- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: Mergers and acquisitions

- Global deal activity down 27.5 percent Month-on-Month (M-o-M) and 46.7 percent Year-on-Year (Y-o-Y) in January 2023.

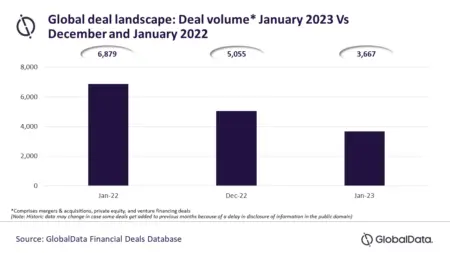

- All the deal types under coverage witnessed massive double-digit decline

- According to the data, a total of 3,667 deals* were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 percent Y-o-Y (Year on Year) decline over January 2022.

Mergers and acquisitions, private equity, and venture financing deal activity is off to a slow start in 2023 globally as the first month of the year itself saw a significant contraction in deals volume according to the latest data from GlobalData, data and analytics company.

According to the data, a total of 3,667 deals were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 …

The regulator said retailers would be free to allocate up to 10% of chilled space/refrigerators in each beverage cooler owned by NBL or Distell Namibia in any on- and off-consumption outlet in Namibia.

“This allocation right will apply only to products manufactured or packaged in Namibia by Namibian-owned and Namibian-controlled companies. The existing NBL commercial policy must be amended, and the merged entity will educate its employees and inform the market of the new changes to its commercial policy,” the conditions read.

The commission said it identified entry barriers as a concern, particularly the ability of small Namibian companies to enter the market.

NBL’s commercial policy prohibited retailers from placing other products in NBL-branded refrigerators. After the merger, the likelihood of this policy being enforced could deter or limit the entry of Namibian-owned and Namibian-controlled undertakings into the market.…

Mergers and acquisitions worth US$52B were completed in South Africa during the first half of 2021, with the value of deals growing by 958% from 2020 with the tech sector in the lead according to Refinitiv Data that provides financial markets and infrastructure data . According to Digest Africa, the value of mergers and acquisitions in the African tech ecosystem in 2018 was US$504M with 24 out of the 39 deals taking place in South Africa making it the country with the most mergers, acquisitions and exits among the KINGS countries. …

The Energy sector has received substantial capital commitments. In the course of the continent’s growth, the sector has seen lucrative returns and enormous risks and losses. The energy sector’s main upside has been the increased economic growth and development witnessed on the continent.

The story has not been an absolute success, however, with some huge losses incurred. The government mainly monopolizes the energy sector in Africa as it provides a critical service to the economy. Failure of the sector could result in a catastrophic collapse of the economy across all fronts.

The impact of mergers in the Energy Sector

Operational cost-efficiency

South Africa has recently welcomed a major energy merger that is effective 1 April 2021. PetroSA, iGas, and Strategic Fuel Fund are set to become one entity called the South African National Petroleum Company. A deal has the potential to produce high-value returns for investors and substantial developments in …

Investment banking fees in Sub-Saharan Africa reached an estimated US$128.2 million during the first quarter of 2020, a decline of 15 per cent from last year’s strong start.

Advisory fees earned from completed mergers and acquisitions (M&A) transactions generated US$33.5 million, down 38 per cent year-on-year, while syndicated lending fees declined 47 per cent to US$35.7 million.

The authors of the report, Refinitiv, note that Equity capital markets underwriting fees more than tripled to reach US$36.7 million, a first quarter total only exceeded twice since the company’s records began in 2000.

China’s Belt and Road Initiative, AfCFTA to anchor Africa’s economy

Bond underwriting fees increased 20 per cent to US$22.3 million, again the third-highest first quarter fee total since our records began.

Almost one-quarter of fees in the region during the first quarter of 2020 were earned from government and agency deals. Almost two-thirds of all fees were generated in …