- Kenyan Farmers Receive $2M Boost from Africa Fertiliser Financing Mechanism

- Brace for High Interest Rates for a Longer Period World Bank Warns Kenya

- Kenya-Ethiopia Trade Relations: Legislators Advocate for Policy Alignment to Boost Ties

- Visualising the state of debt in Africa 2024

- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

Browsing: Africa

The shareholders of Equity Group Holdings Plc have passed resolutions that will reinforce the governance structures of the Group, continue to diversify the Board composition, and also assure investors of dividend pay-out every year as long as the Company posts profits.

In a statement, the Group says shareholders voted for the Amendment of Articles 1 and 79 of the Articles of Association of the Company thereby reinforcing its governance structure and signaling the growing significance of Equity Group Foundation as the social impact investment arm and custodian of the purpose of the Group.

Speaking after the AGM, the Group Board Chairman Equity Group Holdings Plc (EGH Plc), Professor Isaac Macharia said the move will further strengthen the structures to ensure the Board is reinforced through diversified representation for effective oversight.

“In so doing, the shareholders have passed a resolution enabling shareholders with more than 12.5 percent shareholding to participate directly …

According to a top official Seychelles is expected to establish airline connectivity with Angola and enter into a bilateral air services agreement signing that is scheduled in September.

This economic agreement will spur tourism and commerce between the two nations. Seychelles prides in their wonderful natural tourism assets in its beautiful beaches and mountain backdrops which contributes 24.8 percent of gross domestic product (GDP) while Angola is rich in natural resources as well as having large reserves of oil and diamonds, hydroelectric potential, and rich agricultural land.

Speaking to a press earlier this month the Seychelles Minister for Transport, Anthony Derjacques, said that Angola has always been very attractive to Seychelles and its national carrier, Air Seychelles, and such an agreement will open the countries for commerce, exchanges and visitors.

“We are already flying to South Africa and Angola is also in Southern Africa. It will help us a lot …

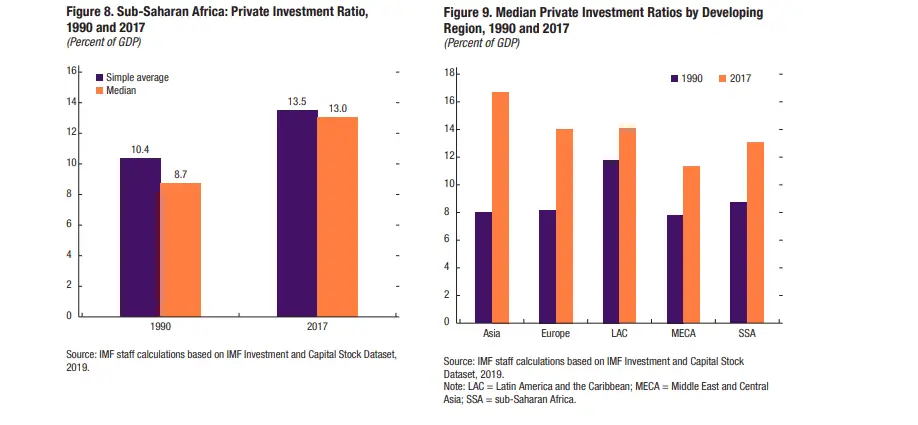

Africa has abundant natural resources and holds immense opportunities for investors to unlock its full potential.

According to the International Monitory Fund (IMF), Africa’s hardwon economic gains for the last two decades which are critical in improving living standards can be reversed from the impacts of the pandemic.

The scope for growth through large public investment programs is limited by the uncertain outlook for international aid and the high public debts levels. In its statement, the IMF notes that if countries in the region are to enjoy a strong recovery and avoid stagnation, Africa’s private sector will have to be more involved in economic development.

According to IMF, the private sector should be involved in both social (health and education) and physical (roads and electricity) infrastructure.

“Africa’s infrastructure development needs are huge—in the order of 20 per cent of GDP on average by the end of the decade. How can …

The private sector in the African continent is set to receive US480 billion in investments over the next five years.

The investments will be made by a consortium of organizations under the G7 Development Finance Institutions (G7 DFI) which includes the European Investment Bank and the private sector arm of the African Development to support sustainable economic recovery and growth in Africa.

The proposed investments come at a time when the Covid-19 pandemic has caused a severe global economic and health crisis, including in the African continent.

The IMF estimates that sub-Saharan Africa needs additional financing of around $425 billion between now and 2025 to help strengthen the pandemic response spending and reduce poverty in the region.

This marks the first time the G7 DFIs have come together to make a collective partnership commitment to the African continent.

The G7 DFI group consists of CDC, Proparco (France), JICA and JBIC …

Despite the world being more digitally connected than ever before, women are still being left behind.

