- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Browsing: private equity

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

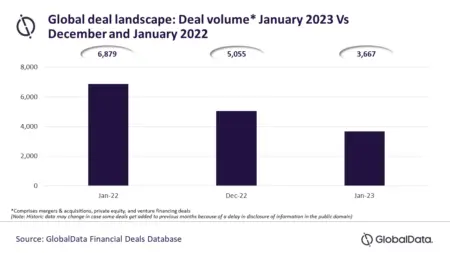

- Global deal activity down 27.5 percent Month-on-Month (M-o-M) and 46.7 percent Year-on-Year (Y-o-Y) in January 2023.

- All the deal types under coverage witnessed massive double-digit decline

- According to the data, a total of 3,667 deals* were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 percent Y-o-Y (Year on Year) decline over January 2022.

Mergers and acquisitions, private equity, and venture financing deal activity is off to a slow start in 2023 globally as the first month of the year itself saw a significant contraction in deals volume according to the latest data from GlobalData, data and analytics company.

According to the data, a total of 3,667 deals were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 …

The Guide mainly covers three key areas – understanding the asset class and where it sits alongside other asset classes, why and how to invest in PEs and an overview of the benefits and risks of investing in PE.

The development of the guide was informed by a market study report that sought to investigate the low uptake of investment by pension schemes.

In Kenya, for instance, PE allocations by pension schemes account for only 0.08 per cent of the total industry assets under management. From a regulatory perspective, there are provisions allowing pensions to invest in PE funds across East Africa (Kenya, Uganda, Rwanda, Tanzania, and Ethiopia).

According to Kenya’s pension regulator, the Retirements Benefits Authority (RBA), though the country has had regulations that provide for diversification of pension funds away from traditional instruments, most pension schemes are still predominantly bond and stock investors.…

One of the features that make the property unique as an investment is that it has a high unit value in comparison to other investments.

A nominal amount like ZWL$1,000.00 can buy an individual investor shares of a publicly listed company on the ZSE and the same amount in US dollars can purchase a decent number of shares through an offshore brokerage account.

This is not usually the case with real estate. There is very little an individual investor can do with ZWL$1,000.00 in terms of direct property investment, at least in the conventional sense.

Even with access to mortgage finance, an investor will also tend to be limited by their credit standing in terms of the funds that they can deploy into property investments.…

The shareholders of Equity Group Holdings Plc have passed resolutions that will reinforce the governance structures of the Group, continue to diversify the Board composition, and also assure investors of dividend pay-out every year as long as the Company posts profits.

In a statement, the Group says shareholders voted for the Amendment of Articles 1 and 79 of the Articles of Association of the Company thereby reinforcing its governance structure and signaling the growing significance of Equity Group Foundation as the social impact investment arm and custodian of the purpose of the Group.

Speaking after the AGM, the Group Board Chairman Equity Group Holdings Plc (EGH Plc), Professor Isaac Macharia said the move will further strengthen the structures to ensure the Board is reinforced through diversified representation for effective oversight.

“In so doing, the shareholders have passed a resolution enabling shareholders with more than 12.5 percent shareholding to participate directly …

The African Private Equity and Venture Capital Association (AVCA) released its sophomore Industry Survey drawing African Limited Partners and General Partners commitment to African investment as long-term.

The survey report that was released on April 15, was conducted in review of broad cross-section of global and African Limited Partners’ (LPs) and General Partners’ (GPs) to determine perspectives and attitudes of investing in African private equity (PE) across various categories, sectors, geographies, investment stages, challenges, and returns.

According to the survey report, Majority of Limited Partners (86%) plan to raise or maintain their allocation to African Private Equity {PE} over the next three years, with impact and the investment mandates viewed by most Limited Partners as the primary factors driving their investment approach.

ALSO READ: Investing in Africa: Trends driving Private Equity and Venture Capital in Africa

65% of Limited partners said that the African Private Equity {PE} attractiveness remained the …

Africa’s private equity landscape continues to attract investment. The operating environment, albeit still turbulent, continues to improve. Granted, the pace of improvement is higher in some countries than others, but overall there is promise of a conducive climate for business.

The enabling environment, coupled with the accelerated digital infrastructure growth, inspires momentum in the private sector contributing to the growing middle class. This will, in turn, lead to improved employment opportunities.…

Winners of the 2020 edition of the Private Equity Awards Africa are set to be announced on 19 November 2020. There are 19 African focused private equity firms in the running for the house of the year position.

In the previous year’s awards, the house of the year award went to Development Partners International, a firm that manages over US$1.6 billion in pan-African private equity.

Several other subcategories will rate private equity firms in terms of deal size, the exit of the year, debt and infrastructure, and a portfolio company of the year. The competition also includes a category for the best advisors and fund administrators.

The London Business School Private Equity Institute in conjunction with the private equity awards advisory panel will make recommendations for the deserving winners.

The ultimate winners will be chosen by an autonomous panel of judges which comprises some of the …

In March of 2013, the Bill and Melinda Gates Foundation announced the commencement of a grant competition to facilitate innovative companies to develop condoms of the future. The idea was to develop the next-generation condom that significantly preserves or enhances pleasure, in order to improve uptake and regular use,” according to the foundation’s Global Grand Challenges website. The most promising designers would score $100,000 in seed funding, plus a chance at an additional $1 million to further finance their projects.

Years down the line, none of the recipients has come up with a condom worth noting. Only around 5% of men worldwide are estimated to use them — despite their 98% effectiveness at preventing unwanted pregnancy and the spread of sexually transmitted diseases and HIV. The main reason has been explained as lack of “enough pleasure” or reaction to latex-the main material for development of condoms.

As the world marks …

Sub-Saharan hospitality investment platform Kasada Capital Management has reached a first close on its maiden fund Kasada Hospitality Fund LP with equity commitments of over USD 500 million.

This is in line with a first announcement disclosed in July 2018 by Katara Hospitality and Accor who are respectively contributing USD 350 million and USD 150 million. In a region which offers robust growth opportunities, the fund will target both greenfield and brownfield projects.

The hospitality market is currently one of the most promising and yet underserviced sectors in Sub-Saharan Africa where growing economies and emerging middle class are creating high-growth markets that are left largely untapped.

The first platform of its kind in Sub-Saharan Africa, Kasada Capital Management intends to bridge the gap between the local hospitality market players and international investors.

The team is co-led by Olivier Granet (CEO and Managing Partner) a former CEO of AccorHotels Middle East …