- The International Monetary Fund (IMF) has committed an additional $938 million to Kenya as part of a strategy to stabilise the country’s economy.

- Financial dynamics suggest that Kenya is currently experiencing a severe economic crisis.

- The International Monetary Fund’s (IMF) expanded support for Kenya is a vote of confidence in the country’s economic future.

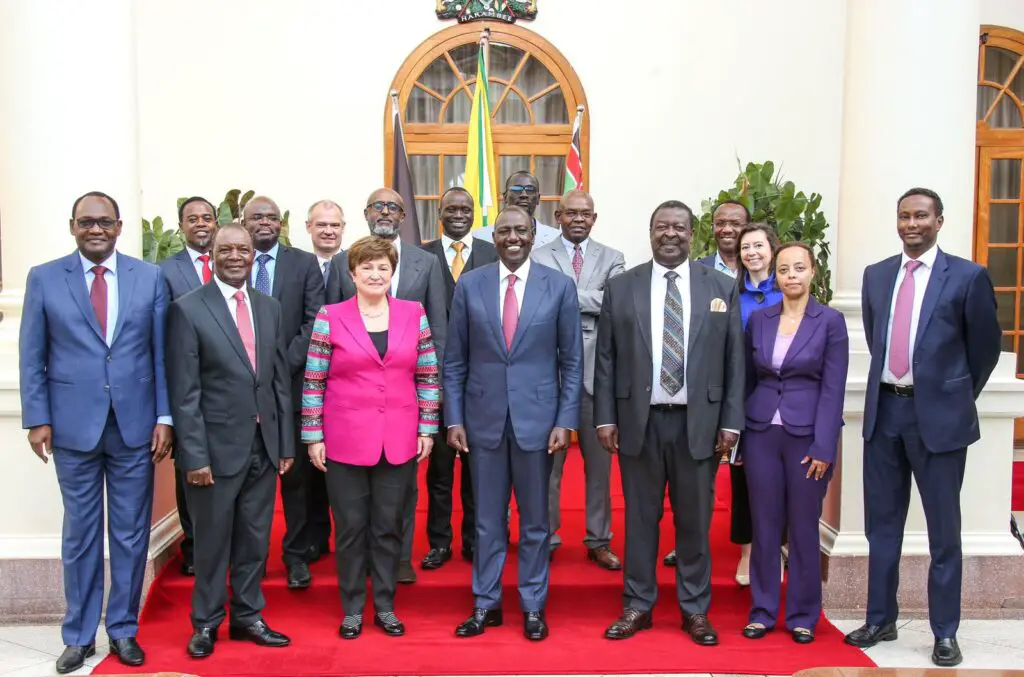

The International Monetary Fund (IMF) has committed an additional $938 million to Kenya as part of a strategy to stabilise the country’s economy, bringing the total support to roughly $4.4 billion. This life-changing infusion of capital comes at a critical time, as the country prepares to make a large repayment of Eurobonds in June.

If the IMF board approves the revised promise, Kenya will have immediate access to roughly $682 million. This action is a reflection of the success of Kenya’s economic reform programme, which has prioritised strengthening policy frameworks to win back the trust of international investors and re-establish the country’s foothold in the international bond market. Maintaining macroeconomic stability requires consistently applying these mutually reinforcing measures, according to Haimanot Teferra, head of the IMF team in Kenya.

The announcement was well received by investors, who drove down the rate on Kenya’s $2 billion Eurobond due in June 2024. In light of the brightening economic and fiscal prospects, Soeren Moerch, a major player in Emerging Markets Debt at Danske Bank, has hinted at the possibility of further bilateral finance.

Since Kenya’s public finances are precarious and the shilling, the country’s currency, has been one of Africa’s worst performers this year, the additional funding could not have come at a better moment. The money will be used to pay off the country’s next $2 billion Eurobond and to increase its foreign exchange reserves.

Due to the country’s rising debt and the exorbitant costs of importing energy and food, Kenya’s government, led by President William Ruto, is considering making a $300 million prepayment in December. According to Churchill Ogutu, an IC Asset Managers (Mauritius) economist, a credible repurchase backed by the IMF money, would greatly improve Kenya’s economic situation.

