- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Doing business in africa

- TradeMark East Africa has rebranded to TradeMark Africa (TMA) and simultaneously officially launched its West Africa operations

- The organisation now has a presence in fourteen countries in sub-Saharan Africa (SSA), including Kenya, Uganda, Tanzania, Rwanda, Burundi, Malawi, Zambia, Mozambique, and Ghana

- TradeMark has made cumulative investments of over $1.3 billion since 2010 to reduce the time and costs of trading across borders, and to improve the export competitiveness of African businesses

TradeMark East Africa has rebranded to TradeMark Africa (TMA) and simultaneously officially launched its West Africa operations.

Founded in 2010 in Kenya, TMA marks an expansion from its previous core operational area of East Africa and the Horn of Africa to also support countries in West and Southern Africa.

TradeMark Africa now has a presence in fourteen countries in sub-Saharan Africa (SSA): Kenya, Uganda, Tanzania, Rwanda, Burundi, the Democratic Republic of Congo (DRC), South Sudan, Ethiopia, Somaliland, Djibouti, Malawi, …

- African Union hosting eight events at the Expo 2020 Dubai

- The world sees Africa as the new frontier for business, trade and investment

- How the UAE is setting itself up as the launchpad for doing business in Africa

The African Union (AU) is hosting eight events at Expo 2020 Dubai. With one event each week, the AU hopes to highlight the continent’s investment opportunities and reshape the general world view of Africa, the least not being, science and technology development on the continent.

“From the onset, we set our sights on showcasing the incredible and continued opportunities that lie across the African continent,” remarked Dr. Levi Uche Madueke, the AU Expo Commissioner General.

“We are hitting the ground running. Our Expo 2020 Dubai activities further advance the cause of fulfilling the aspirations of Agenda 2063,” he said reassuring all visitors of ‘a great show of marvel and awe.’

As part …

Indeed, African governments are reaping a plethora of benefits from the inclusion by international financial markets to broaden the scope of their funding sources, swiftly abandoning foreign aid and traditional multilateral institutions.

International financial markets have opened a window thereby providing a suitable platform for African governments to borrow, chiefly for capital spending through Eurobonds issuance. However, this opportunity has been watered down by overexploitation through excessive borrowing. Consequently, debt has been accumulating devoid of a meticulous assessment of risks posed and the consequences thereof, such as exchange rates and the real repayment costs for the piling debt.

The International Monetary Fund (IMF) has pinpointed a total of 17 African countries, with outstanding Eurobonds as near or under debt distress. African governments have been borrowing through issuing Eurobonds which are international bonds supplied by a country in a foreign currency, commonly in US dollars and euros which allows them …

As the 2021 International Day of Democracy draws closer it is imperative to assess and review the state of democracy in Africa; to celebrate the achievement of significant milestones hitherto whilst charting new pathways towards the attainment and realization thereof, of liberal democracies in the continent. One of the key aspirations of Africa’s Agenda 2063: The Africa We Want, the African Union’s (AU) shared 50-year development and transformation program, for realizing the full potential of the continent is an Africa of good governance, democracy, respect for human rights, justice and the rule of Law. However, on the brink of an abyss, most democracies in Africa stand, beset by a plethora of challenges which begs the question if the concept of a government of, by, and for the people is truly working for the continent? In reiteration Goal 16 of the United Nations Sustainable Development Goals (SDGs) advocates for the promotion …

I am by nature an optimist. A long and challenging life has tempered that optimism with a large dose of realism but I am definitely a “glass half-full” kind of man. As a regular contributor to The Exchange I don’t really want to blame another contributor for tipping me over the edge into downright pessimism but, having read the excellent piece by Eric Kimunguyi entitled, “Europe taking on the world to lock out agriculture” I am not of good heart. In fact, I cannot remember a time when I have been less optimistic about the financial future of the world economy.

