- Africa Startup League announced a Sh122.84 million innovation competition that will kick off in February 2023.

- The continental-wide contest is open for innovators, entrepreneurs, micro-enterprises, and early-stage start-ups to attain access to finance, as well as the much-needed expertise required to scale businesses.

- East African startups raised US$2.3 billion between 2019 and May 2022. The amount represents 23 per cent of the overall funds raised by African startups during the period.

Africa Startup League, a community-powered company builder for startups, has announced a Sh122.84 million innovation competition that will kick off in February 2023.

The Africa Startup League is a critical Humanity Node ecosystem infrastructure component and key decentralized gross domestic product of Africa (DGDPA) accelerant.

The continental-wide contest is open for innovators, entrepreneurs, micro-enterprises, and early-stage start-ups to attain access to finance, as well as the much-needed expertise required to scale businesses.

The model is a unique startup studio platform that connects entrepreneurs with strategists, creatives, engineers, communities, and capital to design, build and launch exponential organizations focused on improving the lives of humans and transforming the world of tomorrow.

Judges are chosen from various fields across Africa, as well as people across the Web3Africa.news community, who will vote on the best startups, which will be evaluated based on criteria such as innovation and impact on the larger African communities.

Over the six-month competition, the Africa Startup League will enable innovators and entrepreneurs to showcase their innovative products. The selected top 100 entrepreneurs will be competing for a grand prize of KSh122.8 million ($1 million) and 99 prizes of KSh 1.2 million ($10,000).

The aim of the initiative is to create an arrangement that allows startups to acquire the initial seed funding, mentoring, and training to scale their businesses.

This will be alongside the key goals for Africans to see the opportunities ahead of them and to compete in a challenge that can produce solutions for pressing needs in African communities.

Mr. Aly Ramji, the Co-Founder and Managing Editor of Web3Africa.news and key partner in the Africa Startup League said, “rather than being left to fend for themselves, Africa’s tech startups would benefit from networks that connect founders, tech hubs, universities, and government bodies to assist in the identification of business opportunities, the overcoming of skill shortages, and the attraction of the required talent.”

The Africa Startup League gives young business people in Africa the opportunity to demonstrate their skills and innovations, while facilitating a more effective strategy for addressing Africa’s challenges and increasing the size and viability of their own companies.

Mr. Aly Ramji, the Co-Founder and Managing Editor of Web3Africa.news and key partner in the Africa Startup League

“The hope is that the ASL (Africa Startup League), will create an enabling environment for young African entrepreneurs to take part of this unique competition, because the startup ecosystem in Africa is not well linked. Founders often do not have access to the support, guidance, openings, and information sharing that are essential to their continued existence,” he added.

According to an article by Making Finance Work for Africa, East Africa accounts for 23 per cent of the funds raised by African startups since 2019. Kenyan startups attracted most of those funds or some US$1.9 billion in two years and a half. (https://maxnovahealthcare.com)

Most of the US$2.3 billion (84 per cent) was raised by Kenyan startups. Tanzania and Uganda were the other two East African markets to attract more than US$100 million in total funding during the period. “Combined, the three countries leave very little room to their neighbors, with 96 per cent of all the funding raised in the region since 2019,” the platform added.

In the past 2.5 years, East Africa has captured nearly a quarter of all the funds raised on the continent. In 2019, they raised US$255 million, US$646 million in 2020, US$571 million in 2021, and US$845 million from January to May 31, 2022.