This is according to a new study which reveals that women are 8 percent less likely than men to own a mobile phone, 15 percent less likely to use mobile internet, and 33 percent less likely to use mobile money in low and middle-income countries across the world.

The data is revealed in the fourth annual GSMA Mobile Gender Gap report, which reveals that these significant gender gaps are preventing women from reaping the full benefits of mobile technology.

The study indicates that closing the mobile gender gap is critically important and can deliver significant socio-economic benefits to understand women, their communities, and the economy.

It estimates that closing the gender gap in access and use could generate a revenue increase for the mobile industry of 12 to 37 percent in a typical low …

Covid 19 wreaked havoc to the economy and no sector was worse hit than the tourism and hospitality sector. Air travel restrictions, mandatory quarantine of arrivals and the shutting of businesses in the tourism and hospitality sectors along with crumple of demand have led to an unprecedented shock.

So bad was the situation that last year, tourism operators in Tanzania forecast revenue contractions of 80% or more while the World Bank’s 14th Tanzania Economic Update (TEU) showed that Tanzania’s economic growth slowed down to 2.5% from the 6.9% growth reported the previous year.

But there is light at the end of the tunnel, with eased travel restrictions, Tanzania is witnessing a revamp in both the tourism and hospitality sectors. Global top brands like Onomo Hotels have opened shop in the commercial capitol Dar es Salaam.

Meet ONOMO General Manager Mark Soderlund as he gives us an inside perspective of the …

Meet ONOMO General Manager Mark Soderlund as he gives us an inside perspective of the …

Over 250 top-level speakers and panelists including a huge range of Africa’s most important investors, dealmakers, and business leaders, have been confirmed ready to attend the Annual AFSIC-Investing in Africa forum that is scheduled for October 11th and 12th in London, These Key Figures in the Corporate world will unpack the increasing global investment momentum into Africa’s growing public and private sectors as well as highlighting new growth opportunities across the continent.

The agenda of AFSIC 2021, remains investment-focused, with several of the most experienced and successful asset management firms investing in Africa sharing insights into where the smart money is investing, and business leaders running some of Africa’s most exciting growth companies showcasing new investment opportunities, with focused streams in Banking, Building, Healthcare, Agriculture, Fintech, Education and Sustainable Growth.

With ABSA Corporate Investment Bank heading up an impressive group of supporting sponsors, the conference will also feature …

G7 Development finance institutions (DFIs) are collaborating with several multilateral partners to invest $80 billion in Africa’s private sector over the next five years.

The investments are aimed at supporting Africa’s economic recovery and growth. The project will boost support for long-term development objectives of the economies that have been affected by the pandemic.

The G7 Development finance institutions consist of the private sector arm of the African Development Bank (AfDB), the European Investment Bank (EIB), the International Finance Corporation (IFC) and the European Bank for Reconstruction and Development (EBRD).

The institutions play a key role in helping to build markets, moderate risk and pave way for investors to enter new markets.

This project will make it the first program that the G7 DFIs have made a collective partnership commitment to the African continent.

According to the International Monetary Fund (IMF), Sub Saharan Africa will need $425 billion in additional …

The lastmile fulfilment for importers Deliverasap.ng, providers in Nigeria celebrated the milestone of fulfilling over 450 orders, worth over $96,958.21, weighing over 1,700kg all this achieved within a pilot phase.

The company which was launched during the COVID-19 lock-down of 2020 officially joins the list of businesses birthed during the pandemic.

Engr Oyedayo Oyeniran a Serial Entrepreneur and who is the Co-founder and CEO had a one-on-one near frustrating experience running delivery errands for a friend who is into mini-importing. It was during that process that he had an aha moment the need for a specific lastmile fulfilment brand for mini-importers with a corporate identity that exudes confidence for patronage among busy importers, professionals, nursing mothers, out-of-Lagos importers, among others.

From July to December 2020 The company started operations activating one of its services which gained massive success without any form of paid marketing or advertisement.

In his words, Engr …

NAIROBI, Kenya, Jun14 – The African Development Bank (AfDB) has unveiled a US$463.9 million 5.5-year Kangaroo bond.

In a statement, AfDB says the transaction, which marks its return to the Australian dollar bond market, was led by Nomura and RBC Capital Markets.

The fixed income instrument, which is a foreign bond issued in the Australian market by non-Australian firms and is denominated in Australian currency, is the institution’s first benchmark Kangaroo since early 2018 and its first in the mid-curve since 2015.

It is also the largest AUD trade ever issued by the Bank.

More than 30 investors participated in the deal, with a total order book of more than A$775 million, leading to an upsize of the trade from the announced size of A$250-300 million to the final size of A$600 million.

These included a strong cohort of Australian investors, while fund managers were the major investor type.

African …