- Diageo UK has announced that it has successfully completed the partial tender offer to acquire an additional 15.0% stake in East African Breweries Plc (EABL)

- Prior to the tender offer, Diageo Kenya PLC held 395.6 million shares out of the total 790.8 million outstanding shares, equivalent to 50.0% of the entire shareholding

- Following the completion of the Tender Offer, Diageo Kenya now holds the largest stake in EABL at 65.0% with 514.0 million shares

Diageo UK, through its wholly owned indirect subsidiary Diageo Kenya, has announced that it has successfully completed the partial tender offer to acquire an additional 15.0% stake in East African Breweries Plc (EABL).

Prior to the tender offer, Diageo Kenya PLC held 395.6 million shares out of the total 790.8 million outstanding shares, equivalent to 50.0% of the entire shareholding.

The tender offer comprised two phases with Diageo Kenya receiving valid tenders from 1,697 shareholders amounting to a total of 143.5 million Ordinary Shares. This translated to an oversubscription rate of 121.2% with Diageo Kenya accepting the maximum 118.4 million Ordinary Shares, as specified in the tender offer.

Following the completion of the Tender Offer, Diageo Kenya now holds the largest stake in EABL at 65.0% with 514.0 million shares, which includes the 118.4 million Ordinary Shares that Diageo Kenya accepted to purchase and 395.6 million Ordinary Shares it owned prior to commencement of the Tender Offer.

Key to note, Diageo purchased each share at KSh 192.0, which represented a 39.1% premium on the EABL’s stock price of KSh 138.0 a day before the announcement of the tender offer.

Investor confidence in Kenya

Commenting on the development, Cytonn Investments said it expects EABL’s stock price to rally as investors sell their stake at a premium, however, the tender closed when the stock was trading at KSh 170.5 per share, 11.2% below the offer price of KSh 192.0 per share.

EABL half year profit remains flat as costs rise

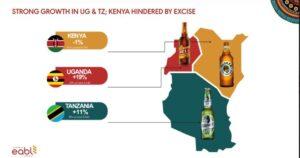

The move by Diageo Kenya to increase its shareholding in EABL affirms the importance of EABL to the larger group and confidence in its future growth despite the challenging macroeconomic environment occasioned by elevated inflationary pressures as well as the government’s decision to increase excise taxes.

Notably, EABL has continued to display strong financial performance, as evidenced by the EABL’s Profit After Tax of KSh 15.6 billion and KSh 8.7 billion in full-year 2022 and half-year 2023, respectively.

Additionally, Earnings per share increased by 172.2% to KSh 15.0 in FY’2022, from KSh 5.5 in FY’2021 and a 2.1% increase in earnings per share to KSh 17.3 H1’2023, from 16.9% in H1’2022.

Share repurchase and buyback in Kenya

Further, the EABL board of directors announced a total of KSh 11.0 dividend per share in FY’2022, translating to a dividend yield of 6.4% and lately recommended an interim dividend of KSh 3.75 in H1’2023.

“As such, we expect this to continue boosting investor confidence in the Group’s stock which has recorded a YTD gain of 0.4%,” Cytonn said.

The investment firm noted that there has been increased activity on share repurchase and buyback in the bourse with Standard Africa Holdings Limited acquiring an additional stake in Stanbic Holdings in February 2022 while in February 2023, Centum Investment Company gained approval from its shareholders to buy back up to 10.0% of its issued shares.

“In our view, we expect to witness more share repurchase and buyback activity in the bourse, especially from companies whose prices and valuations are currently low,” they said.

The firm also commended the CMA for granting exemptions from making full takeovers as it allows for majority investors to increase their shareholding by carrying out on-market trading to acquire a higher stake, as compared to having to acquire the entire entities.

Kenya: EABL to construct an $8.5 million microbrewery in Nairobi

In a separate story, Kenya’s Cabinet Secretary for Investment, Trade, and Industry Moses Kuria recently led a high-powered government delegation to London for the Economic Partnership Agreement and Investment meeting, in which Kenya was seeking to intensify pitches to investors.

The government is aiming to net at least $10 billion in Foreign Direct Investments (FDIs) this year in a plan mooted by the Kenya Investment Authority.

The forum was held through a Ministerial Council meeting on the Economic Partnership Agreement, which was scheduled to kick off on Tuesday, March 21, 2023 in London.