- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Debt Relief

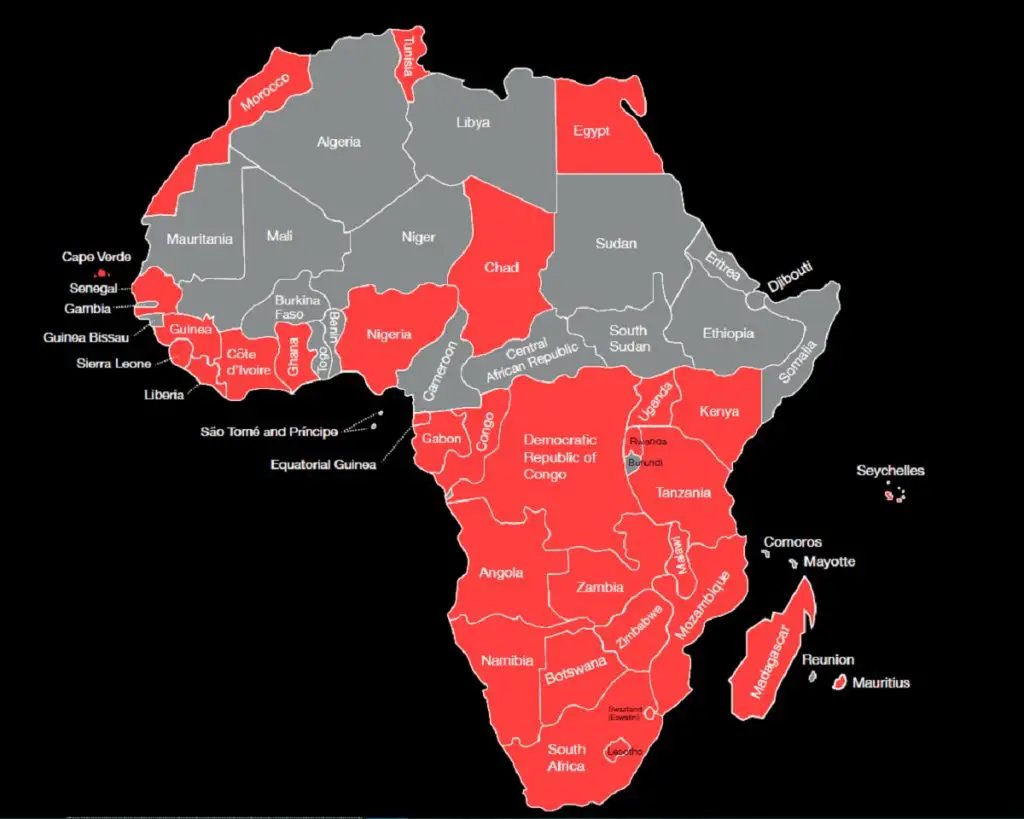

- There is a debt crisis in Africa as countries struggle to repay international loans.

- According to the World Bank, nine African countries entered 2024 in debt distress, with another 15 at high risk of distress and 14 more categorised as moderate risk.

- According to the United Nations, Africa’s public debt will stay above pre-pandemic levels in 2024 and 2025.

At 4 per cent, Africa is projected to be the second fastest-growing economic region in the world in 2024, according to a report by the International Monetary Fund (IMF). However, behind the headline figure is a less optimistic reality.

Many African countries have suffered from slow post-COVID-19 recovery, climate change shocks, worsening food security situation, political instability, weak global growth, and high-interest rates. These economic shocks have pushed over 55 million people into poverty since 2020. The situation is increasingly alarming as more than half of the continent’s countries are in …

In the last 20 years, Africa’s external debt has grown fivefold to about $700 billion. According to Chatham House, a policy centre in London, Chinese lenders account for about 12 per cent of that amount. As of November 2022, the International Monetary Fund (IMF) and the World Bank considered 22 low-income African countries to either be in debt distress or facing potential external debt distress.…

- A Boston University report published on Thursday ,indicates that a Debt reductions of US$500 billions must be written off to assist developing countries that are most at risk of default get back on a better financial footing

- Developing nations’ sovereign debt rose by 178% due to the global financial crisis, reaching US$3.9 trillion by 2021

- Fitch Ratings reported a substantial amount of sovereign debt defaults this year, whereas the International Monetary Fund reported that 25% of developing nations and sixty per cent of developing nations are in or approaching debt distress

Countries in Sub-Saharan Africa (SSA) are dealing with two issues that are reducing productivity and undoing decades of economic progress: increasing levels of debt and an uptick in the frequency and intensity of climate shocks.

Countries now have declining public finances, low resilience to climate shocks, and constrained ability to fund adaptation due to the cumulative nature of these …

The lender stated during the conference that the country’s economic objectives were still under threat from unsustainable debt.

