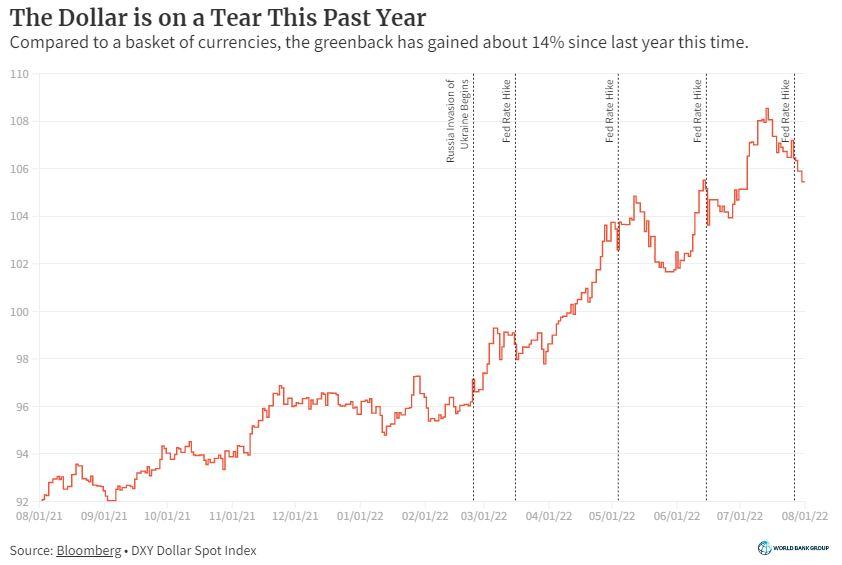

The United States dollar has rallied against major world currencies since the beginning of the year.

According to the World Bank, the greenback has appreciated by as much as 11% since the beginning of 2022. Several major currencies have lost ground to the US dollar and this development has serious implications for emerging markets, many of which are in Africa.

- United States dollar has appreciated in value since the beginning of the year as investors demand them relative to other currencies, World bank reports

- The Federal Reserve has been increasing interest rates, and this has led to investors piling into the currency which they perceive to be safer than the more esoteric emerging market currencies that have shown to be more volatile

- World Bank warns that a strong United States dollar environment will adversely affect Africa and emerging market economies. This is because of fundamental and structural economic vulnerabilities

The New York Times in July 2022 reported that the United States dollar is the strongest it has been in a generation. The New York tabloid and the World Bank agree in terms of why the Greenback has strengthened as much as it has so far. The Greenback appreciates value because of the strong demand for United States dollars. This is because the outlook for the global economy is largely pessimistic.

The outlook points to a slowing global economy. The war in Ukraine has also served to increase demand for the US currency by introducing volatility and geopolitical risks to the markets. Additionally, inflation which has reached historic high levels has prompted the Federal Reserve, which is the US central bank, to increase interest rates.

Read: China sneezes, will Africa catch a cold?

So strong has the rally in US dollars been that the Greenback has, for the first time in two decades, reached near parity with the Euro. These factors are combined with the flight by investors to safe-haven investments. The United States dollar’s appreciation shows that investors still view the currency as a safer option to the more esoteric and exotic investment options that they would otherwise select in a low-risk environment. Investors are exiting investments in Europe, emerging markets, and in other countries in search of safer investments in United States dollar-denominated securities, which require US currency to purchase.

According to the World Bank’s Global Economic Prospects 2022 report, “Global growth is expected to slump from 5.7 per cent in 2021 to 2.9 per cent in 2022— significantly lower than 4.1 per cent that was anticipated in January. It is expected to hover around that pace over 2023-24, as the war in Ukraine disrupts activity, investment, and trade in the near term, pent-up demand fades, and fiscal and monetary policy accommodation is withdrawn. As a result of the damage from the pandemic and war damage, the level of per capita income in developing economies this year will be nearly 5 per cent below its pre-pandemic trend.”

In an environment where the market anticipates further interest rate increases, the consequences tend not to be good for emerging markets and Africa. In fact, a high-interest rate environment in the United States will almost always result in crises for emerging markets.