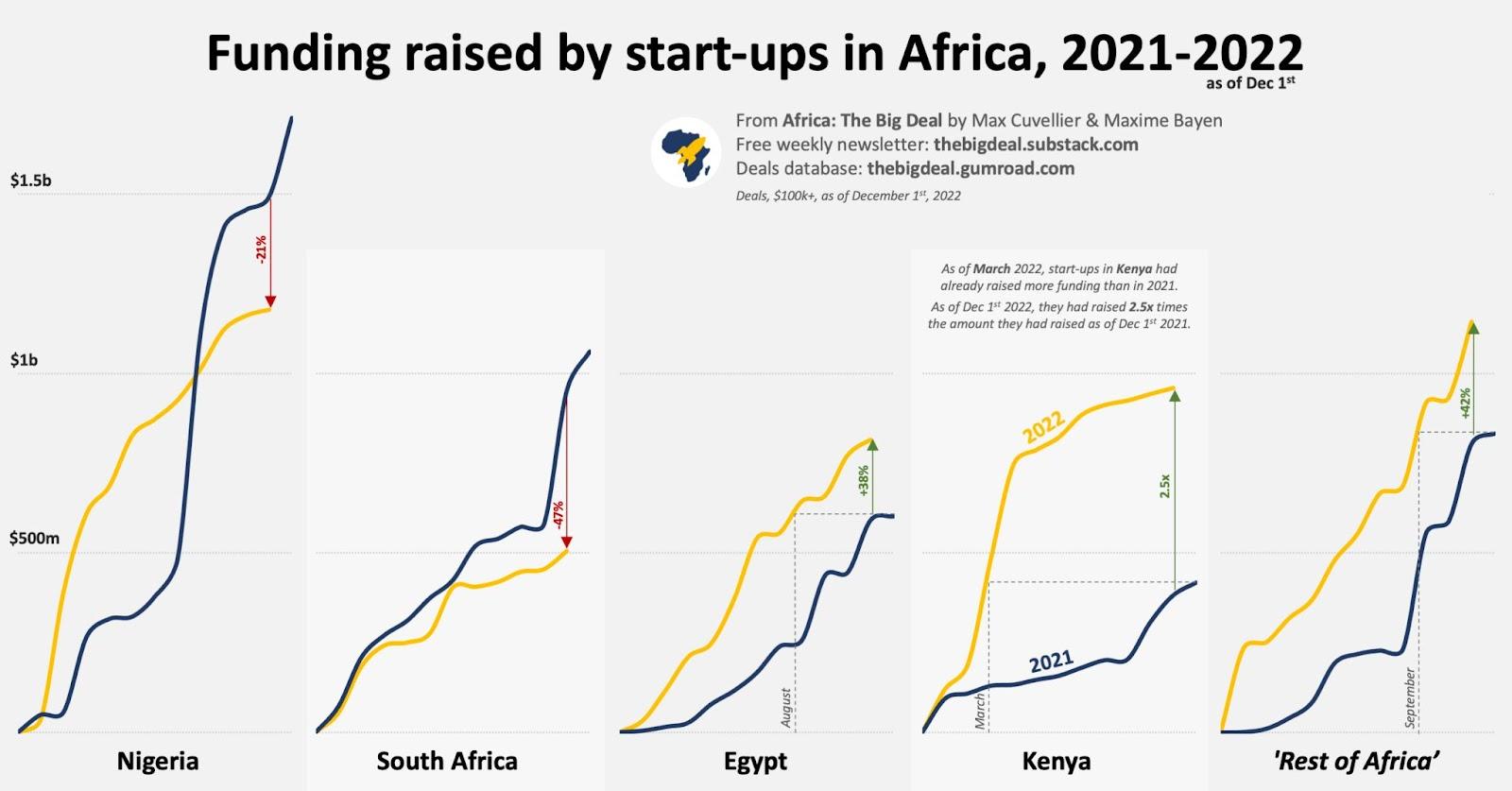

According to the venture capital tracking publication Africa: The Big Deal, Africa was the only continent to record a positive growth venture capital deal value in 2022. However, Nigeria and South Africa, the continent’s two biggest Venture Capital markets, both recorded negative growth trajectories.

During the period, Tanzanian startups raised over US$152 million against about US$125 million for Ugandans. Ethiopia, Rwanda, and Sudan were the underdogs with respectively US$46 million, US$23 million, and US$6 million raised.

According to an article by Chim Reports, Uganda was, in 2015, named the world’s most entrepreneurial country by the B2B Marketplace Approved Index. However, the smiles quickly faded when it emerged that more than 50 per cent of the country’s start-ups do not see their first anniversary.

Comparison of venture capital activity in Africa between 2021 and 2022 from Africa:The Big Deal. [Photo/ Tech Cabal]

South Africa’s venture capital funding activity decreased by almost 47 per cent as of December 1, 2022, from over US$1 billion in funding in 2021 to about US$500 million in 2022.

Another interesting trend in South Africa’s venture capital sector in 2022 has been the upward tick in racial and gender diversity in fundraising.

“Of the deals that we have tracked this year, 45 per cent of funding went to founding teams with at least one non-white founder. Similarly, close to 20 per cent of funded startups had at least one female co-founder. That’s not nearly close to parity, but it is a promising improvement on past performance. Reducing bias and improving diversity in investment allocation is shifting in priority for global and local investors,” said Mathew Marsden, co-founder of funding insights platform, dealbase.africa.

Keet van Zyl, co-founder and partner at Cape Town-based venture capital firm Knife Capital, the South African VC ecosystem is likely to see increased fundraising in 2023 for startups that are solving meaningful problems and an increase in the buy-out of VCs and angel investors to facilitate exits and bring liquidity into the market.