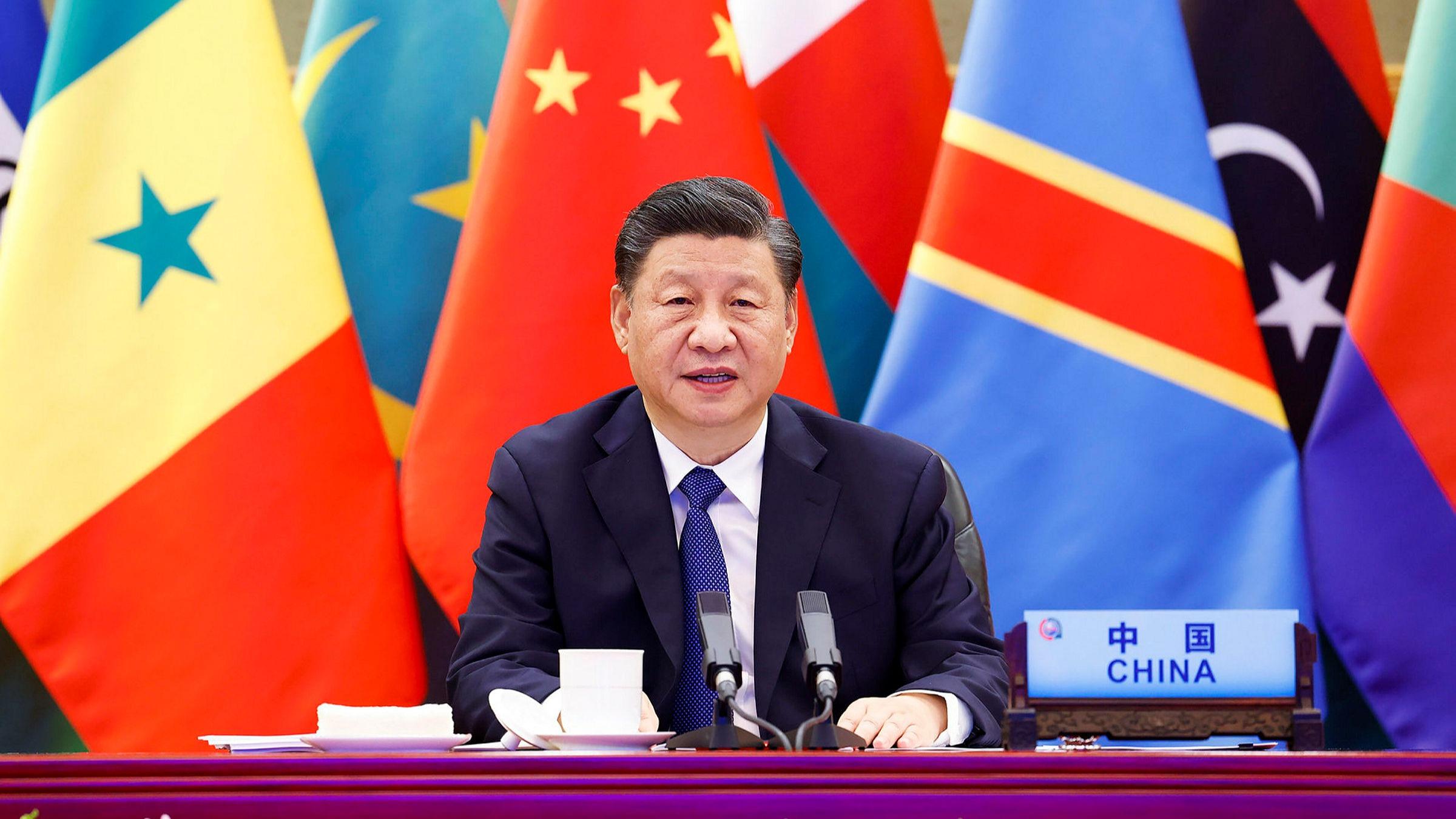

- China is the primary creditor and thus has a significant role in any of Africa’s external debt restructuring arrangements.

- In the last 20 years, Africa’s external debt has grown fivefold to about $700 billion.

- Chinese loan commitments peaked at over $73 billion of Africa’s external debt in 2020 and close to $9 billion of private debt.

Africa’s external debt burden

In the last 20 years, Africa’s external debt has grown fivefold to about $700 billion. According to Chatham House, a policy centre in London, Chinese lenders account for about 12 per cent of that amount. As of November 2022, the International Monetary Fund (IMF) and the World Bank considered 22 low-income African countries to either be in debt distress or facing potential external debt distress.

African countries struggle with other crucial economic growth issues because of their debt woes. For example, countries like Zambia cannot shield themselves from the ravaging effects of climate change because they are getting further into debt. Without the finances to service their debts, it becomes challenging for African countries to work towards the UN Sustainable Development Goals.

In the future, elevated Africa’s external debt, high external debt payment costs, and tight government budgets will continue to worsen. High debt burdens put at risk the economic growth, development, and climate policies of the continent. The global economic slump and falling commodity prices have worsened Africa’s situation. Even though there is no immediate risk of societal and financial breakdown from mounting debt, this trend must be reversed soon enough.

