- China’s economic slowdown will affect Africa since the Asian country is the largest single-country trading partner.

- As China experiences a notable economic slowdown, the IMF asserts that sub-Saharan African countries must proactively respond to the shifting geo-economic landscape.

- The IMF says a promising avenue lies in tapping into the robust demand for minerals crucial for renewable energy development.

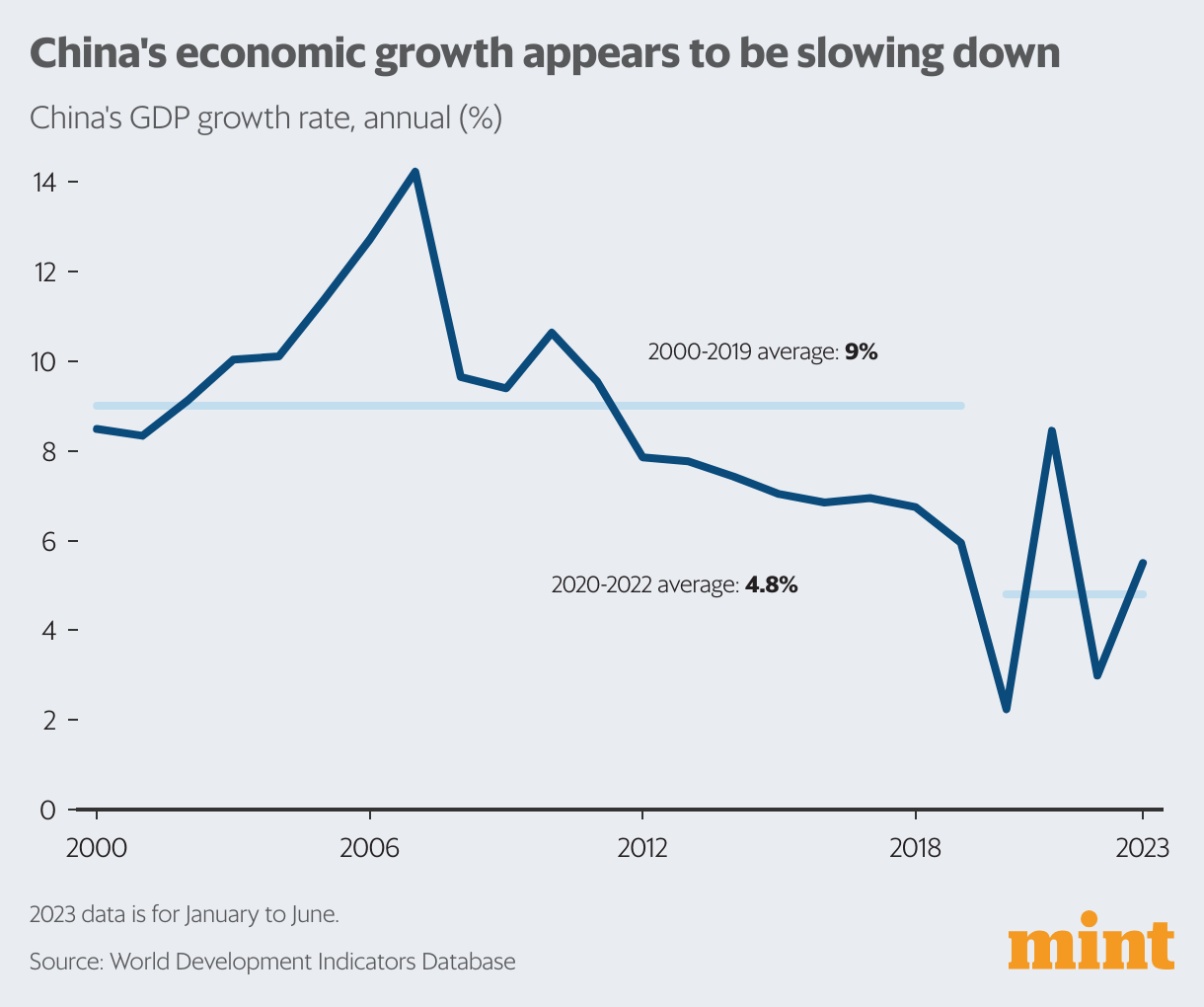

China—Africa’s largest single-country trading partner—is experiencing an economic slowdown. And this matters a lot for policymakers in Africa. As China grapples with a second consecutive month of contracting manufacturing activity posted in November, the implications stretch far beyond the borders of the Asian country.

