- Senditoo and Access Forex partner to give clients hassle-free international transfers.

- The partnership means that Senditoo’s services will be available at approximately 200 payout points across Zimbabwe.

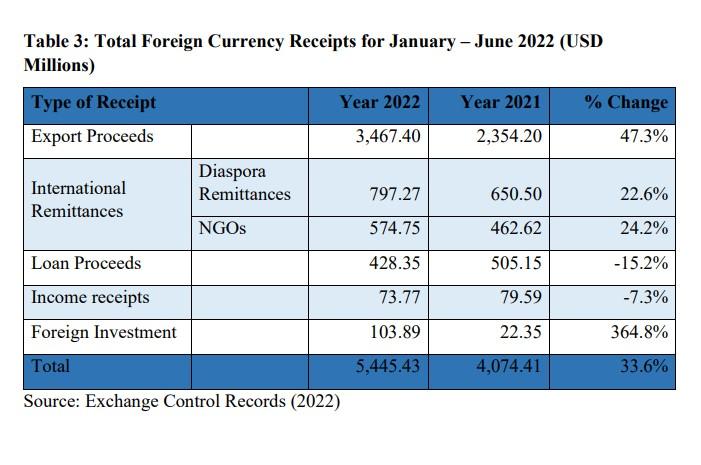

- As of June 30, 2022, total international remittances amounted to US$1.372 billion, an increase of 23 percent from the US$1.113 billion recorded during the same period in 2021. Of the total amount, diaspora remittances amounted to US$797 million, a 23 percent increase from US$650 million received during the same period in 2021.

- International remittances comprise transfers by Zimbabweans in the Diaspora and International Organisations.

Senditoo, an international remittance company has partnered with Access Forex to implement an infrastructure that will enable it to process cross-border transactions. Senditoo has been on the move of late and the partnership with Access Forex marks another milestone in the company’s progression into being one of the big players in the remittance space.

The partnership means that Senditoo’s services will be available at approximately 200 payout points across the country. The company has grown in the last four years, starting with airtime transfers before extending its service offer to include money remittances and enabling customers to pay their bills. They have also introduced an online grocery delivery service according to New Zimbabwe.

Takwana Tyaranini, Senditoo Co-founder, said: “This partnership cements our commitment to being the remittance service provider of choice for Zimbabweans living abroad and locally.

“Senditoo was set up to connect the African diaspora to loved ones at home. In line with our strategic priorities, we have partnered with some of the most reputable businesses and organizations across Zimbabwe, South Africa, Guinea, and the UK to create a strong presence – ensuring our customers have fast, simple, and hassle-free international transfers”.

“We are continually working on our product and service delivery to provide customers across Zimbabwe with accessible payout points that are convenient and cost-effective.

“We have ambitious growth targets and teaming up with Access Forex means we will not only be able to scale up but give our customers a premium and quality service,” he added.

Raymond Chigogwana, Chief Executive Officer of Access Forex, said: “We are delighted to be able to lend our valuable distribution network and secure payout portal to more customers.

“We have enjoyed working closely with Senditoo to switch their full portfolio of services back on and ultimately, ensure that Zimbabweans locally and abroad get cash to where it is needed most. By the time we roll out fully, everywhere you see an Access Forex, you can now also access Senditoo.”

Senditoo’s money transfer service will allow for £2 flat-fee remittances with complimentary exchange rates and real-time transaction monitoring.

Access Forex, established in 2016, is an investment banking business set up to bridge the gap in the market for international money transfers for Zimbabweans living in South Africa and the United Kingdom.

Today, the company’s portfolio of services supports over five million Zimbabweans to manage their money transfers according to New Zimbabwe.

According to an article by TECHZIM published on April 27, 2022, the Reserve Bank of Zimbabwe gave Access Forex the green light to resume local transfers after processing its licensing update application. It was suspended a few days due to pending Exchange Control regulatory approvals.

Speaking at the Zimbabwe International Trade Fair (ZITF), Access Forex head of sales and marketing Shingai Koti said the company is pleased that it has now met Exchange Control regulatory requirements and got the approval to go back to return to the market with this product.

“We are excited that our local transfers are now back online after a few days of suspension due to pending regulatory approval processes. Our platforms are secure, simple, and affordable. We deliver through our growing local network, which includes partners Zimpost, the Spar group, the Truworths, and Number One stores, Quest Financial Services, Edgars/Jet Stores, Friserve Investments, Profeeds, Farmvet and Elizabeth Florist, and our branches. In South Africa, we recently signed on PEP and Ackermanns as a pay-in partner. The ability to partner with these well-known, established brands speaks to the quality of our product.”

“The resumption of local transfers is really good news, not just for us, but also for our clients who rely on us to send and receive money locally and internationally daily. This means we are now running full throttle, with both the domestic and the international services working smoothly; clients can now send and receive money in forex locally, and internationally to and from South Africa and the United Kingdom,” she said.

Meanwhile, the latest Reserve Bank of Zimbabwe (RBZ) data has revealed that Zimbabwe received a total of US$797 million in diaspora remittances, representing a 23 percent increase from the same period last year.

“Of the total amount, diaspora remittances amounted to US$797 million, a 23 percent increase from US$650 million received during the same period in 2021,” reads Mid-Term Monetary Policy Statement published on Thursday.

“International remittances received through the normal banking system on behalf of International Organizations amounted to US$575 million, an increase of 24 percent from US$463 million recorded during the same period in 2021.”

The blueprint also shows that as of June 30, 2022, total international remittances amounted to US$1,372 billion, an increase of 23 percent from the US$1,113 billion recorded during the same period in 2021.

According to an article by New Zimbabwe, for the first half of 2022, banks processed foreign payments amounting to US$3.78 billion. This represents a 19 percent increase in foreign payments from US$3.19 billion recorded for the same period in 2021.

The upward trajectory in foreign payments was largely on account of increased global prices for fuel and electricity.

“Total foreign currency receipts for the period 1 January to 30 June 2022 amounted to US$5.45 billion compared to US$4.07 billion received during the same period in 2021, representing a 33.6 percent increase. This shows a significant growth in receipts during the first half of the year,” the MPS said.