- Last year, trade between Angola and Italy was valued at US$400 million.

- Vice-president of the Angola-Italy Chamber of Commerce and Industry (CCIAI), Hélder Cardoso, said strengthening of financial collaboration between Angola and Italy is with a view to diversifying Angola’s exports.

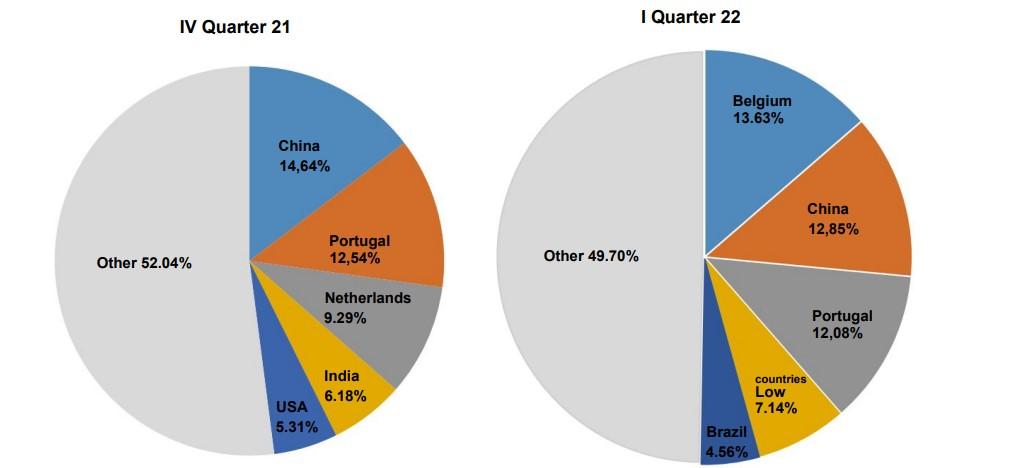

- In the first quarter of 2022, the USA, France, Italy, China and the United Kingdom were the countries that stood out in terms of the origin of foreign direct investment in the oil sector.

In 2021, trade between Angola and Italy was valued at US$400 million, thus corresponding to an increase of more than US$100 million dollars compared to the same period last year.

From the total, US$280 million derived from the country’s oil exports to Italian soil, while US$180 million represents imports of agricultural equipment and the country’s manufacturing industry in this European country.

This information was revealed by Hélder Cardoso, vice-president of the Angola-Italy Chamber of Commerce and Industry (CCIAI), who was speaking to the press as part of the Angola-Italy Business Forum.

Angop, Hélder Cardoso envisaged the strengthening of financial collaboration between Angola and Italy with a view to diversifying Angola’s exports.

Early this year, Italy penned a deal with Angola to ramp up gas supplies from the southern African country as it urgently scrambles to break away from Russian gas over the Ukraine war.

A declaration of intent was signed to develop “new” natural gas ventures and to increase exports to Italy, a statement from the Italian foreign minister announced.

“Today we have reached another important agreement with Angola to increase gas supplies,” Foreign Minister Luigi Di Maio said in the statement.

“Italy’s commitment to differentiate energy supply sources is confirmed,” said Di Maio at the end of a two-and-half-hour long visit to Luanda.

Read: Angola: Huge Investment Opportunities in fossil fuels despite production decline in Africa

Prime Minister Mario Draghi wants to add Angola and Congo-Brazzaville to a portfolio of suppliers to substitute Russia, which provides about 45 percent of Italian gas.

Meanwhile, the official took the opportunity to invoke the fact that it is necessary to modify the fragility of the shortage of qualified professionals on enormous occasions to attract investment in the field of training of frames.

In the sights of Italian businessmen are the fields of Education, Manufacturing Industry, Agri-food, Renewable Energy and Oil and Gas, said the official, who did not reveal the amount available for investment in Angolan soil. Cited by Angop, he also left a prediction that the investments will materialize next year.

The political and social balance as well as macroeconomic reforms were pointed out by the Italian ambassador to Angola, Cristiano Gallo, as reasons that drive Italian companies to invest in Angolan territory, writes Angop.

Meanwhile, five countries dominate foreign investment in Angola. According to a report by the National Bank of Angola (BNA), in the first quarter of this year, the United States of America (USA), France, Italy, China and the United Kingdom were the countries that stood out the most in terms of origin of foreign direct investment from the oil sector in the country.

The report on the Balance of Payments and National Investment Position also notes that South Africa and Belarus stand out in the non-oil sector

More than 90 per cent of foreign investment absorbed by the oil sector Foreign Direct Investment (FDI) in the country is almost entirely absorbed by the oil sector: until the second quarter of this year, the amount collected from FDI in the country was US$9.7 billion, of which more than 90 per cent were used in the petroleum field.

If oil takes the ‘gold’ in terms of greater absorption of FDI, the ‘silver’ goes to diamonds. Placing this sector in second place on the podium, the official said that the diamond sector registers, on average, more than US$100 million annually.

The BNA also states that, in the period in question, the balance of direct investment was “US$1,358.3 million in deficit, against a deficit of US$1,480.8 million recorded in the previous quarter, justified by the reduction in the recovery of investments in the petroleum sector”. Regarding the flows of foreign direct investment in the country, the document also indicates that they were valued at US$1,509.4 million,”mostly in the oil sector, with around 99.6 per cent of the total value.”

Read: Why Angola is Africa’s next mining powerhouse

“With regard to the composition of the other investment, it is important to note that commercial credits and advances represent 52.6 per cent of its total value, followed by coins and deposits with 46.4 per cent”, the document indicates.

The report also mentions that the “stock of Angolan investment abroad” increased from US$2,152.6 million in the fourth quarter of 2021 to US$2,246.9 million dollars, “as a result of the appreciation of some assets invested abroad.”

Among the main destination countries for Angolan direct investment abroad are Mauritius, Portugal, Isles of Man, São Tomé and Príncipe and Cape Verde.

In the quarter under review, the surplus balance on the Goods Account increased by 24.65 per cent, from US$6.89 billion in the fourth quarter of 2021 to US$8.57 billion in the first quarter of 2022. This increase was due to the increase in the value of exports (18.05 per cent), higher than the increase in the value of imports (3.60 per cent).

Compared to the same period last year, the Goods Account balance increased by 88.26 per cent (US$4.55 billion in the first quarter of 2021), having been influenced by the increase in the value of exports by 69.61 per cent, greater than the increase in the value of imports by 34.53 per cent.

The 18.05 per cent increase in export earnings was influenced by the increase in the value of oil exports by 18.03 per cent and non-oil exports by 18.44 per cent compared to the previous quarter.

With regard to the value of imports, its increase was essentially due to the increase in the value of imports of fuels by 18.53 per cent and of products which are Cast iron, iron and steel (90.32 per cent ); Cast iron, iron or steel works (37.28 per cent); Books, newspapers, prints and other products from the graphic and text industries (35.66 per cent); Electric machines, equipment and materials, and their parts; recording devices (29.00 per cent); Plastics and articles thereof (24.74 per cent); Motor vehicles, tractors, cycles and other land vehicles, their parts and accessories (15.73 per cent); and Nuclear reactors, boilers, machines, devices and mechanical instruments (9.24 per cent). As for the countries of origin of Angolan imports, Belgium and China were in the lead and not Italy during the quarter under review,