The World Bank went on to support this position by relating historical incidents of such crises that took place in the 1980s in Latin America and in the 1990s in Mexico, which extended to Russia and Asia. The multilateral financial institution also expects that countries with high levels of sovereign debt will cause stress for countries with unsustainable borrowings. This is because low-income or poor countries cannot borrow in their own currencies in the amounts and for the maturities they desire.

For lenders, they cannot afford to be paid back for credit that they would have extended in the volatile currencies of emerging markets. In this instance, these same low-income and poor countries commit to borrowing United States dollars and repaying their debts in United States dollars regardless of the exchange rate.

In such a scenario, when the United States dollar becomes stronger relative to their own currencies, the loan repayments become more expensive in terms of the domestic currency. This is what is known in economics as the “original sin”. This is pertinent, especially for Africa. In May 2022, the Economic Intelligence Unit reported that African states have been accumulating external debt at a rapid pace over the past decade, taking advantage of an abundance of low-cost international credit for budgetary and balance-of-payments support to help to drive development plans and for other purposes.

The stock of total external debt held in Africa—debt accrued by the public- and private-sector entities and owed to foreign lenders—surpassed US$1trn, and related annual servicing costs broke through the US$100bn threshold for the first time ever in 2021. External debt remains highly concentrated in Africa, with just nine countries holding two-thirds of the region’s total external debt stock in 2021: South Africa (holding 15% of Africa’s total external debt), Egypt (13%), Nigeria (7%), Angola (7%), Morocco (6%), Sudan (6%), Tunisia (4%), Kenya (4%) and Zambia (4%).

Africa is in for interesting times…

Also read: AFCFTA will transform Africa if it can be implemented

According to the EIU graphic, much of the external debt stock of African countries consists of public medium- and long-term borrowings. This form of borrowing has been on the rise since 2000.

Private medium- and long-term debt stock in Africa has also been on the increase but not at the same scale and magnitude as the public debt. In short, governments, through their finance ministries, have been on a borrowing binge since 2000, whereas the private sector has marginally increased its borrowings in United States-denominated debt.

The increased levels of borrowing in hard currency badly expose governments to movements in interest rates and exchange rates. South Africa has the most external debt exposure of any country in Africa, followed by Egypt and Nigeria. With these facts in mind, it is no surprise to how much the Rand, the South African currency unit, has depreciated against the dollar.

African countries are highly leveraged with unsustainable levels of debt on their books. This problem going forward will be compounded by the increasing cost of servicing the debts as their currencies depreciated, as evidenced by the case of South Africa, which has seen its currency steadily depreciate against the United States dollar. External debt servicing will remain an issue, with the region projected to spend no less than 15% of its foreign exchange income on this cost category. This will culminate in difficult financing conditions for several countries on the continent. Most will not be able to access further debt to finance their development. In the worst of cases, others will experience heightened levels of financial distress in servicing their loans.

A strong dollar has implications for economic growth…

As the Federal Reserve increases interest rates, other central banks will follow suit. The World Bank is of the view that investors will need an incentive in the form of higher interest rates to continue investing in currencies other than the Greenback. This action will lead to a dilemma where a central bank will increase interest rates to protect foreign investment and the domestic economy but will also inadvertently lead to a lower rate of growth or a shrinking economy altogether.

The strengthening US dollar will also have an adverse effect on trade. This emanates from the dominance of the US dollar in settlement of international trade transactions. A case in point is in the trade of minerals and commodities like oil which happens exclusively in United States dollars. Developing economies like those that constitute the continent of Africa are price takers, which means that their policies and actions have little to no impact on the global markets. Such countries are largely dependent on global trade, unlike the case of India, which has a vibrant domestic economy. Where there is excessive dependence on global trade, a strong dollar can seriously and negatively impact the economy.

A strong dollar will lead to increased inflationary pressure in some economies. Zimbabwe is a case in point. The southern African country is highly dependent on imports for nearly everything. A strengthening US dollar makes good produced in that country more expensive.

World Bank official Marcello Estevão advises that there is no easy solution to problems arising from the strong United States dollar. To prevent the next crisis, countries should act now to shore up their financial position and engage in sustainable borrowing. Even in challenging times, policymakers can find opportunities to encourage investment and spur economic growth while reducing fiscal pressures. For its part, the international community must do more to speed up debt restructuring. Doing so will go a long way to put countries back on a more sustainable fiscal path.