- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Reserve Bank of Zimbabwe

- RBZ Governor John Mangudya revealed that as of July 21st, the bank had conducted 11 issuances of GBDT.

- The Governor noted that the bank received 590 applications to purchase tokens equivalent to 325.02Kg of gold.

- In 2022, as the international economic environment worsened, Zimbabwe turned to gold coins were introduced to tame runaway inflation.

Zimbabwe’s struggles with hyperinflation has since been making headlines for decades. In 2009, inflation was so devastating that the country issued a new Zimbabwean dollar (ZWL), shedding twelve zeros from the earlier currency (ZWD).

By November 2022, the annual consumer price inflation for a compressed basket of goods was at 107 per cent in the country and in June, inflation rose to 175.8 per cent following devaluations of the local currency.

According to the Reserve Bank of Zimbabwe (RBZ) mid-term monetary policy statement, inflation increased to 86.5 per cent and 175.8 per cent in May and …

The central bank kept the policy rate at 200 per cent saying it would be reviewed in line with developments in monthly inflation. The high rate is to ensure that it is not viable to borrow local currency to speculate in the black market or even buy gold coins.

With foreign currency-denominated loans now constituting more than half of the total banking sector loans, with effect from September 1, statutory reserve requirements would be extended to forex deposits at rates of 5 per cent for call deposits and 2,5 per cent for time and savings deposits to ensure continued soundness of the banking sector.

Foreign exchange retention thresholds have been maintained at 75 per cent for agricultural exporters and 100 per cent for tourism, recovering from the effects of Covid-19.…

- Senditoo and Access Forex partner to give clients hassle-free international transfers.

- The partnership means that Senditoo’s services will be available at approximately 200 payout points across Zimbabwe.

- As of June 30, 2022, total international remittances amounted to US$1.372 billion, an increase of 23 percent from the US$1.113 billion recorded during the same period in 2021. Of the total amount, diaspora remittances amounted to US$797 million, a 23 percent increase from US$650 million received during the same period in 2021.

- International remittances comprise transfers by Zimbabweans in the Diaspora and International Organisations.

Senditoo, an international remittance company has partnered with Access Forex to implement an infrastructure that will enable it to process cross-border transactions. Senditoo has been on the move of late and the partnership with Access Forex marks another milestone in the company’s progression into being one of the big players in the remittance space.

The partnership means that Senditoo’s …

All sales of the gold coin, weighing 33.93g, by the agents would be subject to normal know-your-customer (KYC) principles in line with international best practices, which include the declaration of the source of funds.

“The gold coins shall be sold at the prevailing international price of gold plus 5% to cover the cost of production and distribution of the coin on a payment vs delivery basis,” the guidelines read in part.

“The bank shall publish the Mosi-oa-Tunya gold coin price by 0800 hours daily, which shall be based on the previous day’s London Bullion Market Association (LBMA) PM Fix plus the cost of producing the coin. The Mosi-oa-Tunya gold coins shall be sold with an accompanying bearer certificate with security features.”…

Among Zimbabweans, there is a clear preference for the use of the United States dollar over the local currency. This is to the extent that there are some government services which cannot be accessed without United States dollars.

There are also some basic household commodities and goods that one will need to pay for using hard currency and will not be able to purchase if they have the local currency. Following on the issue of the currency crisis is the fact that exporters are already heavily burdened with operating costs in United States dollars.

Regardless of whether it is an exporter or partial exporter, 40 per cent of all export proceeds generated by Zimbabwean-based exporters must be surrendered to the central bank. This is how the central bank has been funding its auction system to allocate foreign exchange to importers.

To be fair, the surrender requirements are not uniformly or …

The new coins will be available for sale from 25 July in local currency, US dollars, and other foreign currencies at a price based on the prevailing international price of gold and the cost of production.

“The gold coins will be available for sale to the public from 25 July 2022 in both local currency (ZW$) and United States Dollars (US$) (and other foreign currencies) at a price based on the prevailing international price of gold and the cost of production. The coins will be sold through the Bank and its subsidiaries, Fidelity Gold Refinery (Private) Limited and Aurex (Private) Limited, local banks, and selected international banking partners. Entities selling the coins shall be required to apply to Know Your Customer (KYC) principles,” read the statement.

Aurex Private, a subsidiary of the central bank, is involved in diamond cutting and polishing over and above the manufacturing of jewellery.…

Despite these fundamentals, the Zimbabwe dollar has continued to slide against the United States dollar prompting the government to take drastic and unprecedented measures last month which culminated in the prohibition of bank lending (albeit temporarily), the prohibition of third-party international payments, the prohibition of third-party payments to stockbrokers and the introduction of taxes which can be viewed as punitive for investors on the Zimbabwe Stock Exchange.

