- Stock broker Morgan and Co to launch Made in Zimbabwe ETF on June 17, 2022

- Made in Zimbabwe ETF to be listed by way of introduction

- The ETF will initially contain Zimbabwean Manufacturers as constituents

Award-winning stock broker Morgan and Co to launch Morgan and Co Made in Zimbabwe Exchange Traded Fund (ETF) on June 17, 2022, on the Zimbabwe Stock Exchange (ZSE). The ETF is going to be launched on the local bourse by way of introduction. According to a presentation by the broker, the fund is set to be largely constituted by manufacturing companies listed on the ZSE, with exposure to other non-manufacturing counters. In addition, the fund will be an actively managed fund with the objective of providing superior returns.

An exchange-traded fund (ETF) is a basket of securities that can be bought or sold on a stock exchange the same way a regular stock can. According to Investment Company Institute statistics, the ETF industry globally ended 2020 with over US$5.5 trillion in investments.

Read: Kenya lists its first Exchange Trade Fund

ETFs can track a benchmark index (passive) or actively managed as is the case with the new listing.

According to the company’s website, Morgan and Co is an investment banking group that was formed through a partnership between several respected Zimbabwean financiers and a group of highly experienced international investors. It is licensed by the Securities and Exchange Commission of Zimbabwe (SECZ). The broker won the ‘Best Innovative Stock Broker’ last year at the Financial Markets Indaba Awards. Morgan and Co is also a member of the Zimbabwe Stock Exchange (ZSE) and Financial Securities Exchange (FINSEC).

Early this year, the Securities and Exchange Commission of Zimbabwe highlighted that at least three new ETFs are to list on the ZSE this year as the capital markets continue to grow. With this new listing, it means that only two are expected now.

According to the ZSE prospective Exchange Traded Product issuers will have to prove that the underlying asset or security track is sufficiently liquid to satisfy the exchange such that there will be proper price formation in the product.

Securities and Exchange Commission of Zimbabwe’s (SECZim) acting Chief Executive, Gerald Dzangare at a media workshop in the capital, said the market would see more of these listings going forward.

“In addition to the Old Mutual ETF and the Morgan and Co ETF, there are three more coming on board of which two have already been approved and one is in the pipeline,” he said.

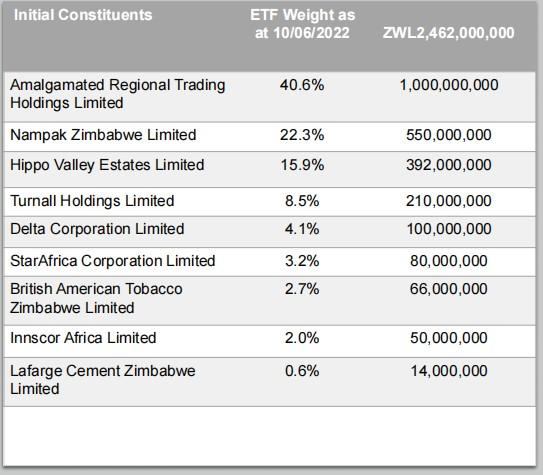

Made in Zimbabwe ETF Constituents

According to the broker the initial counters selected to constitute the Made in Zimbabwe ETF met the following criteria:

- Revenue of contribution from manufacturing activities was a minimum of 50% of the total revenue.

- The Company was profitable in FY2020 and FY 2021

- The counters have a free float of at least 3% of the total shares in issue.

Read: Unpacking the Tanganda Tea Company in Zimbabwe

Benefits and Risks associated with investing in the ETF

ETFs are transparent compared to unit trusts (or mutual funds) since the underlying assets are fully disclosed to investors in their proportions. Morgan and company said the ETF will grant investors exposure to the relatively illiquid counters thus increasing the opportunity for value creation. They are also flexible since they are actively managed. In addition, investors can also benefit from arbitrage opportunities and portfolio diversification.

