- Oil-rich UAE will provide $4.5 billion, drawing contributions from both the public and private sectors.

- In Nairobi, the US has pledged an annual commitment of $3 billion to bolster climate adaptation initiatives.

- The European Commission unveiled a €1 billion ($1.07 billion) fund designed to de-risk green bonds and attract private investments in emerging markets.

The US and the United Arab Emirates (UAE) have stepped up their support for Africa’s climate action efforts with multi-billion-dollar pledges during the inaugural Africa Climate Summit in Nairobi.

The commitments come at a crucial time as Africa grapples with the severe impacts of industrial pollution, with 17 out of the 20 worst-affected countries calling the continent home.

US Unveils PREPARE: $3 Billion Annual Commitment

John Kerry, US Climate Envoy, unveiled President Joe Biden’s Emergency Plan for Adaptation and Resilience (PREPARE), signaling Washington’s strong commitment to climate adaptation across countries. Under PREPARE, the US has pledged an annual commitment of $3 billion to bolster climate adaptation initiatives.

He noted that the US will work alongside African economies to lead the way in adapting to and managing the impact of climate crisis.

Mr. Kerry announced, “As part of implementing PREPARE, the US will provide $30 million for climate-resilient food security efforts across Africa.” Of this amount, $20 million will be allocated to the Africa Adaptation Food Initiative Accelerator program.

Specifically, these funds will be invested in agricultural businesses to help them establish resilient supply chains. The other $10 million will support Climate Resilient Adaptation Finance, particularly focusing on technology transfer to enhance adaptations like cold chain storage, ensuring the quality and safety of food from farms to homes.

“We have learned that adaptation saves lives, creates jobs, and obviously fights poverty,” emphasized Mr. Kerry, highlighting the transformative impact of climate adaptation efforts.

EU’s €1 Billion Fund to De-risk Green Bonds

Ursula von der Leyen, President of the European Commission, made a significant announcement during the summit by unveiling a €1 billion fund designed to de-risk green bonds and attract private investments in emerging markets. “This could help attract upto 20 billion Euros in sustainable investments.”

This initiative aims to mobilize additional private sector financing to address Africa’s climate financing needs, recognizing that resources from the global North alone are insufficient.

Von der Leyen expressed the EU’s readiness to share expertise with Africa on developing green bonds markets. She also highlighted the effectiveness of carbon pricing as a tool to foster innovation in the private sector, encourage polluters to pay a fair price, and generate revenue for clean transitions in developing countries. Von der Leyen stressed the importance of rewarding Africa for its wealth in carbon sinks.

UAE Commits $4.5 Billion to Africa’s Clean Energy Initiatives

COP28 President Sultan Al-Jaber announced a substantial commitment by the UAE to support Africa’s clean energy initiatives. The UAE will provide $4.5 billion, drawing contributions from both the public and private sectors.

Notable contributors include the Abu Dhabi Fund for Development, Etihad Credit Insurance, Masdar, and AMEA Power. These funds will be disbursed in collaboration with Africa50, an investment platform established by African governments and the Africa Development Bank.

Al-Jaber emphasized that the initiative will prioritize investments in African countries with clear transition strategies, enhanced regulatory frameworks, and master plans for developing integrated grid infrastructure. The goal is to bridge the gap between supply and demand while supporting Africa’s sustainable development journey.

“The initiative is designed to work with Africa, for Africa,” Al-Jaber stated, underlining the UAE’s commitment to being a key partner in Africa’s clean energy transition.

These substantial commitments by the United States, the European Union, and the United Arab Emirates reflect a global recognition of Africa’s pivotal role in addressing climate challenges.

The pledges are set to catalyze transformative climate resilience efforts across the continent, emphasizing the urgency of international cooperation in the fight against climate change.

Read Also: COP28 President pushes for climate finance reforms in Africa

Africa Carbon Markets Initiative

In a monumental push to ramp up Africa’s carbon credit production before 2030, the continent’s inaugural climate summit in Nairobi opened with a resounding success.

The event drew hundreds of millions of dollars in pledges from global investors, marking a significant stride in Africa’s climate resilience efforts.