External debt relief

To restructure a country’s debt, creditors must typically consent to reducing the loan’s interest rate, extending the loan term, and forgiving a portion of the debt. China, which has confronted various domestic financial difficulties over the past three years, has remained reluctant to incur debt losses and has called for other lenders, such as the World Bank, to act on external debt restructuring.

The need for a resolution remains palpable for the nations with the greatest need for aid. Zambia defaulted in 2020 and has since sought to restructure $8.4 billion in debt. The South African country owes approximately $6 billion to Chinese creditors, and its total debt to foreign creditors grows closer to $20 billion.

READ MORE: TICAD8: Billions to Support African debt restructuring

Monetary policy tightening amid raging inflation

Central banks in the West have embarked on a monetary policy tightening cycle to combat the threat posed by inflation. This has raised the cost of Africa’s external debt and reduced available finance for some nations. The Federal Reserve raised its main policy target rate by 250 basis points in 2022. Expectedly the Fed will tighten further to push the main target rate to 3.1 per cent by the end of 2023.

At a domestic level, many African states have adjusted their policy rates with a tightening bias. For instance, African monetary unions have followed the lead and raised their respective policy interest rates. The Common Monetary Area (CMA) nation of South Africa, Lesotho, Eswatini and Namibia raised their interest rates—with the South African Reserve Bank in the lead in their quest to support their currency and shield against massive outflows of the foreign investment portfolio.

In the meantime, the 14 member countries of the two CFA Franc Zones pegging their currency to the euro—the Central African Economic and Monetary Union and West African Economic and Monetary Union— adopted the ECB’s lead, raising their policy interest rates in late 2022 and early 2023.

External debt relief mechanisms toned-down

A moratorium on debt repayments to official creditors within the G20—the so-called Debt Service Suspension Initiative (DSSI)- was implemented after the pandemic and coordinated by the World Bank and the IMF. The DSSI temporarily suspended US$10.3bn of debt service for eligible low-income countries.

Nevertheless, the DSSI expired at the end of 2021. The expiry ended a vital source of relief for Africa’s external debt. Consequently, the Paris Club introduced a Common Framework (CF) with G20 countries to deliberate on debt-restructuring appeals. That arrangement assessed case-by-case requests from the 73 countries eligible for the terminated DSSI.

Interestingly, only a few countries—Zambia, Ethiopia, Chad, and Ghana—have pursued external debt restructuring under the new framework. Many countries have abstained from this path for fear of credit rating downgrades. Besides, private-sector creditors remain reluctant to participate on equal terms under the CF, as with the DSSI. This continues to deny African states potential restructuring or relief on a large proportion of their borrowing.

China’s huge chunk of Africa’s external debt

China remains a significant source of bilateral development finance for African nations. Chinese loan commitments peaked at over $73 billion of Africa’s external debt in 2020 and close to $9 billion of private debt. Recently, China’s increased lending to the continent has drawn significant attention and criticism from the West.

Chinese debt varies widely across Africa but has mainly helped to drive development and infrastructure projects. Africa’s external debt from China remains critical in only a subset of the continent’s 54 nations. Figures from Boston University Global Development Policy Center indicate that Ethiopia and Angola are the two leading recipients of Chinese debt.

Recently, China has struggled to recoup its money from several African countries. Consequently, Asia’s giant economy has had to participate in complicated debt restructuring negotiations. Beijing has also grown more cautious about lending to Africa, with the possibility of default looming. The eighth Ministerial Conference of the Forum on China-Africa Cooperation (FOCAC) in November 2021 saw China cut investment pledges to Africa for the first time. (https://mrghealth.com) This cut resulted in a drop from US$60bn pledged at the seventh meeting in 2018 to US$40bn.

China’s two leading policy banks, China Development Bank and China Eximbank, have adopted progressively hardline lending conditions. China did not solely cause Africa’s external debt distress. However, China remains a crucial stakeholder in finding a lasting solution.

Africa’s creditors must lay aside geopolitical differences to resolve the debt issue across emerging economies on the continent. Fixing Africa’s debt sustainability struggles calls for the cooperation of China, African economies, Paris Club members, and other significant stakeholders.

China’s crucial role amid pressure for debt restructuring

Many African countries, have struggled economically during the pandemic and face the possibility of defaulting on debt payments. China is the primary creditor to these nations and thus has a significant role in any debt restructuring arrangements. The United States, supported by other Western countries, has pressured China to allow some of the developing nations to restructure their debt and reduce the amount that they owe.

China has maintained that other multilateral creditors should absorb financial losses as part of any debt restructuring. This insistence has bogged down a critical debt restructuring process. The delays threaten to push millions of people in Africa deeper into poverty.

On 11th January 2023, China’s Foreign Affairs Ministry released a statement asserting their commitment to helping with nations’ external debt burden by joining hands with the G20 and signing various agreements. China has also previously agreed to consider debt restructuring on a case-by-case basis. This is an attempt to continue protecting its commercial and strategic interests.

Moreover, under growing pressure from top international policymakers, China appeared to indicate in early April that it is ready to abandon the hardline stance and make concessions that would unlock a global effort to restructure hundreds of billions of dollars of Africa’sexternal debt.

A breakthrough would represent an economic lifeline to Africa’s vulnerable economies during uncertain financial stability and sluggish growth. It would gesture a renewed interest from China in global economic diplomacy. Development experts and economists will closely monitor the developments. This will determine if China’s words are followed by action considering its critical role in Africa’s external debt restructuring.