Mozambique consistently ranks as one of the top global producers of cashew nut and is currently the second largest producer in East and Southern Africa.

The country’s ideal growing conditions and strong local processing sector make the country uniquely well-positioned to become one of the most competitive global providers of high-quality cashew.

Cashew nuts have enormous potential for generating economic value through its value chain. In terms of production alone, it employs 1,400,000 families in Mozambique and, in the 2021-2022 marketing year, generated a gross income of US$87 million.

- Mozambique has been renowned for its cashews since the early 1900s. and the country’s ideal growing conditions and strong local processing sector make the country uniquely well-positioned to become one of the most competitive global providers of high-quality cashew.

- In the 2021-2022 marketing year, cashew in Mozambique generated gross income of US$87 million.

- Europe is the largest importer of cashews nut kernels in the world, accounting for 35-40 per cent of global cashew import value. The value of European cashew nut imports increased by an average of 2 per cent a year in the 2017-2021 period, and volumes increased 6.5 per cent annually over the same time. Virtually all cashew imports from outside Europe come from developing countries.

Cashews are kidney-shaped nuts that are a good source of protein and minerals. They are low in sugar and rich in oil, fibre, protein, healthy fats, antioxidants, magnesium, zinc, copper, and phosphorus. Cashews are commonly available in powder, paste, whole, roasted, and split forms.

They are obtained from fruit-producing trees, grow near the sea areas, and are widely used in beverages, dairy products, cereals, bars, cosmetics, and bakery products. They assist in boosting immunity, lowering blood pressure, controlling weight, and enhancing brain functions, bone density, and eyesight. Cashews also provide various health benefits, such as decreasing blood cholesterol levels and preventing cardiovascular diseases, cancer, and gallstones. As a result, cashew finds extensive application as snacks and desserts in the food and beverage industry.

Mozambique has been renowned for its cashews since the early 1900s. For much of the 20th century, Mozambique was the world’s leading producer of cashew nuts. Africa’s first industrial cashew processing plant was established in Mozambique in 1960, and the domestic processing industry began to thrive soon after that, according to Mozambican cashew.

The southern African country quickly built a reputation for quality production and efficient processing. However, the country’s cashew nut industry was dealt a body blow first by the 1977-1992 civil war and then by a controversial World Bank assistance package.

The global cashew market size reached US$6.76 Billion in 2021. IMARC Group expects the market to reach a value of US$ 8.89 Billion by 2027, exhibiting a CAGR of 4.42 per cent from 2022-2027. Significant growth in the global food and beverage industry is creating a positive outlook for the market. Mozambique can bank on this to grow its economy by exporting cashew. Of course, several things must be done to make cashew production efficient and profitable. Let us look at some of the things that can be done.

Local cashew processing

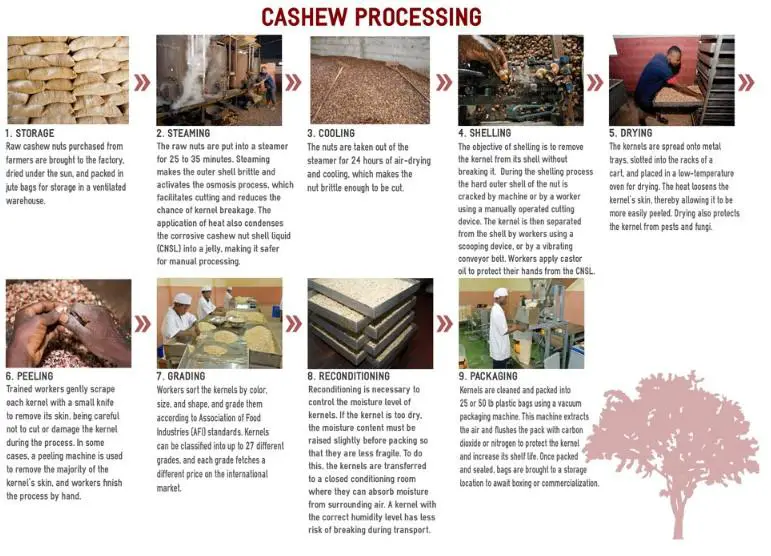

According to Mozambican cashew, the country has 20 cashew processing facilities located primarily in rural communities. All processing factories in Mozambique employ either manual or semi-mechanized processing models. While the quality and efficiency of machines have improved greatly in recent years, there is still a lower breakage rate with manual processing, and many facilities choose to process the largest, most valuable nuts by hand to ensure maximum profit. Building and increasing local processing will definitely increase supplies of the nuts. The country can also look into digitalizing the processing of the plants to improve on efficiency and production of high-quality nuts. This area presents several opportunities for people who are into mechanization and digitalization of mechanical operations.

Factories purchase raw nuts from farmers during the harvest season from October to February, with most of the purchases occurring in November and December.

Competitive pricing

The minimum reference purchase price per kilogram of cashews in Mozambique has just fallen by two meticais this year, but the government guarantees that a greater quantity will be sold. Meanwhile, the industrialists want the executive to allow the economy to self-regulate according to the law of supply and demand, which should alone establish the price.

The Cashew Industry Association (AICAJU) does not identify with the current model, which assigns the government the leading role in setting prices. “AICAJU reinforces its position already expressed previously, and once again appeals to the need to let the market work, since this is what will dictate the real reference price,” reaffirms the association’s Julina Harculette.

In 2021, Harculette said, the Mozambican cashew industry processed around 32,663 tons of cashew nuts last year when the reported total production was 146,000 tons, an increase of 6.52 per cent against the previous year. In 2020, 30,664 tons of cashew were processed in Mozambican cashew industries.

According to Tridge, Europe is the world’s largest importer of cashew nut kernels, accounting for 35-40 per cent of global cashew import value. The value of European cashew nut imports increased by an average of 2 per cent a year in the 2017-2021 period, and volumes increased by 6.5 per cent annually over the same time. Virtually all cashew imports from outside Europe come from developing countries.

In the next five years, the European market for cashew nuts is likely to increase with an annual growth rate of 3-5 per cent. Demand for cashew nuts in Europe is stable, but import quantities sometimes fluctuate due to variable production in the main supplying countries. Regular fluctuations in imports will continue to be influenced by the harvested crops and price situation rather than changes in demand.

Although the demand for cashew nuts in the European market is quite stable, it is influenced by price fluctuations. The price of cashew nuts is higher compared to most other nuts on the European market.

Since the pricing of the nuts influences the market demand, Mozambique can leverage on this and set competitive prices that attract buyers.