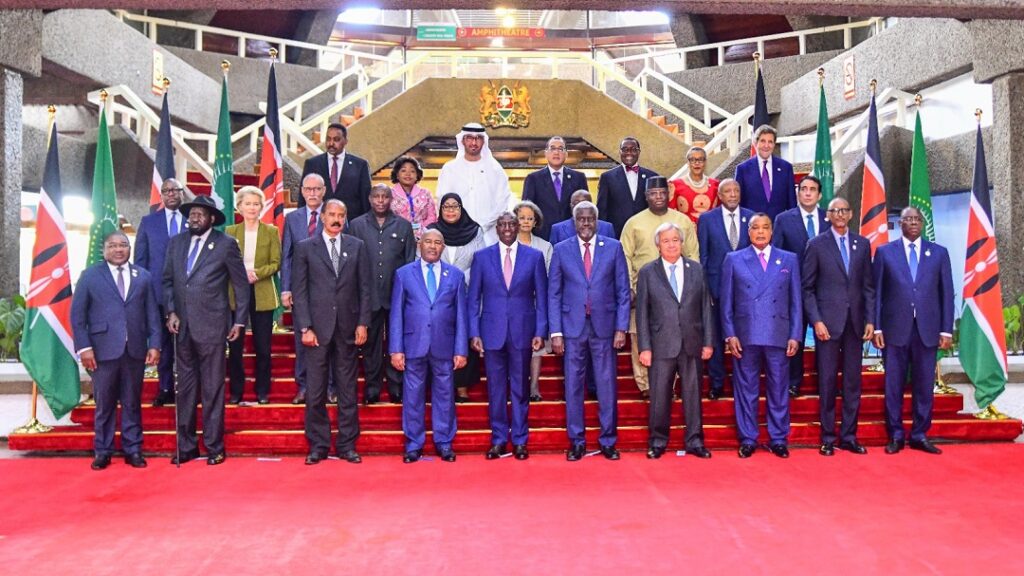

President William Ruto of Kenya inaugurated the summit, setting the stage for more than 20 presidents and heads of government to convene and outline Africa’s stance ahead of the upcoming UN climate conference and COP28 in Dubai.

Investors from the UAE took center stage by committing to purchase a staggering $450 million worth of carbon credits from the Africa Carbon Markets Initiative (ACMI).

Launched at Egypt’s COP27 summit last year, the ACMI aims to bolster Africa’s carbon credit production and environmental initiatives.

Hassaan Ghazali, an investment manager at the UAE Independent Climate Change Accelerators (UICCA), announced the investment from the UAE Carbon Alliance—a coalition of private sector entities. The UAE, known for its oil production, is increasingly positioning itself as a climate financing leader in Africa.

Further, Climate Asset Management, a joint venture between HSBC Asset Management and Pollination, a specialized climate change investment and advisory firm, pledged $200 million towards projects that will generate ACMI credits.

Climate Asset Management commitment underscores the growing global interest in supporting Africa’s climate goals.

UK-Backed projects worth $62 million

Additionally, Britain declared that UK-backed projects worth £49 million ($62 million) would be unveiled during the summit, while Germany announced a €60 million ($65 million) debt swap with Kenya, freeing up substantial funds for green projects. These commitments demonstrate a collaborative effort to drive sustainable development in Africa.

“A fair international financial architecture is not an unfair proposition to make,” Dr Ruto said.

While carbon credits have faced criticism as a pretext for continued pollution by wealthier nations and corporations, African leaders see them as a vital tool to secure climate finance.

Market-based financing instruments like carbon credits can be generated through emissions-reduction projects, such as reforestation and clean energy adoption.

COP28 President Sultan Al Jaber acknowledged the importance of carbon markets but called for commonly agreed standards to enhance their integrity and value.

A working paper released by the Debt Relief for Green and Inclusive Recovery Project highlighted that sub-Saharan African countries face annual debt servicing costs nearly equivalent to their climate finance needs. This underscores the urgency of green financing solutions.

President Ruto emphasized the potential for green growth to unlock economic opportunities worth billions, highlighting Africa’s readiness to capitalize on them.

The Africa Climate Summit seeks to redefine Africa as a destination for climate investment, challenging the perception of the continent as solely a victim of climate-induced disasters. Market-based financing instruments like carbon credits are viewed as essential tools to mobilize funding, bridging the gap left by rich-world donors.

As Africa charts its path toward climate resilience and sustainability, these unprecedented pledges and commitments signify a global recognition of the continent’s pivotal role in addressing the climate crisis.