- The African continent receives only 2 per cent of the total global value of all cryptocurrencies.

- Chainalysis ranks Kenya, South Africa, and Nigeria as three of the top ten countries for cryptocurrency adoption globally

- Many African countries have overlooked this financial innovation, maintaining cryptocurrency exchanges while failing to provide a regulatory framework or allowing trading but not providing an exchange for their citizens.

The development in internet access in sub-Saharan Africa has brought with it new technologies such as cryptocurrencies and blockchain that have the potential to enhance and significantly revolutionise financial and economic sectors.

The African continent receives only 2 per cent of the total global value of all cryptocurrencies. In February 2022, CoinGecko estimated the crypto market to be worth US$2.04 trillion, translating to a US$40 billion African market worth.

The rapid growth of crypto in the continent will profoundly impact the financial sector in sub-Saharan Africa, which is increasingly becoming digital and urban due to increased internet connectivity and not so well connected traditional financial systems.

As proof that a 2 per cent global value of cryptocurrencies is not that small, Chainalysis, a blockchain data platform, reports that Africans received US$105.6 billion in cryptocurrency payments between July 2020 and June 2021, representing a 1200 per cent increase over the same period the previous year. Another point of interest is that Chainalysis ranks Kenya, South Africa, and Nigeria as three of the top ten countries for cryptocurrency adoption globally.

Cryptocurrencies are keen to offer a solution to traditional banking services by introducing decentralised peer-to-peer lending services. They have the potential to level the playing field in the economy and expand finance options to underserved customer markets, among other things.

Investors across the globe are seeking to diversify traditional assets in Africa into cryptos to counter rising fiat inflation, with a majority of crypto investors and traders believing that tokens are safer and more secure than traditional investments such as gold, oil, stocks, liquid cash and real estate.

As evidenced by Usefultulips, in August 2020, Bitcoin trading in sub-Saharan Africa was $18.3 million of the $95 million weekly global trades –the highest peer-to-peer Bitcoin trading volume, second only to North America ($28.7 million) globally.

Some people have argued that the significant increase in Bitcoin trading in sub-Saharan Africa has been inspired by the need to cushion against the highly volatile local currencies in the wake of local economies lockdowns in the Covid-19 pandemic.

Read: Cryptocurrencies for Africa’s economic ascension require more than talk.

The role of cryptocurrencies in Africa

Cryptocurrencies are well-positioned to address various economic challenges in the region, ranging from bridging financing gaps for the region’s micro, small, and medium-sized enterprise (MSME) sectors to streamlining the transfer of remittances.

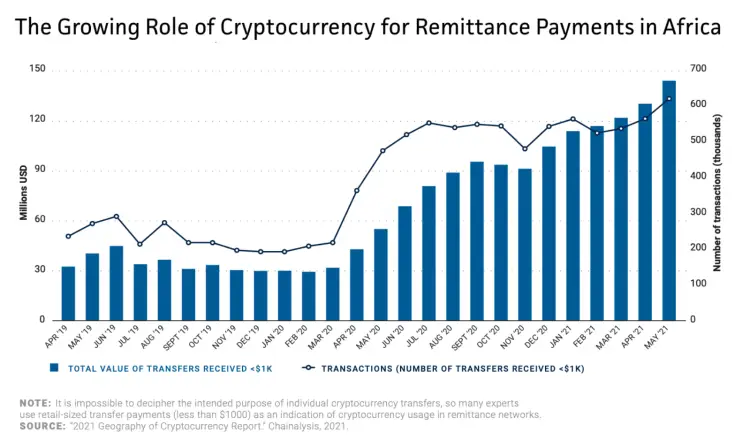

Chainalysis estimates that over US$562 million in remittance payments to Sub-Saharan Africa were paid through cryptocurrencies. Cryptocurrencies have also sped up obtaining affordable mortgages and are accommodating irregular income patterns that restrict credit availability.

Bitange Ndemo, an entrepreneurship professor at the University of Nairobi, notes that Empowa, a fintech start-up based in Mozambique, embodies the spirit of this new movement—the reformation of finance—by crowdsourcing funding to finance residential real estate development through cryptocurrency.

According to Ndemo, decentralised finance’s proof of concept is demonstrated in Africa due to this project, which circumvents traditional bottlenecks in financing homes while utilising the blockchain platform to channel funds toward developers and innovators.

Read: Central Bank of Kenya firm on Cryptocurrencies ban

To bridge the capital gap between SMEs and investors, this venture allows foreign lenders to send USD stable coin (a type of digital currency that is pegged to some external asset, such as fiat currency or other assets like gold), convert it to Kenyan shillings, and use other credit-scoring facilities to bridge the capital gap. Pezesha facilitated over 3,751 loans in Kenya and 344 loans in Ghana by March 2022, according to the company.

On the contrary, Africa’s policymakers have struggled with reconciling cryptocurrencies with the continent’s existing monetary system even though decentralized finance and blockchain technology is scalable and operationalised in other countries and regions.

As Bitange Ndemo observes, many African countries have overlooked this financial innovation, maintaining cryptocurrency exchanges while failing to provide a regulatory framework or allowing trading but not providing an exchange for their citizens, making it difficult to realise the role of cryptocurrencies in Africa fully.

Sub-Saharan Africa needs stable regional currencies independent of European financial institutions that force economic dependency on the West. Some have claimed that the introduction of a regional cryptocurrency will ultimately free local economies from outside interference. However, this potential is hampered by regional restrictions such as internet outages and gaps in cybercrime, data security, and privacy regulations.

Nonetheless, the mobilisation of young enterprises around technological innovation, combined with civil society and government-led innovation in digital economic expansion, holds some promise that cryptocurrency use can contribute to Sub-Saharan Africa’s social-economic development on a country or regional needs basis.

Blockchain technologies are the wave of the future, and any attempt to ban them — or even excessively intervene in their operations — would meet the same fate as other attempts by governments to regulate behaviour in the past.

Furthermore, restricting cryptocurrencies at this time, when they are facilitating innovations and brimming with potential, would jeopardize the financing of critical sectors such as MSMEs, affordable housing, and remittance payments, which are desperately needed in Africa at a time when the continent is in dire need of these options.

Governments must have sufficient financial and technological policies, including legislation that encourages cryptocurrency creation, maintains cyber-security, and safeguards user privacy and data protection.

Furthermore, ubiquitous access to digital and internet services and high-quality service delivery and infrastructure improvements would go a long way toward encouraging the use of digital financial technologies.

In Kenya, for example, has just developed a “regulatory sandbox” to crowdsource finance for micro, small, and medium-sized enterprises (MSMEs). It is described as a “tailored regulatory environment that allows for the live testing of innovative capital markets-related products, solutions, and services that have the potential to deepen and develop the capital markets before launching into the mass market” by Kenya’s Capital Markets Authority.

Kenya’s approach to artificial intelligence and blockchain was designed to provide a secure environment for the supervision of emerging technologies, processes, and services that have the potential to benefit the general public. This strategy enables the state to foster experimentation and progress without formally approving new procedures or practices.

Governments in Africa should establish their regulatory sandboxes and increase their ability to track and trace all transactions, ensuring that all citizens have proper identification (to validate clients and ensure the security of transactions) and strengthen their cybersecurity systems utilising cryptocurrencies in Africa.

However, while no one can predict the future of cryptocurrencies, we know that their uniqueness necessitates adopting a similarly nontraditional regulatory approach—one that is as invested in the virtues of experimentation and entrepreneurship as the practices aspire to regulate.

Read: Africa: UNICEF issuing US$100,000 to startups through cryptocurrencies.