- Coconut remains one of the most important and useful palms globally.

- The global coconut industry was worth $4,512.37 million in 2023.

- There are opportunities in the global coconut industry for the African government and the private sector to explore and earn foreign exchange.

Coconut remains one of the most important and useful palms globally. The global coconut products market could reach $31.1 billion by 2026. This follows its increasing use in food, beverage, cosmetics, and other industries. There are opportunities in the global coconut industry for the African government and the private sector to explore and earn foreign exchange.

Yet the global coconut industry remains significantly unpronounced. Not many people even know about the International Coconut Community (ICC), an entire international organization dedicated to the trading of coconuts and related products. According to the ICC, the global coconut industry was worth $4,512.37 million in 2023. The ICC projects this value to reach $7,260.61 million by 2028. This represents an annual growth of 9.98 per cent over the next five years.

International Coconut Community (ICC)

The ICC represents an intergovernmental organization formed by coconut-producing countries in 1969 under the aegis of the United Nations Economic and Social Commission for Asia and the Pacific (UN-ESCAP).

With its Secretariat in Jakarta, Indonesia the ICC represents close to 20 coconut-producing countries. This handful of countries accounts for over 90 per cent of the global coconut production and trade of coconut products.

Unsurprisingly, most of the ICC members come from Asia and the Pacific peninsula. Nine Pacific countries make up the ICC. They include the Federated States of Micronesia, Fiji, Kiribati, Marshall Islands, Papua New Guinea, Samoa, Solomon Islands, Tonga, and Vanuatu. The eight Asian representatives at the ICC include India, Indonesia, Malaysia, Philippines, Sri Lanka, Thailand, Vietnam and Timor Leste.

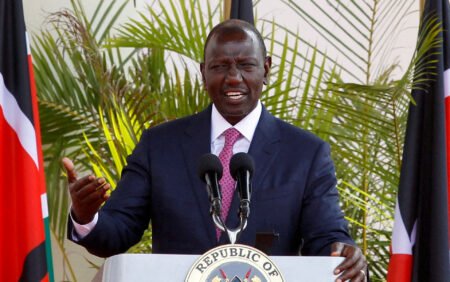

Many would expect more Caribbean countries in the ICC but only Jamaica makes it to that list. Similarly, Africa is mostly a tropical continent with huge coastlands perfect for coconut farming. Ironically, only Kenya represents Africa at the ICC. Moreover, only Guyana represents South America.

Africa’s low representation at the ICC

Africa’s representation at the ICC remains low despite membership in the Community is open to all coconut-producing countries. Moreover, membership to the ICC is not complex as it is based on the unanimous consent of existing members and acceding to the agreement established by the ICC.

The ICC Secretariat, headed by an Executive Director carries out the Community’s operations. A chairperson, a one-year rotational office heads the Community. Moreover, a network of National Liaison Officers (NLOs) represents the member countries’ interests. The NLOs have the responsibility of developing the global coconut industry and spearheading the national interests of their respective countries.

“ICC maintains close contacts with the United Nations bodies and the UN-ESCAP as well as the international institutions such as ACIAR, SPC, CGIAR, Bioversity International, ITC and others to be able to exercise its functions,” the body asserts.

Though it is not a member of the ICC, Nigeria has recently taken an interest in the coconut industry and its future potential in its national economic development. Currently, the coconut industry in Nigeria already brings in over N20 billion annually for farmers and agribusiness entrepreneurs.

Huge incomes across the value chain

Granted this huge income is not from the sale of raw coconuts but rather coconut by-products including dehusked nuts which Nigeria exports close to 350,000 metric tonnes which in turn is the raw material for the production of an excess of 1,700 metric tonnes of coconut oil.

Take Lagos for instance, that single state reportedly has the potential to produce more than 10 million coconut trees and over 1 billion husked nuts valued at over N45 billion.

Across the continent in Tanzania, coconut farming is largest in Mtwara where annual production is estimated to be between 600 and 800 tonnes.

Then you have the Kilwa, Lindi and Liwale districts whose estimated production stands at 95,000 tonnes over an area of more than 10,800 hectares earning the country an average of Sh954 million (2019/20).

Given these lowly figures and the super underrepresentation of Africa in the ICC, there is every reason for African policymakers to revisit this sector. On a positive note, Coconuts have proven a very sustainable crop, harvested at least three to four times a year per tree and each tree has a life span of several decades.

Coconut shells used for firewood

Also, the coconut value chain in Africa is very short, coconuts are mostly used directly for cooking as coconut milk and for oil. Other than that, in Africa, coconut shells are used as firewood and in a very small percentage, used for ornaments.

Coconut husks are used to make ropes and baskets and as most tourists would know, the unripe coconut is famous for being a healthy delicious natural drink in almost all coastal areas.

Read also: Got Milk? How a small town is using digital tech to sell milk

The COVID-19 pandemic affected direct trade between countries and even within countries, however, the pandemic did increase consciousness of the need for healthier diets and with that, the demand for coconuts grew and is growing.

“The pandemic promoted the importance of a plant-based diet and alternative protein to maintain a healthy immune system. In addition, the market witnessed rising consumer interest in cooking and baking at home, which has led to the increased demand for plant-based dairy products such as coconut milk and cream,” reads a Mordor Intelligence report.

Clean-label, plant-based foods

Titled ‘Coconut products market size and share analysis – growth trends & forecasts (2023 – 2028)’ the report also points to the growing demand for plant-based milk which directly touches the coconut industry and of course, soya beans and the now highly demand soy milk.

“There has also been an increased interest in halal-certified and clean-label plant-based food and dairy alternatives,”

All in all, owing to these Covid-19-based behaviour changes, now you have companies showing interest in investing in the coconut value chain. The trade is mostly online retailing. The report cites Koita, a Dubai-based manufacturer of non-dairy milk products which reportedly enjoyed increased online sales by 370 per cent over the pandemic period in 2020.

According to the report, in Saudi Arabia alone, the firm’s sales shot up 300% during the pandemic; the gift of the curse, so to speak.

Rising adoption of vegan diets

The growing consumer concerns associated with the consumption of conventional dairy-based food and beverage products and the adoption of vegan diets due to rising health awareness are expected to drive the growth in coconut products.

As the organic industry continues to grow, so will demand for food and beverages manufactured out of organically produced ingredients and here Africa has its niche. Africa still, for the large part, produces organic foods, especially when it comes to coconuts, this industry remains largely untapped and so the introduction of hybrid coconut plants has not taken root.

Also based on this report, Africa should focus on maintaining its natural food production industry to capture the growing market for organic foods, including coconuts and coconut products.