Kenya has been looking for other options after being discouraged from using capital market refinancing due to high-interest rates. In order to handle the repayment of the Eurobonds, Treasury Secretary Njuguna Ndung’u suggested looking into loans from multilateral and bilateral lenders.

Read also: IMF to the rescue of debt-saddled Kenya with $938 million fresh loan

The International Monetary Fund has confidence in Kenya’s economic renaissance

The International Monetary Fund has drawn attention to two threats to Kenya’s economy. However, things may turn around for the better if investor confidence fully recovers, resulting in a stabilising infusion of money that may bring inflation down more quickly than expected. Conversely, a lack of policy impetus could lower confidence, boost demand for foreign currency, and deplete reserves.

This change reflects Kenya’s strategic economic management, which strikes a balance between meeting short-term financial needs and ensuring the country’s economy remains stable in the long run. The International Monetary Fund’s (IMF) expanded support for Kenya is a vote of confidence in the country’s economic future and a testament to the country’s potential as a stabilising force in the East African economy.

Kenya’s financial dynamics

Financial dynamics suggest that Kenya is currently experiencing a severe economic crisis. Inflationary pressures, commodity price volatility, and tightening international financial conditions all fall within this category. The currency rate is under stress, and foreign exchange reserves are constricted, compounded by the impact of the worst drought in forty years. Due to these causes, food insecurity has increased, threatening the livelihoods of millions.

Concerns have been raised concerning Kenya’s debt sustainability and its ability to finance development in light of the country’s dwindling hard currency reserves and heavy debt burden. Following a significant recovery from the COVID-19 pandemic, the country’s economic growth slowed to 4.8 per cent in 2022, down from 7.5 per cent the year before.

Kenya’s economic prospects appear sturdy over the medium term despite these challenges. It is anticipated that GDP growth will level off at about 5 per cent, with real per capita incomes growing by about 3% during the next few years. Poverty, inequality, high young unemployment, issues of transparency and accountability, the effects of climate change, lacklustre private sector investment, and vulnerability to internal and external shocks are only some of the important development challenges the country must face.

In accordance with these concerns, the World Bank has emphasised the need for Kenya to curb its high debt levels, which now hinder the inclusiveness and sustainability of its economic growth. A healthy and prosperous economic future for the country depends on this debt reduction.

Read also: Kenyan fintech Cellulant expands into MENA region with new Egypt payment licenses

What went wrong for Kenya

Extensive borrowing by both the previous and current administrations of Kenya has contributed to the country’s fiscal difficulties. This level of debt has strained government budgets, making it harder to keep up with regular expenditures. Moreover, the economy has been pushed further and investor confidence has been lowered as a result of the allocation of borrowed cash towards projects that fail to generate revenue.

An alarming increase in Kenya’s debt from $16 billion in 2013 to an anticipated $71 billion by 2021 is a reason for concern. With approximately one-third of the government’s revenue going towards interest payments, this dramatic increase in debt offers considerable issues in managing the massive dollar-denominated debt. The government’s ability to finance development projects and the debt’s long-term viability would both be called into serious question under such circumstances.

Many international shocks have also threatened the Kenyan economy. Fiscal and current account deficits have widened as a result of the COVID-19 epidemic, the global food crisis, financial instability, and severe droughts. The instability and predictability of Kenya’s macroeconomic policies have been eroded by the effects of global variables such as rising inflation, pressure on the exchange rate, and a tumultuous political climate.

Persistent development concerns like poverty, inequality, young unemployment, governance issues, climate change, limited private sector investment, and sensitivity to internal and foreign shocks all contribute to economic uncertainty.

These root problems must be addressed if Kenya’s economy is to stabilise and be redirected onto a sustainable course. It is recommended to prioritise revenue-generating initiatives, stabilise the national currency, restore investor confidence, and address salary and pension payment delays. Furthering the government’s aim for inclusive growth requires lowering the high debt levels and executing reforms. International organisations have advised these measures in an effort to help Kenya overcome its economic challenges and move towards a more secure and prosperous future.