Early this year active ZSE investor, Dr. Solomon Guramatunhu during the listing ceremony of the Morgan and Co Multi-sector ETF said actively managed ETFs are a good proposition since they are based on the continuous decision-making on the underlying portfolio instead of tracking a benchmark index. He added that there is a good opportunity for making market-beating returns, unlike passive ETFs which can only match a given market return.

In an article by the Herald dated January 4, 2022, Dr. Guramatunhu was quoted saying investing and saving were critical for a developing country like Zimbabwe given that it promotes capital formation, create employment opportunities, and controls excess liquidity.

In the same article during the listing of the Morgan and Co Multi-Sector ETF, Morgan and Co-Head of research Batanai Matsika said the ETFs are a cheaper way of getting access to a wider range of stocks and sectors.

“It makes it a very relevant product for retail as well as institutional investors,” he said.

During their presentation, Morgan and Co said ETFs face market risks since they are only a wrapper for their underlying investments. They added that negative exogenous shock affecting the manufacturing sector will directly the portfolio, thus potentially eroding returns.

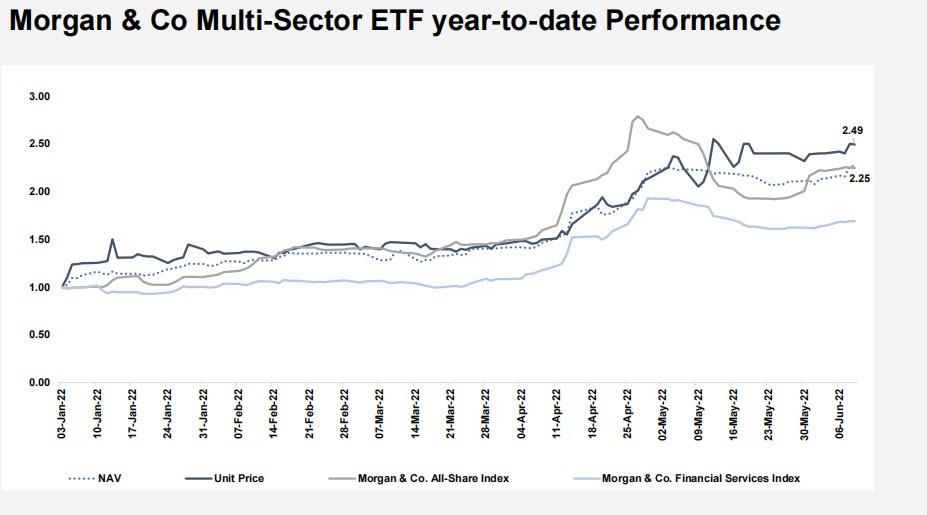

The Made in Zimbabwe ETF is the second ETF from the broker after launching the Morgan and Co Multi-sector (MCMS) ETF on January 3, 2022. The Multi-sector ETF is currently the best performing ETF on ZSE in 2022. The constituents of this ETF are not determined by an index. But they are picked by the fund managers with the help of contracted TN management.

The Morgan and Co Made in Zimbabwe ETF also joins the Old Mutual ZSE Top 10 ETF and Datvest Modified Consumer Staples ETF.

According to an article published by the ETF STRATEGY on January 12, 2021, the Old Mutual Zimbabwe ZSE Top 10 ETF was listed in January 2021 and tracks the ZSE Top 10 index, which consists of the largest ten companies listed on the local bourse. The Datvest ETF was listed on the local bourse on March 3, 2022. It tracks the performance of the ZSE Modified Consumer Staples index and is rebalanced quarterly.

Meanwhile, the ZSE introduced on April 1, 2022, new indices namely the ZSE Agriculture and the ZSE Exchange Traded Fund (ETF) Indices. The ZSE Agriculture Index measures the performance of companies that are agricultural oriented whilst the ZSE ETF Index tracks the performance of all ETFs listed on the ZSE. The new ETF’s performance will be tracked by the ZSE ETF index.