeds Agency (ASA) has been instructed to produce 15,000 tonnes of quality seeds for distribution to farmers in various regions reaching 2025,” states the USAID report which provides a glimpse at Tanzania’s ambitious strategy to more than triple its domestic edible oil production in just two years.

Tanzania’s Agriculture Minister Hon. Hussein Bashe confirms the plans announcing that; “We expect to produce and distribute 5,000 tonnes of quality seeds this year, double the amount to 10,000 tonnes by next year. ASA is expected to triple production reaching 2025.”

“We are planning to plant 20 million seedlings of palm oil in the 120,000 to 150,000 hectares in order to get a minimum of 18 million palm oil trees,” Minister Bashe announced.

To produce this huge number of seeds, Tanzania will need to cultivate an average of 300,000 hectares, and the country is ready. The Minister said plantations are available across some five regions including Kagera, Katavi, Kigoma, Tabora and Coast regions.

The move is thanks to intervention by President Samia Suluhu Hassan who recently ordered the ministry to increase production of edible oil.

Also Read: Tanzania: A hybrid solution to low oil supply problem

ASA’s Chief Executive Officer Sophia Kashenge, is ready to meet the executive order. Speaking to local media, the CEO said the country’s annual demand for quality seeds is 187,197 tonnes and with the growing demand for cooking oil, and on the backdrop of the presidential order, this figure is only expected to balloon.

However, the total area used for seed production is a mere 30,000 hectares. To achieve self sufficiency, ASA needs no less than 300,000 hectares.

According to ASA data, as of “April 2022, about 35,199.39 tonnes of seeds was available for farmers to use; 11,340.2 tonnes from imports and the private sector, 20,436.39 tonnes was produced by the agency while 3,422.80 tonnes remained from last season.”

ASA reports that it has 13 farms covering a total area of 16,588 hectares, but unfortunately, of these, only 12,731 hectares are suitable for farming.

With the respective districts in brackets, here is a list of the farms that are been cultivated to increase sed production in Tanzania; Msimba (Kilosa)-815 hectares; Mwele (Mkinga)-305 hectares, Bugaga (Kasulu)-30.8 hectares, Kilimi (Nzega)-300 hectares, Namtumbo-88.8 hectares and Msungura (Chalinze)-100 hectares.

Even if ASA had the required 300,000 hectares of land to cultivate sunflowers, palm trees and other oil-producing plants, the country will have to tackle climate change, low technology levels, and lack of local refineries to grow oil-producing plants.

“Despite strong growth in sunflower seed production, the level of edible oil processing in Tanzania is low compared to prevailing demand,” states the USAID report.

If anything, Tanzanian consumers prefer refined sunflower oil over imported palm oil, however, the price is the barrier and most people are forced to settle for the less preferred palm oil.

In an effort to reduce the cost of refined sunflower oil to meet local demand, the Tanzanian Planning Commission which operates under the Ministry of Finance Planning is working with the USAID to

industrialize the sector to help Tanzania increase it capacity to refine sunflower oil.

Extending 10% import tariff on crude palm oil

Following a feasibility study by the USAID/Tanzania Mission, it was agreed that the country needs to invite and incentivize investors who are specifically interested in refining local sunflower oil at a price that will be affordable to a low-income market.

Also Read: Tanzania: Sunflower production targets to combat drought

“Such investors would require USD 10M in start-up capital for a 12,000MT/year capacity plant and a strong aggregation and distribution network,” reported the USAID Tanzania Mission.

Interestingly enough, according to the USAID report, there are already large Tanzanian companies that are “…well positioned to make this investment; investors can source raw materials from local SMEs, which would experience higher productivity from rising demand.”

To increase foreign investment in the sector, USAID advised Tanzania to extend its 10% import tariff on crude palm oil to give the domestic sunflower oil industry a longer runway to become price competitive against palm oil imports.

Secondly, Tanzania should also place VAT exemption for agricultural processing equipment that is specifically

needed for sunflower oil refining. The country is also advised to offer a temporary VAT exemption for sunflower

seed cake.

To increase the production of sunflower oil, Tanzania should also “…prioritize and streamline land allocation close to major markets for oily seedcake, commercial farms, and processing sites.” Finally, the USAID report advises Tanzania to support access to technical assistance and training for farmers and youth to engage in the sunflower production and refinery sectors.