The world financial system is even sicker than the world’s population. The Covid-19 pandemic is still having devastating effects on human health and wealth around the world – some 18 months after it first appeared. The world’s leading economies are broken and are still printing money to subsidise their …

Kenya is commonly considered to be East Africa’s financial hub. Its economic growth has increased steadily in the last decade due to significant political, structural and economic reforms. The SME sector stands out as the key driver of Kenya Vision 2030 which seeks to transform the country into a newly industrialized middle income country by 2030. SMEs are crucial in encouraging industrialization and helping to eradicate poverty by creating employment and raising income levels.

Social and Economic Benefits

SMEs complement large firms as subsidiary units; because they are more flexible they can effectively meet the needs of the market. They have a facilitative role in entrepreneurial activities across the country in both urban and rural settings, thus contributing immensely towards the socio-economic development and transformation of the country. SMEs are can ensure the achievement of sustainable development goals (SDGs), promotion of inclusive economic growth and sustainable industrialisation and fostering as …

Kenya has huge potential for avocado production from both small scale and large scale farmers which makes it the world’s third largest producer of avocados. Avocado is also Kenya’s leading fruit export, accounting for nearly one-fifth of its total horticultural exports.

In terms of export, Kenya ranked 8th globally (2.1% of market share) in 2019 in export of avocados shipping out 59,000 tons with annual value of Ksh10.6 Billion ($97.92 million), behind Mexico, Netherlands, Peru, Spain, Chile, Colombia and the United States.

…

According to Brand Africa 100: Africa’s Best Brands 2020 survey, Africans prefer foreign brands over local ones. In 2011, the representation of African brands seemed very optimistic when they registered a 34% representation, but in 2020 it dropped to an all-time low of 13%.

< p class="fade">This is a worrying statistic as it may indicate that Africa is failing to meet the needs of its growing consumer market, which was worth $1.4 trillion in 2020. The AfCFTA if properly implemented will create an even bigger continental free trade zone with a potential market of 1.7 billion people. …

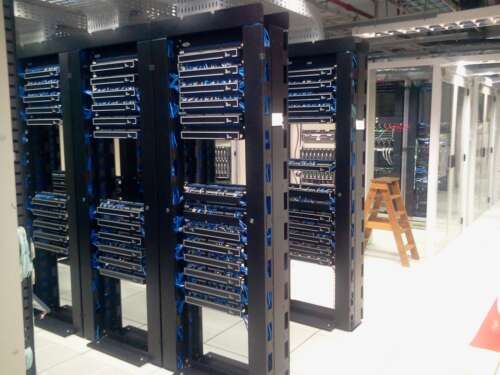

Data centers are Information Technology (IT) facilities responsible for the management of data in an organization. Data centers house state-of-the-art computing infrastructure with very powerful machines. Traditionally, data centers were associated with extensive use of space and a lot of hardware components to support big data storage and management services.

As technology evolves, the use and development of software-based data centers requiring less space are increasingly becoming more common.

Cloud computing, a modern model used for data centers is growing in popularity in Africa. This technological innovation allows for an integrated approach to data management services such as storage, applications, and servers. Cloud-based data centers have lower costs compared to traditional physical data centers. Most cloud computing services are outsourced from well-established companies that have the resources and experience to do so. Companies such as Microsoft, Amazon, and Teraco continue to invest significantly in cloud infrastructure, globally.

High growth

…SMEs are the major contributor to investments in the agricultural sector in Africa. In most cases, most African enterprises are run as opportunistic arbitrage entities keen on profiting from demand/ supply disparities because of a lack of substantial capital.

Investment into value addition business is limited in this sector due to challenges arising from lack of finance, poor access to markets, and lack of supporting policies. The continent’s main formal economic activity is agriculture, contributing 80% to the region’s employment.

Snapshot of the industry

Crocodile farming is an agricultural niche that holds vast potential for profit-making and value addition for SMEs. The risk of failure in this market segment is relatively low because of farming support systems and a readily available high-demand market.

The sector generates hundreds of millions in exports through the global demand for crocodile skins.

Other uses and income-generating avenues from this farming venture include …