- Kenya’s polls will determine how the country’s stalling economy rebuilds following the devastating coronavirus outbreak and the anxiety to achieve a calm democratic process

- Whoever triumphs will receive a weak economy and a disgruntled people amid a domino effect of Covid-19, famine, and the Ukrainian conflict, which has disrupted fuel, wheat, and fertilizer supplies and exacerbated an extreme famine situation in East Africa.

- The President-elect must address Kenya’s unsustainable budget imbalance.

Kenya Elections 2022 date

Kenya will conduct a general election on August 9, 2022, with adjustments to all political offices in the government, including parliament, senate, and the Presidency.

Kenya’s polls will determine how the country’s stalling economy rebuilds following the devastating coronavirus outbreak and the anxiety to achieve a calm democratic process. With all of its diplomatic and economic might in the region, Kenya’s election has far-reaching ramifications for East Africa’s development and growth.

Scores of foreign corporate giants that have chosen Kenya as their regional headquarters and Africa-inclined entrepreneurs worldwide will be watching with bated breath.

The macroeconomic evaluations of the economy and policy-mix choices (between monetary and fiscal policy sides) are critical in the 2022 electoral pledges. Strict policies are hardly ever popular with everyone. A coalition of political leaders and the CBK must make decisions that, while initially difficult and unpopular, may put Kenya back on course for long-term success.

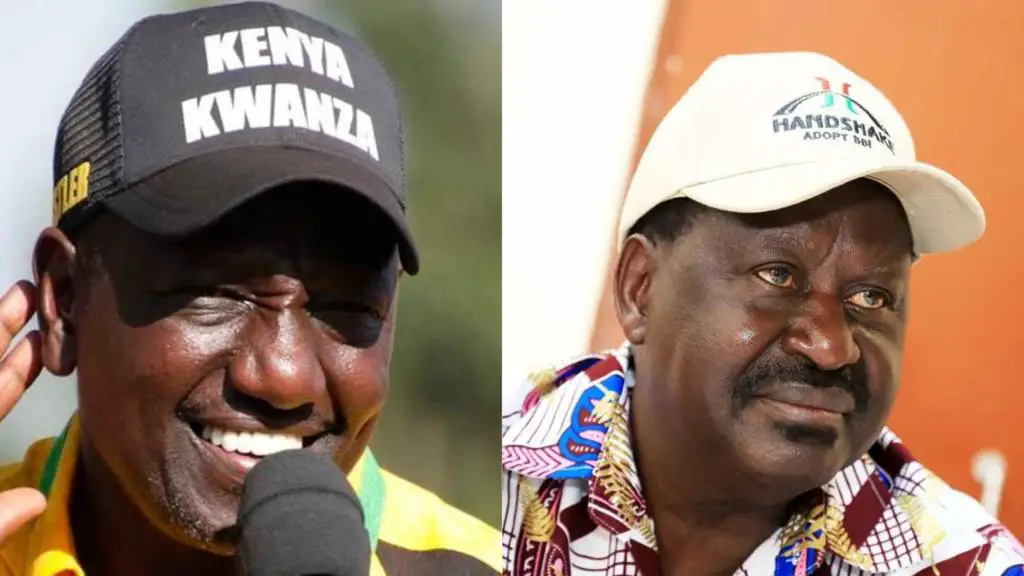

The big question is, who is likely to be the President of Kenya in 2022? The two main candidates by popularity are Raila Odinga and William Ruto.

Read: Kenya’s food inflation, 2022 elections a headache for many

Raila Odinga up against William Ruto

On the other side, Eng Raila Odinga has committed to finding a route to recovery by combating corruption, which is rampant in East Africa’s largest economy. According to the ODM party leader, properly combating corruption will address Kenya’s economic issues.

Reversed Gains from Kibaki’s Economic A-game

Above all, all sectors agree that the economy must be rebuilt to re-ignite growth and jobs. All of the sector prospects that COVID-19 deteriorated will rely on economic recovery, contingent on the country’s top macro-pivots.

Long-term experience suggests that positive achievements with policy credibility may emerge in recovery, as the Kibaki Presidency proved from 2002 to 2011. To be sure, Uhuru deserves credit for enacting the Constitution of 2010 and devolution, but Kibaki rebuilt a damaged economy not once but twice.

Taking over an economy submerged to its neck in public debt (64.1% of GDP), with considerable borrowing wasted or stolen, Kibaki’s fundamental plank was to reduce the debt, expand GDP, and recover tax revenues from the resultant increase in output.

When the global financial crisis of 2008-2009 endangered his recovery path, Kibaki demonstrated how to rebuild an African economy from the ashes and return it to development and jobs. Both stages made use of traditional macro-policy instruments. In the latter situation, he eased both fiscal and monetary policies.

Kibaki left the present administration with a national debt of Sh1.89 trillion (less than 40% of GDP, down from Moi’s 64.14% of GDP). After Moi’s government reduced GDP growth to 0.5% by 2002, Kibaki increased it to 8.4% by 2010 and was financed almost 90% of the national budget through the National Treasury. He ruled out financing from Bretton Woods institutions or Eurobonds.

Under the existing regime, total public debt is expected to reach 79 per cent of GDP by June 2022. The state debt has risen by US$57.4 billion, accounting for more than 354 per cent of the public debt discovered in Kibaki’s records by Uhuru Kenyatta’s administration.

