- Global deal activity down 27.5 percent Month-on-Month (M-o-M) and 46.7 percent Year-on-Year (Y-o-Y) in January 2023.

- All the deal types under coverage witnessed massive double-digit decline

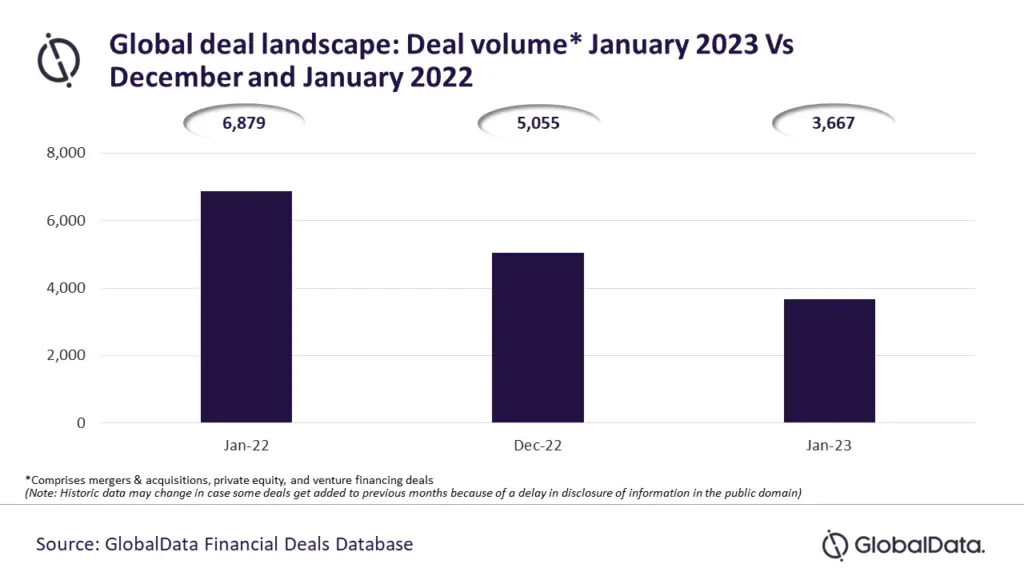

- According to the data, a total of 3,667 deals* were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 percent Y-o-Y (Year on Year) decline over January 2022.

Mergers and acquisitions, private equity, and venture financing deal activity is off to a slow start in 2023 globally as the first month of the year itself saw a significant contraction in deals volume according to the latest data from GlobalData, data and analytics company.

According to the data, a total of 3,667 deals were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 percent Y-o-Y (Year on Year) decline over January 2022.

“Several global headwinds such as the Russia-Ukraine conflict, inflationary pressures, macroeconomic challenges and recession fears disrupted deal-making activities in 2022 and these factors also seem to have a spillover effect in 2023, ” said Aurojyoti Bose, Lead Analyst at GlobalData.

An analysis of GlobalData’s Financial Deals Database revealed that all the deal types under coverage also witnessed a massive double-digit decline in deals activity in January 2023, thereby contributing to the overall decline. The number of private equity deals, venture financing deals, and merger and acquisitions deals declined by 54.2 percent, 51.8 percent, and 40.9 percent respectively.

“Deals activity in all the regions also saw a slowdown as most of the key global markets witnessed a decline. North America, Europe, Asia-Pacific, Middle East & Africa, and South & Central America region registered 48.9 percent, 39.6 percent, 50.5 percent, 32.9 percent, and 54.4 percent Year-on-Year decline in deals volume in January 2023 and Month-on-Month (M-o-M) decline of 12.3 percent, 27.6 percent , 44.9 percent , 10.2 percent, and 47.3 percent, respectively,” the report states.

The US, which is the top market in terms of deal activity, witnessed a massive 50.4 percent Y-o-Y drop in deals volume in January 2023 and an 11 percent decline compared to the previous month. Similarly, China, the UK, India, Canada, Japan, and Germany registered 46.2 percent, 28.2 percent, 51.6 percent, 29.3 percent, 50.7 percent, and 48.2 percent Y-o-Y decline in deals volume in January 2023 and M-o-M decline of 49%, 6.7%, 20%, 23.4%, 44.4%, and 36.6%, respectively.

Travel and tourism sector’s deal activity took the most hit in the first month of 2023. A total of 38 deals comprising merger and acquisition, venture financing and private equity deals were announced in the sector globally in January 2023, which is a decline of 42.4 percent in terms of deals volume compared to the previous month, reveals GlobalData,

“Deal-making sentiment in the global travel and tourism sector appears to have been heavily impacted by current geopolitical tensions and recession fears. Deal volume in several leading economies experienced considerable slowdown, which contributed to the overall decline, ” Bose added.

According to the report there was a decline of 36.8 percent , 50 percent and 50 percent in the number of merger and acquisition deals, venture financing deals, and private equity deals announced during January 2023 compared to the previous month, respectively.