Simbisa Brands advises that the Board approved the delisting of the company from the Zimbabwe Stock Exchange (ZSE), immediately followed by its listing on the Victoria Falls Stock Exchange (VFEX).

Further details of the Transaction will be provided once all regulatory processes have been finalized.

- Simbisa Brands is set to delist from the Zimbabwe Stock Exchange, immediately followed by its listing on the Victoria Falls Stock Exchange, bringing to 5 the number of listings on the Victoria Falls Stock Exchange.

- GetBucks also advises that negotiations for a recapitalization and migration of the company’s listed securities from the ZSE to the VFEX are still in progress.

“The Directors of Simbisa Brands Limited (the “Company”) wish to advise all shareholders and the investing public that the Board has approved the delisting of the Company from the Zimbabwe Stock Exchange, immediately followed by its listing on the Victoria Falls Stock Exchange (the “Transaction”),” said a statement to shareholders.

“Further details of the Transaction will be provided to Shareholders once all regulatory processes have been finalized. Shareholders are therefore advised to exercise caution and consult their professional advisers when trading in the Company’s shares.”

This will make it the fifth stock to list on the USD exchange joining SeedCo International, Padenga Holdings, Caledonia Mining Corp and Bindura Nickel Company and might provide the necessary momentum the exchange desperately needs.

Read: Victoria Falls Stock Exchange plans to list an ETF linked to Old Mutual, PPC shares

The VFEX is a subsidiary of ZSE that was established some two years ago to exclusively trade in foreign currency and position itself as a regional offshore capital market to attract global investors.

The group operates a network of 524 owned restaurants under Chicken Inn (140 restaurants), Pizza Inn (129), Creamy Inn (87), Bakers Inn (58), Galito’s Africa (36), Nando’s (14), Steers (9) and other (51) brands such as Rocomama’s (Zimbabwe Only) and Vida E Caffé, located in Zimbabwe, Kenya, Zambia, Ghana, Mauritius and Namibia. Simbisa listed on the ZSE in 2015.

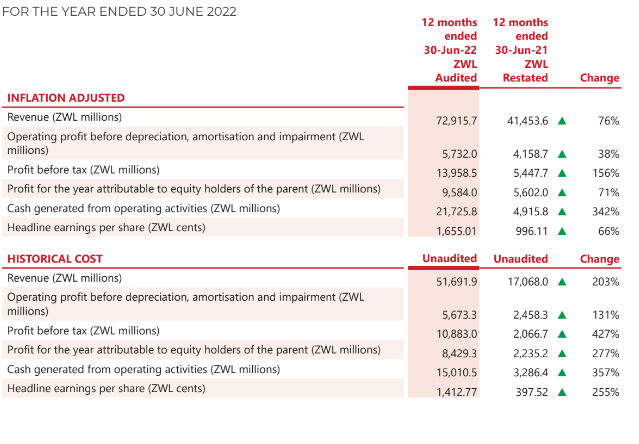

Meanwhile, Simbisa Brands Limited full-year results to June 30, 2022, were fair on account of recovery in customer counts (+28.6 per cent y-o-y), growth in real average spend (+10.3 per cent y-o-y), the addition of new counters, promotional initiatives, and cost control.

A final dividend of USD 0.58 cents per share was declared, implying a cover of 2.9x and a yield of 3.8 per cent. The share trades ex-dividend from Wednesday, October 12, 2022. The dividend will be paid on or about October 19, 2022.

Management also reported that organizational structure across all markets changed to focus on brand-oriented structure. This is expected to enhance and streamline operating efficiencies and improve accountability.

In terms of share performance on the Zimbabwe Stock Exchange, Simbisa Brands closed on Thursday, September 29, 2022, at ZWL 159.2311 per share, recording a 6.5 per cent drop from its previous closing price of ZWL 170.3374. Simbisa Brands began the year with a share price of ZWL 90.00 and has since gained 76.9 per cent on that price valuation, ranking it 13th on the ZSE in terms of year-to-date performance.

Simbisa Brands was also one of the Issuers that won at the Zimbabwe Quoted Companies Survey (QCS). Simbisa Brands was the First Runner Up 2022 QCS Best Performer. The company also won the Second Runner Up-Innovation and Technology Award.

- Simbisa Brands is a quick-service restaurant operator exposed to multiple Sub-Saharan African countries.

- The company also declared a final dividend of US$0.58 cents per share, implying a cover of 2.9x and a yield of 3.8 per cent. The share trades ex-dividend from Wednesday, October 12, 2022. The dividend will be paid on or about October 19, 2022.

In an article published by this media house on April 2, 2022, Laurence Sithole said companies in Zimbabwe are starting to list on the Victoria Falls Stock Exchange but not to raise capital. They are listing on that market for other reasons and not necessarily for the core purpose of a stock exchange.

Read: Is Victoria Falls Stock Exchange capital market innovation or regulatory haven?

It is quite clear that Simbisa Brands is not the only company to list on VFEX but GetBucks has also issued a cautionary statement. From my observations, companies are queuing to go to the VFEX from the ZSE. Can then one conclude that the Exchange is dollarising?

GetBucks Microfinance Bank’s migration of its listed securities from the Zimbabwe Stock Exchange to the Victoria Falls Stock Exchange, as well as negotiations for a re-capitalisation, are both still in progress.

GetBucks Microfinance Bank is a Zimbabwe-based financial service company with operating segments, including Consumer Lending, which provides individual public sector consumer loans. The small and Medium Enterprise (SME) Lending segment provides corporate clients loans and other credit facilities.

“Further to the cautionary announcement dated 30 August 2022, shareholders are advised that negotiations for a recapitalisation and the process of migration of the Company’s listed securities from the Zimbabwe Stock Exchange to the Victoria Falls Stock Exchange are both still in progress, the full impact of which is still being determined and, if successful, may have a material effect on the price of the securities,” read a cautionary statement signed by Company Secretary, Michael Mnemo.

Further, if the volumes of trades on the VFEX from its inception to date are an indication to go by then, the VFEX is not living up to its purpose as a funding and investment mechanism. There haven’t been any real offerings to raise capital on the VFEX.

Companies are considering and even going forward with decisions to list on VFEX. The question is, why? The monetary authorities created a policy where companies listed on the VFEX would retain 100% of their foreign exchange and export receipts.

The prospect of retaining 100% of their foreign exchange receipts has proven to be a strong incentive to list on a stock market which has empirically shown that it is inefficient at raising capital. This is where the real reason for listing on the VFEX comes into play.

The benefits of listing on the VFEX, according to Mawere Sibanda commercial lawyers, are; Companies get the ability to raise capital in hard currency, i.e. USD as the trading and settlement currency, and Tax incentives for shareholders. Flexible exchange control requirements. Also, easier remittance of disinvestments and dividends since there is no need for exchange control approval.