Kenya would be significantly better off now if the borrowing had been utilized to optimize output, even after factoring in inflation and COVID. However, the Auditor General’s findings and unanswered debt-related questions- Eurobond, SGR, Pandora affair, etc.- are plagued with infiltration worries.

Kenya’s economic outlook scene post-election

Whoever triumphs will receive a weak economy and a disgruntled people amid a domino effect of Covid-19, famine, and the Ukrainian conflict, which has disrupted fuel, wheat, and fertilizer supplies and exacerbated an extreme famine situation in East Africa. As per Kenya’s Agriculture and Food Authority, 90 per cent of the wheat available for consumption in the country is sourced from Ukraine and Russia.

“The election will not be decided on any other vital topic than the economy,” says Javas Bigambo, a Kenyan political expert. “Any presidential candidate who does not prioritize economic debate will be held accountable.” “People are fighting to exist,” he argues, citing increased commodity prices before the coronavirus and monopolization.

Between 2015 and 2019, East Africa’s largest economy increased at a 4.7 per cent yearly rate on average. Still, it was heavily damaged by Covid-19, which interrupted commerce and transportation and placed the vital tourist sector on life support. According to economists, the GDP drop was restricted to 0.3 per cent due to a solid farm sector. However, that industry is currently in a slump due to a decline in fertilizer supplies.

As per the 2022 Kenya Economic Survey, the economy recovered strongly last year, rising by 7.5 per cent. Still, growth would slow to roughly 5 per cent this year due to food and fuel inflation and the poor performance of Kenya’s currency. With prices rising, many Kenyans resort to savings and loans, which are widely available through Kenya’s world-class mobile-money system, while others are sinking into poverty. A severe drought has devastated cattle and fueled ethnic tensions in northern areas. “This country’s economic outlook is nothing to write home about,” adds Bigambo.

Both Ruto and Odinga have promised double-digit growth. “The economy should expand by 10%, and I will reach that aim by making it easier to conduct business in the nation,” Mr Odinga stated at a recent campaign event in the Mount Kenya area.

Limited Policy Options

Based on current economic problems, there are just a few possibilities. The President-elect must address Kenya’s unsustainable budget imbalance while the slump/recession that threatens long-term prospects is reversed.

Read: African elections to watch in 2022 and how businesses can survive them

Appropriate policy corresponds to the decision to pursue a strict fiscal policy and a smaller government.

Fiscal discipline and monetary policy loosening can rectify shortfall burdens while reinvigorating private capital expenditure and consumer spending to substitute large government expenditures, which is the goal of Kenya’s GDP gap (uncaptured output going into 2022 and 2023) and the country’s GDP gap.

To do this, the government must strengthen and collaborate with a monetary authority (CBK) whose space for monetary policy transmission has been undermined by FinTech. External capital infusions significantly impact regulated commercial banking, jeopardizing liabilities that should aid intermediation (not small-time borrowing for gambling). Loans to the private sector can be enlarged, and a sustainable deficit can be achieved.

On the other hand, Kenya must avoid an IMF-style counter-policy combination that tightens both fiscal and monetary measures. It would be unsuitable, a double blunder that would worsen the economic downturn by lowering investment and consumer expenditure. It’s known as austerity.

Historically, Democratic Party President Bill Clinton in the United States illustrated the power of the aforementioned mix — looser monetary policy and tighter fiscal policy. Clinton took office in 1992 with a historic budget deficit of 4.5%, the second-highest in the United States after World War II. By 1998, he had transformed the deficit into a surplus through a tightening fiscal policy assisted by monetary easing by Alan Greenspan, the Fed’s chairman.

To generate growth, jobs, and growing government revenues, demand was successfully transferred from government expenditure (or previous Republican President Reagan’s tax cuts) to an increase in private sector investment and consumer spending. This turnaround required a “switching” policy mix, the primary consequence of which was to shift output momentum from the government to the private sector.

A new combination is required if the incoming government pursues and succeeds with policies that encourage a surge in Foreign Direct Investment. The government reduces taxes and boosts concessional borrowing and even County transfers while facilitating local and foreign investors to fuel the investment boom.

In this instance, the CBK aims to elevate interest rates to combat the resulting inflationary pressures. In the face of inflows, the impact of government spending cuts in this situation is to channel and induce “crowding in” expenditures that “allow” demand and consumption for goods and services, from which it garners revenues to commence addressing its public debt issue. Growth, jobs, and sound public finances would follow.

Controlling the bleeding of public resources is an urgent concern. Budget implementation in a presidential structure is often linked with the pre-election agenda. Budget execution is also coordinated with the winning presidential candidate. That is why the Parliamentary Budget Office (PBO) exists to work with the President on the budget.

The lack of an Office of Management and Budget (OMB) has been and still is a massive void in the Presidency, with the result that the Head of state laments theft from public coffers at a pace of $17.2 billion each day from afar, while he is unable to find explanations and is helpless to halt the rot.

To his credit, President Kenyatta proposed a remedy on November 23, 2015, approving an OMB recommendation as follows: “I have charged the Chief of Staff and the Head of the Public Service with creating a Management and Budget Office under the Presidency.” The Presidency will prepare a President’s Budget in collaboration with the Parliamentary Budget Office,” he added.

“This will guarantee that I drive budget priorities, supervision, and decrease influence-peddling while ministries and agencies focus on implementation and service delivery.” Fellow Kenyans, I believe that before we seek additional taxes, we in government should take better care of your money.” As a result, the OMB should be a top focus for the future administration.

Read: Kenya’s economy to hit 5.4% growth defying 2022 election jitters