The government announced last week that external debt grew to US$13.7 billion in September, up from roughly US$10.7 billion the previous year.

Zimbabwe’s debt accounts for more than half of the country’s GDP.…

The International Monetary Fund (IMF) picked 28 countries that are to benefit from the $142.7 million debt relief program and Rwanda and Tanzania are drawing benefits.

In the East Africa region, Rwanda led the as the country that enjoyed the highest debt relief of $71.23 million while Tanzania followed at $26.43 million, Burundi at $25.42 million and Ethiopia at $19.71 million. South Sudan, Kenya and Uganda were not part of the selected 28 countries.

This comes after Bretton Woods institution which now plays a central role in the management of balance of payments difficulties and international financial crises, approved the third tranche of grants for debt service relief for 28 member countries under the Catastrophe Containment and Relief Trust (CCRT).

In April and October last year, two tranches were approved which now facilitates the disbursement of grants under the CCRT for payments of all eligible debt service totalling $238 million …

Last year Africa spent more money servicing debts than on the health issues of its public. According to World Bank, Africa is home to the world’s highest number of heavily indebted poor countries owing a total of US$493.6 billion in long term debts.

As the World Bank and IMF issue funding aid to help support Africa respond to the effects of COVID-19, countries including Tanzania and Rwanda have asked that the international community focus more on debt relief.

The IMF issued a statement listing certain countries as being eligible for debt relief and asked others to state their case—to explain why they deserve debt relief.

The Institute for International Finance, a club of some 450 banks and financial investment firms from across the globe, say they are working on temporarily suspending debt financing by the poorest countries, most of which are in Africa.

Also Read: Why high

…Did you know, last year (2019) Africa spent more money servicing debts than the amount it spent on health issues of its public? This obviously a general statement, it does not mean that each and every country in Africa spent more on debt servicing that the money it allocated to its health center, but the fact holds true for most of Africa’s 53 countries.

It is not that Africa does not care about the health of its people, on the contrary, its just that, according to World Bank stats, Africa is home to the World’s highest number of heavily indebted poor countries owing a total of USD 493.6 billion in long term debts.

As the World Bank and International Monetary Fund issue funding aid to help support Africa respond to the effects of the COVID-19 global pandemic, many African countries including Tanzania and Rwanda have asked that the international community …

The United Nations Conference on Trade and Development (UNCTAD) is calling for debt deal for developing nations in face of the Covid-19 coronavirus.

UNCTAD, in a report titled From the Great Lockdown to the Great Meltdown: Developing Country Debt in the Time of Covid-19, notes that the virus outbreak came at a time when developing economies have already been struggling with unsustainable debt burdens for many years.

Coronavirus: African leaders stuck with neglected, outdated healthcare systems

The report notes that if the challenges are huge in advanced economies, they are enormously more daunting in developing economies.

“While advanced country governments struggle to revamp administrative and regulatory frameworks and to break ideological taboos, developing countries cannot easily flatten the contagion curve by closing down their largely informal economies without facing the prospect of more people dying from starvation than from the Covid-19 illness. Moreover, even the most advanced high-income developing …

The novel Coronavirus (COVID-19) battle in Tanzania stands to get French government’s funding, as the East African nation awaits to receive part of the $1.3 billion (1.2 euros) provided by the G20 member for Africans to wipe off the pandemic.

Tanzania which is currently battling with more than 250 confirmed cases of the virus, will receive an amount that has not yet been established, according to information from The Citizen.

The French government—which is also one of Tanzania’s development partner, has already initiated discussions with the health ministry to fish out key areas to allocate the support, France ambassador to Tanzania Frederic Clavarier told The Citizen.

In that context, earlier this month French President Emmanuel Macron announced that his government would provide 1.2 ($1.3 billion )Euros for Africa to fight the virus.

“Up to this moment, we do not know how much Tanzania is going to get but after discussions …

Africa’s close development partner, World Bank—on Thursday took a serious initiative to restore its relations with Somalia, after being dull for almost 30 years

According to the statement from World Bank Group, the bank’s Board of Executive Directors moved toward normalizing its relations with the Federal Government of Somalia (FGS).

World Bank anticipates that the restoration will open up opportunities for Somalia to access concessional financing from the World Bank’s International Development Association (IDA) and to work closely with all arms of the World Bank Group to attract investment that will support the country’s stability and development.

The restoration could revitalize Somalia’s economic sphere, as the nation’s real gross domestic product (GDP) growth weakened in 2017 due to the severe drought. Although Somalia averted widespread famine in 2017, the drought led to large-scale food insecurity, affecting more than six million people.

In that context, World Bank Vice President for Africa …