China’s purchasing managers’ index (PMI) stumbled to 49.4 in November, a slight dip from October’s 49.5, falling short of economists’ expectations of 49.7. This statistical swing around the pivotal 50-point mark, which separates contraction from expansion, paints a nuanced picture of an economy needing stimulus to revive growth and instill confidence that its governing bodies can adeptly navigate industry support.

China-Africa trade relations

China has established itself as Africa’s biggest trading partner for over two decades, with $282 billion of trade recorded in 2022. Data from the General Administration of Chinese Customs indicates that China experienced an 11.2 percent increase in exports to African countries in 2022, reaching $164.49 billion.

In the same 12-month period, Chinese imports from Africa amounted to $117.51 billion, primarily propelled by escalating commodity prices, with China serving as a major consumer of these goods.

The world’s second-largest economy is grappling with a property market crisis and sluggish growth. As a result, China’s economic interactions with the global community and Africa are transforming, holding significant implications for future growth, trade, and investment developments.

For policymakers in Africa, this scenario unfolds as more than a distant economic phenomenon—it holds the potential to reshape strategies and redefine priorities.

The International Monetary Fund (IMF), in its latest Regional Economic Outlook, introduces a sobering perspective: a mere one percentage point decline in China’s growth rate could cast a shadow on average growth in the African region, diminishing it by approximately 0.25 percentage points within a year.

As the winds of economic change blow from the East, the African policymakers find themselves at a crossroads, compelled to decipher the intricate choreography of global economic interdependence and chart a course that safeguards their nations’ economic vitality.

Read also: Inside Kenya’s high-stakes game with World Bank and IMF loans

How Africa can counter the blow from China’s economic slowdown

As China experiences a notable economic slowdown, the IMF asserts that sub-Saharan African countries must proactively respond to the shifting geo-economic landscape. The secret lies in adapting to China’s decelerating growth and reduced economic engagements.

According to the multilateral lender, the key is cultivating resilience by fostering increased inter-African trade. This calls for the rebuilding of buffers through strategic tax policy reforms and economies enhancing their revenue administration. IMF explains that by fortifying these economic safeguards, African nations can better withstand the repercussions of China’s economic deceleration.

What’s more, diversification emerges as a pivotal strategy in navigating the challenges posed by China’s economic slowdown. The IMF underscores the importance of efforts to broaden African economies, ensuring sustainability in future growth trajectories.

A promising avenue lies in tapping into the robust demand for minerals crucial for renewable energy development. This presents an opportunity for forging new trade relationships and encourages the development of Africa-based processing capabilities, fostering economic independence while significantly reducing economies’ vulnerability to external shocks.

In enhancing competitiveness, African countries can strategically create a favorable business environment. Investments in infrastructure become instrumental, catalyzing economic growth and attracting foreign investments.

Additionally, deepening domestic financial markets will help contribute to economic stability and resilience, countering external uncertainties stemming from China’s economic slowdown.

By implementing these multifaceted strategies, Africa can counter the economic blow caused by China’s slowing economy and lay the groundwork for sustained and diversified growth.

Read also: China’s Crucial Role in Africa’s External Debt Restructuring Arrangements.

China’s economic slowdown impact on extending economic support to other countries worldwide

The adage goes that when the US economy sneezes, the rest of the world catches a cold. Yet, as China, home to more than 1.4 billion people, contends with many challenges, such as economic slowdown, high youth unemployment, and a tumultuous property market, it prompts a crucial question: what happens when China is unwell?

Given that China contributes over a third of global economic growth, any form of economic slowdown within its borders sends reverberations far beyond. This is especially important as China has been a major player in extending economic support to countries worldwide.

Across 150 nations, Chinese loans have financed critical infrastructure projects such as roads, airports, seaports, and bridges. Within Africa, China is the largest official bilateral lender to countries.

Despite this, the proportion of debt owed to China remains relatively modest, comprising just under six percent of the region’s total public debt. Notably, this African debt is primarily concentrated in five countries: Angola, Cameroon, Kenya, Nigeria, and Zambia.

However, recent data from the IMF adds a layer of concern. The ripple effects of China’s economic slowdown are discernible in sovereign lending to sub-Saharan Africa, which dipped to under $1 billion last year—the lowest level in nearly two decades.

This downturn raises questions about the future trajectory of Chinese investments abroad. Will we witness a reduction in Chinese investments beyond its borders? The answers to these questions remain uncertain, adding an element of complexity to how China’s domestic economic challenges will reverberate in its foreign policy.

As we navigate this intricate web of interconnected economies, it becomes evident that China’s economic health is not just a national concern but a global one. The intricate dance of global economics hinges, to a significant extent, on how China weathers its internal economic storms and how these, in turn, influence its interactions with Africa and the rest of the world.