- Tourism has revamped after a series of strategic measures to keep the sector strong

- The review showed the exports of gold decline due to global price decline

- Tanzania debt is still high amounting to more than $37 billion

How Tourism and Gold Export increase Tanzania Economy

Tanzania economy is recovering from the gruesome impacts of the pandemic. According to the recent Monetary Policy Statement, Mid-Year Review for 2021/2022 analyzes global and domestic economic performance.

The detailed publication by the central bank of Tanzania (BoT) provides an outlook on the domestic economy and stance of monetary policy in the second half of 2021/2022.

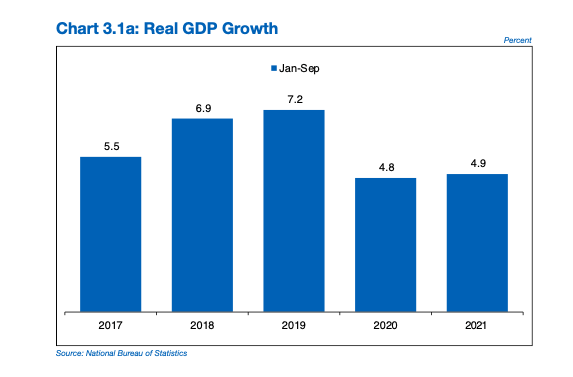

Tanzania has seen economic growth standing at 4.9 per cent in the first three quarters of 2021 compared with 4.8 per cent in the corresponding period in 2020. The report argues this increase is attributed to construction, agriculture, mining and quarrying, manufacturing, transport and trade activities.

Despite the strong waves of covid-19 affecting various sections of the global economy, Tanzania has instead maintained a firm stance within crucial veins of the economy – especially inflation which gradually increased but remained within targets.

As one of the competitive economies in the East African region, Tanzania has adopted a strategic economic diplomacy approach and customized its foreign direct investment measures, which favours the growth of the private sector.

READ:Report Insight: Tanzania economy still standing tall

The report brought exciting figures and facts surrounding Tanzania’s government plan to achieve its macroeconomic objectives aligned with its Third National Five-Year Development Plan 2021/2022 – 2025/26 (FYDP III).

Inflation Developments

According to the report, inflation gradually spiked from July to December 2021 but remained within the targets.

“Headline inflation averaged 4 per cent compared with 3.2 per cent during July to December 2020. The review noted that the increase was driven by the price of both food and non-food consumer,” the review noted.

On the other side, core inflation, which accounts for 73.9 per cent of the consumer price index, stood at 4.5 per cent compared with 2.6 per cent – building materials, transport, rent and garment are argued to have driven the numbers up.

Food inflation was 4.3 per cent from 3.4 per cent, due to an increase in demand for food in the neighbouring countries – and the non-food inflation rate rose to 3.9 per cent from 3.2 per cent.

Read: At least 250,000 Children in East Africa may have starved to death in 2021: report

Money Supply and Credit

According to the review, money supply to accommodative monetary policy measures and supportive fiscal policy during the first half of 2021/2022.

Tanzania is a nation whose economy is driven by the healthy participation of the private sector, the sector fair well amid slow times.

Credit to the private sector grew by 5.9 per cent compared with an average of 5.1 per cent from July to December 2020.

“The slow pace of private sector credit growth was attributed to subdued demand for new loans, following the adverse effects of covid-19 in some activities.” The report argued.

The review noted that interest rates charged on loans responded to accommodative monetary policy in a subdued manner on interest rates.

The BoT review highlighted the weak transmission associated with the lagged effect of the impact of the measures adopted, the existence of high-risk premium attributable to the adverse impact of the pandemic on businesses and investment and prevailing structural hindrances.

“Average lending interest rates marginally declined to 16.55 per cent during July to December 2021 from 17 per cent in the corresponding period of 2020”, the review noted.

Exchange Rates

Over the decades, the exchange rates category has been an exciting phenomenon for Tanzania, especially when trading the shilling versus the US dollar.

In the review, the nominal exchange rate remained stable throughout July to December 2021, trading at an average of Tshs2,308.3 per US dollar compared to Tshs 2,309.19 per US dollar in the corresponding period of 2020.

According to the BoT review, this represented a minimal appreciation of 0.004 per cent.

“The exchange rate stability was primarily supported by low inflation, prudent monetary and fiscal policies, and adequate foreign exchange reserves.” The review argued.

Tanzania Debt

Tanzania is not new to debt, as it owes a substantial amount of loans to the international financing community. Hence—the national debt, comprising public and private debt, stood at $37.1 billion at the end of December 2021 from $33.77 billion in June 2021.

The review showed other high numbers on external debt – increasing to more than $27 billion from $25.519 billion, of which 73.6 per cent was public debt.

Also, public domestic and external debt amounted to more than $29 billion, which is an increase from around $28 billion, of which external debt was 75.6 per cent.

Tourism in Tanzania

Tanzania is internationally recognized as one of the most exotic and competitive tourism hotspots in the continent—hence in that pocket, things have been improving as the global economy recovers from the effects of the pandemic.

According to the review, from July to December 2021, tourism earnings rebounded though lower than the pre-pandemic levels, showing a gradual revamp in tourism operations as shown by a rise in tourist arrivals.

Tanzania Exports

The review took a profound take on the performance of the exports sector. Whereby, exports of goods and services amounted to $5.735 billion in July to December 2021 compared with $4.598 billion in the corresponding period in 2020 – service receipts and non-traditional goods accounting for the largest share of 87.5 per cent.

“Services receipt increased by 78.5 per cent, owing to a significant rebound in tourist arrivals to 543,644 from 262,093. Exports of goods amounted to $3.85 million, dominated by non-traditional goods at 81.4 per cent.”

However, the review noted that good performance was recorded in exports of manufactured goods, horticulture, fish and fish products. Meanwhile, exports of gold amounted to more than $1.3 billion compared with around $1.6 billion.

The review argues that the decline is attributed to the decline in the price of gold in the world market consistent with the strengthening of global financial markets.

Tanzania Imports

However, the review noted that the imports of goods and services were around $6.5 billion from July to December 2021, compared with $4.699 billion in the corresponding period in 2020.

The rise in price and volume effects of oil affected oil imports (increased by 76.7 per cent, which is more than $1.1 billion) which accounted for about 21.4 per cent of goods imports.

“Furthermore, imports of machinery and building and construction rose by 16.3 per cent, and 41.5 per cent, respectively and altogether accounted for 28 per cent of goods imports. Services payment amounted to $1.035 billion.”

Read: East Africa’s largest economy expands by 6.2pc