- Safaricom license that was obtained last year was due for upgrading to include other services like M-Pesa

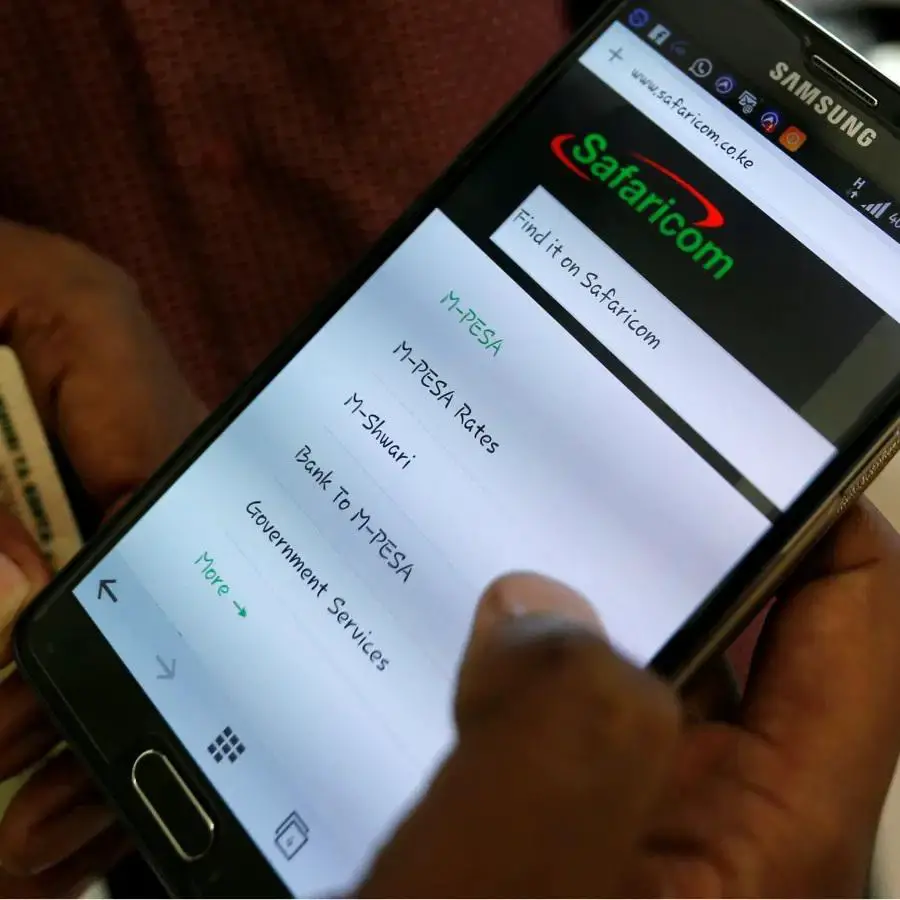

- M- Pesa, a mobile money transfer founded in 2007 by the Vodafone Group and Safaricom

- Safaricom was waiting for directions from Ethiopian Communication Authority (ECA) to launch the M-Pesa services

Ethiopia is in the final stages of finalizing legal documentation which contains some changes that will see the Central Bank issue permits of operation and license to Safaricom, a giant telecommunication company for mobile financial services.

This is despite the country denying the telecommunication company a second telecoms operator permit, details of the initial agreement show that the Safaricom license that was obtained last year was due for upgrading to include other services like M-Pesa, its mobile money transfer service once the bid for the second permit was put on the table.

The Ethiopian state minister for finance Dr Eyob Tekalgn Talino issued a statement confirming that they had decided to treat the two permit applications separately and De-linked the M-Pesa mobile money services permit from the second operator’s license.

Read: M-Pesa on course to become a US$1Bn business

Further details of the statement revealed that the money transfer services were due for launch in May this year and the suspension for the bid of a second telecoms operator permit was not in any way going to interfere with the services in the populous nation.

“Ethiopia will keep its promise to Safaricom from Kenya to allow its M-Pesa operations within our borders,” Said Dr Talino.

“We expect Safaricom to commence their M-Pesa operations this year and anticipate the economic revolution that the money transfer services will have in our” noted Talino

In May last year, a consortium formed to negotiate on terms of operations led by Safaricom managed to secure the first license which was limited and had no permits for services like M-Pesa.

Now the Horn of Africa Nation wants to put up another offer for a second operator permit after experts advised that the offer which was put up with the first one sold to Safaricom had not yet attracted the right bidder.

In 2018, Prime Minister Abiy Ahmed unveiled a comprehensive digital economy blueprint and now Ethiopia is liberalizing the telecoms sector to ensure the blueprint is implemented.

The sector was majorly monopolized by the state ethio telecom that attracted up to 4 million users in a short period of time after it launched its mobile financial services called Telebirr around the same time Safaricom obtained its license last year, showing the potential in mobile financial services for Money Transfer.

Read: How Safaricom will Transform the Ethiopian Economy – Kenyan President

Safaricom was waiting for the final words from Ethiopian Communication Authority (ECA) to launch the mobile money services into the wide potential market.

Confirming their activities towards the may launch, Dr Tolina said that the company has far built momentum as they have been very active in the country.

In May last year, the Ethiopian Communications Authority (ECA) said in a statement that the Global Partnership for Ethiopia has incorporated and registered its local company Safaricom Telecommunications Ethiopia PLC.

The license permits them to operate in the country for a fifteen (15) years renewable period and will operate under its original name Safaricom in offering the mobile money services .

This is after Safaricom led other consortium members including the British development finance agency CDC Group and Japan’s Sumitomo Corporation in winning the $850 million bid to start its operations in the country.

M- Pesa, a mobile money transfer founded in 2007 by the Vodafone Group and Safaricom has shown immense growth under the rise of digital takeover and has recently hit 50 million users who actively transacts using the application.

The platform is currently spread across many African continents with users in Kenya, South Africa, Tanzania, and Democratic Republic of Congo, Mozambique, Lesotho, Ghana and Egypt wh have all embraced the mobile money services .

The launching of the M-Pesa supper app has also enabled its users to operate mobile money transfer easily and securely making it rise faster in the African continent.

For instance, access to financial services and products in Kenya grew by an astonishing 56 per cent between 2006-2019 due to the availability of the mobile money services . M-Pesa has been credited with lifting at least two per cent of Kenyan households out of extreme poverty.

Read: Ethiopia’s economy cannot hold with more conflict