Prior to these stringent measures, the monetary authorities had instituted a policy called willing buyer willing seller to try and narrow the gap between the official foreign currency exchange rate and the parallel market foreign currency exchange rate. This gap between the 2 exchange rates reached its peak in the first week of May 2022 at 153% according to a Zimbabwe publication called the Business Weekly.

The premium between the parallel market rate and the official rate has reduced somewhat to 60%. The …

According to an article by the Herald published on June 27, 2022, popular bullion coins include the American eagle, the Canadian Maple Leaf, the South African Krugerrand, the Isle of Man Gold Cat, the Australian Kangaroo, and the China Mint Panda Bear. They added that gold is a haven against inflation and a gold coin is made mostly of gold while most gold bullion coins are pure gold.

Meanwhile, in an article dated May 27, 2022, Bloomberg described the RBZ as the world’s most aggressive central bank. According to an article by Pindula News published on June 27, 2022, Zimbabwe’s former Finance and Economic Development Minister, Tendai Biti, said the Reserve Bank of Zimbabwe (RBZ) has outlived its usefulness and, therefore, should be abolished.

He made the remarks in response to a cocktail of measures introduced by the government to stabilize the economy. The main duty of the RBZ is …

The president announced in a May 7 televised speech that banks had been banned from lending in a bid to stem the precipitous decline of the local currency inter alia increasing capital holding tax, banning third party transactions on the local bourse, and increasing Intermediated Money Transfer Tax (IMTT).

The move came as the local currency had been depreciated against the United States dollar. This is amid high demand for the greenback which is seen as a store of value.

An executive at an agro-processing firm, name with-held, told NewZimbabwe that his company can’t borrow what it needs to pay 500 farmers for the soy and sugar beans. It contracted them to grow, or fund the purchase of inputs such as fertilizer for the next season’s crop.…

The shortage of cash is a legacy of the hyperinflation 13 years ago that caused the government at the time to abandon the Zimbabwean dollar. In 2018, the government printed 100 trillion bank notes, causing inflation to reach 500 billion per cent.

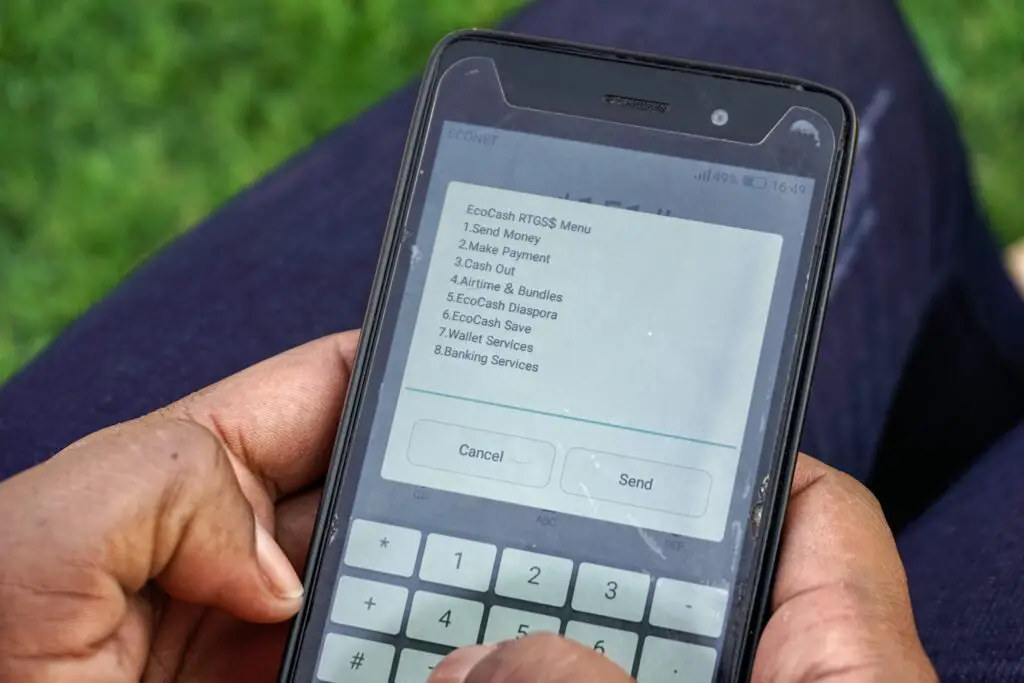

In a report published by the), a worldwide organization representing the interests of mobile money operators, Zimbabwe is ranked top among the 16 member states of the Southern African Development Community (SADC) in reference to mobile money penetration.

The GSMA, on the other hand, has stated that the), also known as the 2% tax, is making mobile money transactions more expensive.…