The Uganda Securities Exchange said it has created a Specialised Market known as USE Edaala.

This unquoted securities platform will support companies which do not meet listing requirements on the main exchange to access long-term capital.

The USE currently has 18 companies listed on Main Investment Segment, with only two corporate bonds and more than 34 treasury bonds.

Uganda Securities Exchange has the Growth Enterprise Market Segment (GEM) which has failed to takeoff. USE noted that the segment had attracted low public participation thus forcing it to rethink on a new way through which small and medium sized companies can be revitalized to participate in equity markets before upgrading to publicly listed companies in the stock exchange.

- The Uganda Securities Exchange has created a Specialised Market known as USE Edaala,

- The new segment will allow companies to access long term capital through private placements, a wider pool of domestic and international investors, flexible admission and regulatory compliance requirements.

- The USE currently has 18 companies listed on Main Investment Segment, with only two corporate bonds and more than 34 treasury bonds.

The segment was established in 2012, with an objective to create a window for small and medium-sized companies, through which they would raise capital to accelerate growth of their business offered against flexible listing requirements.

Commenting about the new segment in Kampala, the USE chief executive officer, Mr Paul Bwiso, said the name “USE Edaala” was derived from a Luganda word Edaala, which means a ladder, because of underlying symbolic meaning of growth, raising to next level, bridging gaps and scaling heights.

“We think this is exactly what USE Edaala will do for small and medium businesses,” he added, noting that any private or public company that is operating and has been incorporated in Uganda, will be eligible to apply to participate in the market provided it has minimum net capital of Shs500m.

A Small and Medium Enterprise (SME) in Uganda, is business whose operation has a threshold of at least Shs 100 million in total assets and employing between five and 250 people.

The funds, USE noted, will be available to private companies through private placements and restricted offers provided by professional capital investors for both equity and debt funding.

The USE Edaala will also facilitate private companies with numerous shareholders benefits from the deficiencies provided by existing trading and depository platforms with shareholders being able to trade their shares should they wish to divest their stock and utilise portfolio management tools.

The application period for the first cohort is expected to close on December 8, after which the USE will conduct an assessment of the applicants for eligibility.

Through the new segment, companies will be able to access long term capital through private placements, access to a wider pool of domestic and international investors, flexible admission and regulatory compliance requirements, among others.

Capital is the main fuel of every business, no matter what size. However, sometimes a business can face monetary constraints and a shortage of funds. In such a scenario, business finance can help power up the enterprise.

Capital can help Businesses for multiple purposes. It could range from enhancing working capital, expansion, purchasing new assets, replenishing a stock, hiring more staff, or refinancing to pay off existing debt.

Meanwhile, banks in Uganda launched a US$261.7 million regional export facility to support exporters within the country and the East African region.

Read: EU hypocrisy: Bullying Tanzania, Uganda over oil

The facility, launched by banks under the aegis of Uganda Bankers’ Association, started from November 1, 2022.

It mainly provide loans to businesses suffering from the pandemic and those which show growth potential. The export facility charges a 12 per cent interest per annum for shilling-denominated loans and 6 per cent per annum for foreign currency-based loans

The facility seeks to support the improvement of cross-border export risks. The facility is available to individual exporters, SMEs, local corporate exporters, and multinationals.

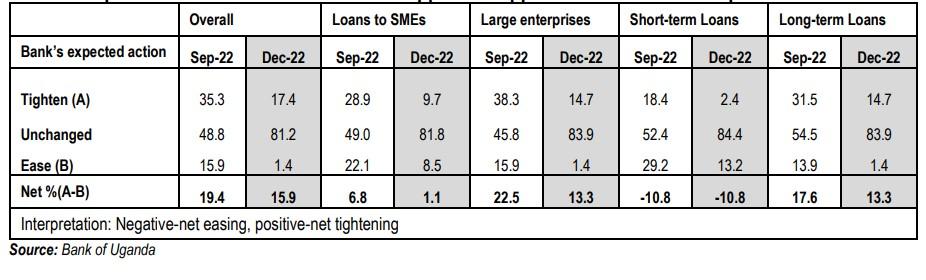

According to bank of Uganda, in the quarter to September 2022 credit standards on loans to enterprises tightened signalled by the measure of net tightening of 3.0 per cent, contrary to the 0.1 per cent net easing recorded in the quarter to June 2022.

The divergence in the out turn despite the consistence in direction could be attributed to competition for the few trustworthy clients while not compromising the loan portfolio quality.

Credit standards consist of internal banking rules which determines the type of loans and amounts to be provided, and to which clients. This is based on classifications by sector, area, size, duration, and financial indicators.

Going forward, banks forecast an overall increase in demand for credit, a higher expectation compared to the rise in credit demand reported. Notably, the increase in credit demand is expected across all firm sizes and loan durations, higher than the previous quarter. The reasons cited by most banks for the expected increase in credit demand were largely driven by developments in economic fundamentals, which include.

- Short term funding to facilitate the preparations for the festive season.

- The start of the second rainy season expected to influence the need for funds for agricultural activities.

- The cashflow deficits caused by increased operating costs on account of high commodity and fuel prices may need funding to maintain enterprises in business.

The above anticipated increase in demand is expected to be moderated by the increased cost of doing business on account of the high cost of loanable funds due to currency depreciation, low purchasing power of customers and the general economic uncertainty.